SC1065 K 1 2020

What is the SC1065 K-1?

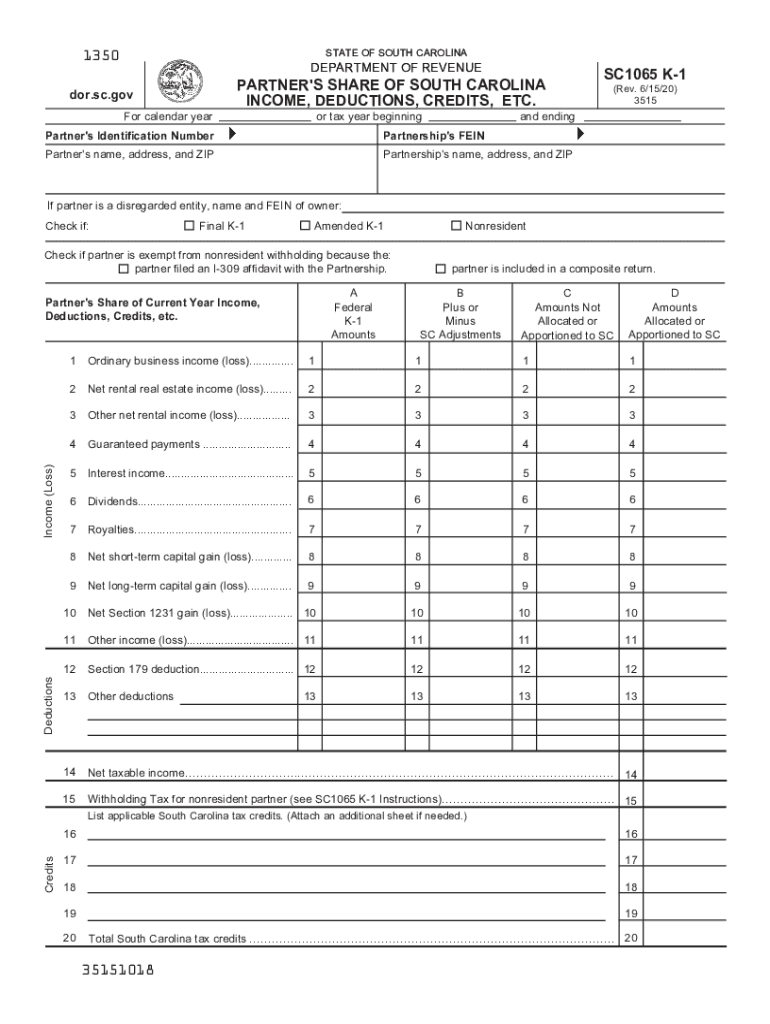

The SC1065 K-1 is a tax document used in South Carolina to report income, deductions, and credits from partnerships, limited liability companies (LLCs), and other pass-through entities. Each partner or member receives a K-1 form that details their share of the entity's income, which they must report on their personal tax returns. This form is crucial for ensuring that all partners accurately report their income and comply with state tax regulations.

Steps to complete the SC1065 K-1

Completing the SC1065 K-1 involves several important steps:

- Gather necessary financial information from the partnership or LLC, including income, deductions, and credits.

- Fill out the identifying information at the top of the form, including the name and address of the entity and the partner.

- Report the partner's share of income, losses, and deductions in the appropriate sections of the form.

- Ensure that all amounts are accurate and reflect the partnership's financial activities for the tax year.

- Review the completed K-1 for any errors before distributing it to partners.

Legal use of the SC1065 K-1

The SC1065 K-1 must be used in accordance with South Carolina tax laws. It serves as an official record of a partner's share of the entity's income and must be filed with the South Carolina Department of Revenue. Failure to accurately complete and file the K-1 can lead to penalties for both the entity and the individual partners. It is essential for partners to retain their K-1 forms for their personal tax records and to ensure compliance with state tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the SC1065 K-1 align with the partnership's tax return deadlines. Typically, partnerships must file their SC1065 forms by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. Partners should receive their K-1 forms in a timely manner to ensure they can accurately report their income on their personal tax returns by the April 15 deadline.

How to obtain the SC1065 K-1

Partners can obtain the SC1065 K-1 from the partnership or LLC in which they hold an interest. The entity is responsible for preparing and distributing the K-1 forms to all partners. If a partner has not received their K-1 by the filing deadline, they should contact the entity to request a copy. Additionally, partners can access their K-1 forms electronically if the entity provides digital copies.

Required Documents

To complete the SC1065 K-1, certain documents are necessary:

- Financial statements of the partnership or LLC, including profit and loss statements.

- Records of any distributions made to partners during the tax year.

- Documentation of any deductions or credits that the partnership is eligible to claim.

- Previous year’s K-1 forms, if applicable, for reference.

Examples of using the SC1065 K-1

For instance, if a partnership generates $100,000 in income and has two partners, each partner may receive a K-1 indicating their share of the income, which could be $50,000 each. This income must then be reported on their individual tax returns. Similarly, if the partnership incurs $20,000 in deductions, these would also be reflected on each partner's K-1, allowing them to reduce their taxable income accordingly. Accurate reporting via the K-1 is essential for proper tax compliance and to avoid penalties.

Quick guide on how to complete sc1065 k 1

Effortlessly Prepare SC1065 K 1 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without complications. Manage SC1065 K 1 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric task today.

The Easiest Method to Modify and eSign SC1065 K 1 with Ease

- Find SC1065 K 1 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign SC1065 K 1 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 k 1

Create this form in 5 minutes!

How to create an eSignature for the sc1065 k 1

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What are SC 1065 instructions?

SC 1065 instructions refer to the guidelines provided for filing an SC 1065 tax return, which is essential for partnerships in South Carolina. These instructions help ensure compliance with state tax regulations while allowing businesses to accurately report their income and deductions.

-

How can airSlate SignNow assist with SC 1065 instructions?

With airSlate SignNow, businesses can streamline the process of preparing and signing documents related to SC 1065 instructions. Our platform offers an intuitive interface to facilitate e-signatures, making it simpler for partners to collaborate and finalize their tax documents efficiently.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides robust features for managing tax-related documents, including customizable templates, real-time collaboration, and secure e-signatures. These functionalities make it easy to adhere to SC 1065 instructions while ensuring that all paperwork is completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses handling SC 1065 instructions?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses, making it a cost-effective choice for handling SC 1065 instructions. Our solution helps save both time and resources, ensuring that tax documents are processed efficiently without breaking the budget.

-

Can airSlate SignNow integrate with other accounting software for SC 1065 instructions?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, enabling businesses to easily manage their documents related to SC 1065 instructions. This integration simplifies the workflow by allowing users to access and send documents directly from their preferred software.

-

What are the benefits of using airSlate SignNow for SC 1065 instructions?

Using airSlate SignNow for SC 1065 instructions offers numerous benefits, including enhanced security for sensitive tax documents, quicker turnaround times, and improved collaboration among partners. Our platform ensures that all parties can sign, edit, and finalize documents efficiently, reducing the stress of tax season.

-

How secure is airSlate SignNow for managing SC 1065 instructions?

airSlate SignNow prioritizes security, using advanced encryption methods to protect your documents and sensitive information when managing SC 1065 instructions. Our platform complies with industry standards to ensure that your data remains safe throughout the e-signing process.

Get more for SC1065 K 1

Find out other SC1065 K 1

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF