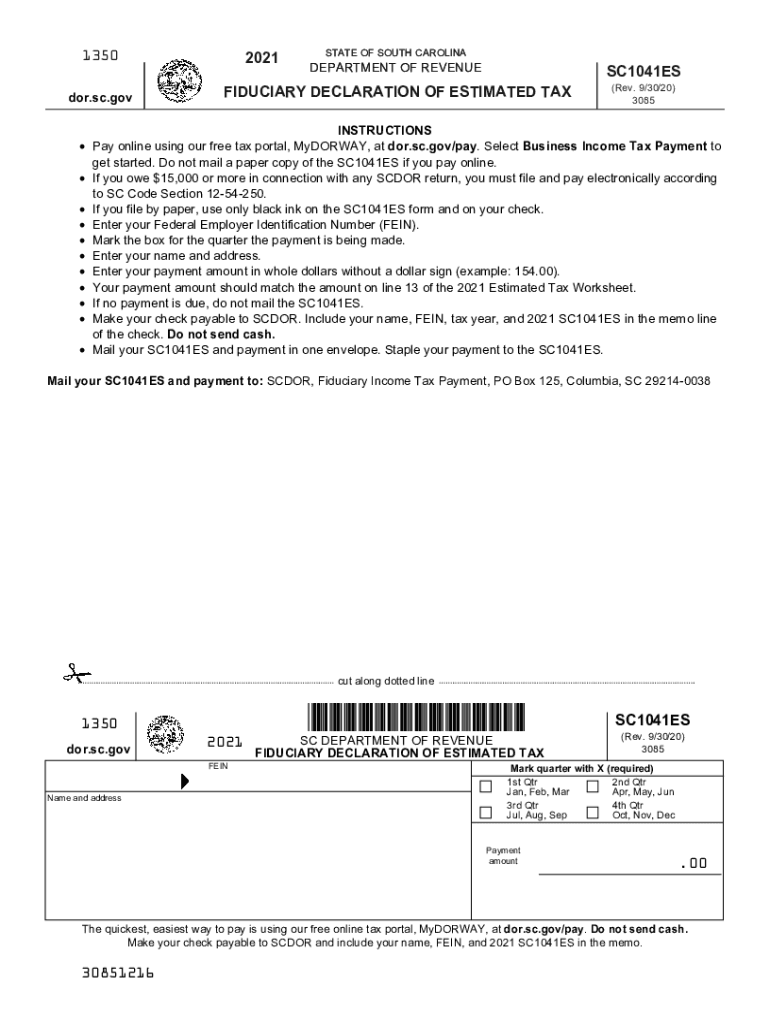

FIDUCIARY DECLARATION of ESTIMATED TAX 2021

What is the fiduciary declaration of estimated tax?

The fiduciary declaration of estimated tax is a specific form used by fiduciaries, such as executors or trustees, to report estimated tax payments for estates or trusts. This form is essential for ensuring that the tax obligations of the estate or trust are met in a timely manner. It allows fiduciaries to calculate and remit the appropriate amount of estimated taxes owed to the Internal Revenue Service (IRS) on behalf of the estate or trust, thereby preventing potential penalties for underpayment.

Steps to complete the fiduciary declaration of estimated tax

Completing the fiduciary declaration of estimated tax involves several key steps:

- Gather necessary financial information about the estate or trust, including income sources and deductions.

- Calculate the estimated taxable income for the estate or trust for the current tax year.

- Determine the estimated tax liability using the appropriate IRS tax rate.

- Fill out the fiduciary declaration of estimated tax form with the calculated figures.

- Review the form for accuracy and completeness before submission.

Filing deadlines / important dates

Filing deadlines for the fiduciary declaration of estimated tax are critical to avoid penalties. Generally, estimated tax payments are due quarterly. The specific due dates are:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

It is essential to adhere to these deadlines to ensure compliance with IRS regulations.

Required documents

To complete the fiduciary declaration of estimated tax, several documents are necessary:

- Financial statements for the estate or trust, including income and expense reports.

- Previous tax returns for the estate or trust, if applicable.

- Documentation of any deductions or credits that may apply.

- IRS guidelines and instructions related to the fiduciary declaration of estimated tax.

Penalties for non-compliance

Failure to file the fiduciary declaration of estimated tax or to make timely payments can result in significant penalties. The IRS may impose:

- Late payment penalties, which can accumulate quickly.

- Interest on unpaid taxes, calculated from the due date until payment is made.

- Potential legal action against the fiduciary for failure to meet tax obligations.

Understanding these penalties emphasizes the importance of timely and accurate filing.

IRS guidelines

The IRS provides specific guidelines for completing and submitting the fiduciary declaration of estimated tax. These guidelines include:

- Instructions on calculating estimated taxes based on the estate or trust's income.

- Details on how to report any changes in income or deductions throughout the year.

- Information on electronic filing options and payment methods.

Fiduciaries should refer to the IRS website or consult a tax professional for the most current guidelines and requirements.

Quick guide on how to complete fiduciary declaration of estimated tax

Effortlessly Prepare FIDUCIARY DECLARATION OF ESTIMATED TAX on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage FIDUCIARY DECLARATION OF ESTIMATED TAX on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Simplest Way to Alter and Electronically Sign FIDUCIARY DECLARATION OF ESTIMATED TAX with Ease

- Find FIDUCIARY DECLARATION OF ESTIMATED TAX and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and electronically sign FIDUCIARY DECLARATION OF ESTIMATED TAX to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary declaration of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the fiduciary declaration of estimated tax

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are SC estimated tax forms?

SC estimated tax forms are documents used to report and pay estimated taxes to the South Carolina Department of Revenue. Businesses and individuals often use these forms to ensure compliance with state tax laws. Proper use of SC estimated tax forms can help avoid penalties and interest for underpayment.

-

How can airSlate SignNow help with SC estimated tax forms?

airSlate SignNow streamlines the process of completing and signing SC estimated tax forms. Our platform allows for easy eSigning and sharing of documents, ensuring you can manage your tax responsibilities efficiently. With a user-friendly interface, you can quickly upload, sign, and send your SC estimated tax forms without hassle.

-

Is there a cost associated with using airSlate SignNow for SC estimated tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to your needs. Whether you are a small business or a large enterprise, our cost-effective plans provide the necessary features to manage SC estimated tax forms seamlessly. Check our pricing page for detailed information on packages and features.

-

What features does airSlate SignNow offer for handling SC estimated tax forms?

airSlate SignNow includes features like document templates, advanced eSigning, and secure cloud storage for SC estimated tax forms. You can also track the status of your documents, set reminders, and integrate with other applications. These features enhance the overall efficiency and security of managing your tax documents.

-

Are SC estimated tax forms securely stored with airSlate SignNow?

Yes, airSlate SignNow prioritizes security for all documents, including SC estimated tax forms. We utilize industry-standard encryption and compliance protocols to keep your sensitive information protected. You can trust that your documents will remain confidential and secure within our platform.

-

Can I integrate airSlate SignNow with other software for SC estimated tax forms?

Absolutely! airSlate SignNow integrates with various software solutions, enabling you to streamline the workflow for SC estimated tax forms. Whether it’s accounting software or CRM systems, our integration capabilities enhance collaboration and efficiency across your operations.

-

How user-friendly is airSlate SignNow for completing SC estimated tax forms?

airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete SC estimated tax forms. The intuitive interface allows users to navigate the platform efficiently without extensive training. Get your forms ready for submission with just a few clicks.

Get more for FIDUCIARY DECLARATION OF ESTIMATED TAX

Find out other FIDUCIARY DECLARATION OF ESTIMATED TAX

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe