If Yes, Submit a Copy with This Form 2020

Understanding IRS Form IT-280

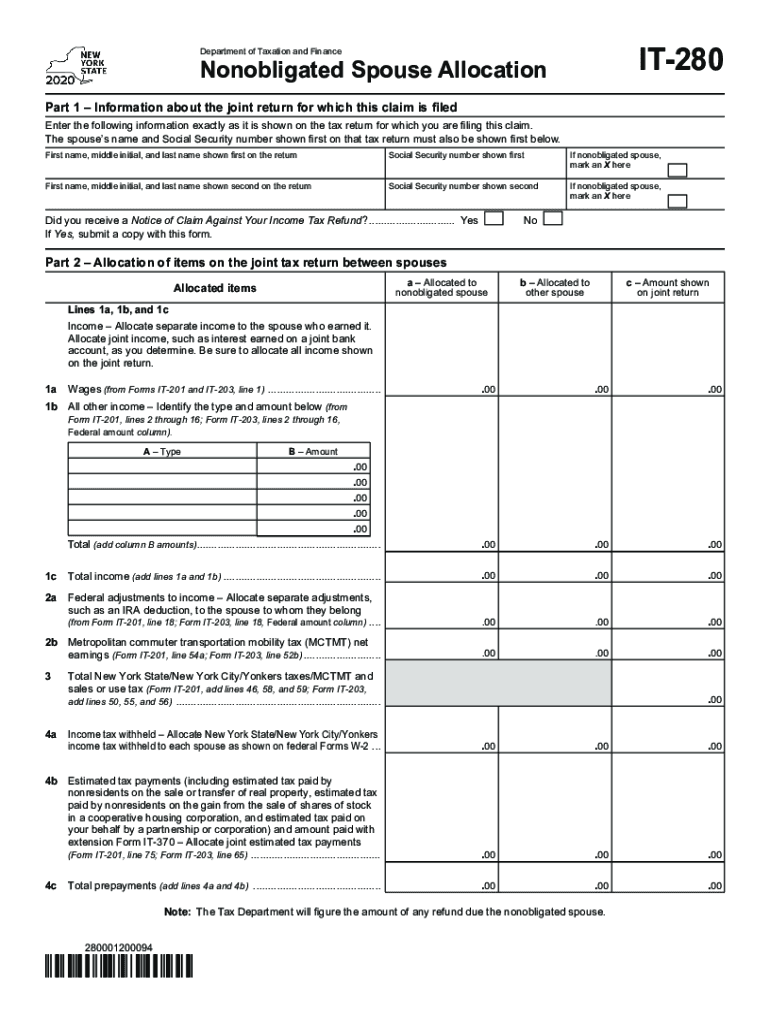

IRS Form IT-280, also known as the Non-Obligated Spouse Allocation Form, is used by individuals in New York State to allocate income and deductions between spouses when filing taxes. This form is particularly relevant for couples where one spouse is not responsible for the tax liability. By completing this form, taxpayers can ensure that the non-obligated spouse's income is appropriately accounted for, potentially reducing the overall tax burden.

Steps to Complete IRS Form IT-280

Filling out IRS Form IT-280 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements, tax returns, and any relevant financial records.

- Clearly identify both spouses' income sources and liabilities for the tax year.

- Fill out the form by entering the required information, ensuring that all details are accurate and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with your tax return, either electronically or by mail, depending on your filing method.

Required Documents for IRS Form IT-280

To successfully complete IRS Form IT-280, certain documents are essential:

- Previous year’s tax return for both spouses.

- W-2 forms or 1099 forms for all sources of income.

- Any documentation supporting deductions or credits claimed.

- Proof of residency and any other relevant financial records.

Filing Deadlines for IRS Form IT-280

It is crucial to be aware of the filing deadlines associated with IRS Form IT-280. Typically, the deadline for submitting your tax return, including this form, is April 15 of the following year. If you require additional time, you may file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Legal Use of IRS Form IT-280

IRS Form IT-280 serves a legal purpose in tax filings, particularly for couples in New York. It allows for the proper allocation of income and deductions, ensuring that the non-obligated spouse is not unfairly taxed on income they did not earn. Proper use of this form can protect both spouses from potential legal issues with the IRS regarding tax liabilities.

Who Issues IRS Form IT-280

The New York State Department of Taxation and Finance is responsible for issuing IRS Form IT-280. This form is specifically designed for residents of New York who are filing their state taxes and need to allocate income between spouses. It is important to use the most current version of the form to ensure compliance with state tax laws.

Quick guide on how to complete if yes submit a copy with this form

Effortlessly Prepare If Yes, Submit A Copy With This Form on Any Gadget

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your paperwork promptly without delays. Manage If Yes, Submit A Copy With This Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign If Yes, Submit A Copy With This Form seamlessly

- Locate If Yes, Submit A Copy With This Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign If Yes, Submit A Copy With This Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if yes submit a copy with this form

Create this form in 5 minutes!

How to create an eSignature for the if yes submit a copy with this form

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the IRS Form IT 280?

IRS Form IT 280 is a document used to request the Taxpayer Identification Number for certain tax purposes. It's essential for individuals and businesses alike to ensure accurate tax reporting. Understanding this form can help streamline your tax process.

-

How can airSlate SignNow assist with IRS Form IT 280?

airSlate SignNow simplifies the process of sending and eSigning IRS Form IT 280. Our platform ensures that your form is signed and submitted swiftly, reducing errors and delays. This efficiency helps you stay compliant with tax regulations.

-

What pricing options are available for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for individuals and enterprises. Our cost-effective solution ensures you get the best value for handling IRS Form IT 280 and other documents. Consider exploring our plans to find the right fit for your organization.

-

What features does airSlate SignNow provide for document management?

With airSlate SignNow, you gain access to a comprehensive set of features for document management, including eSignature capabilities, templates, and real-time collaboration. These features enhance your workflow, making it easier to manage IRS Form IT 280 and other important documents. Plus, everything can be done from any device, giving you flexibility.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. These integrations make it convenient to manage IRS Form IT 280 and other documents directly within the tools you already use. This connectivity enhances productivity and simplifies your document workflow.

-

What are the benefits of using airSlate SignNow for IRS Form IT 280?

Using airSlate SignNow for IRS Form IT 280 offers several benefits, including time savings, improved accuracy, and enhanced security. Our platform helps ensure that your documents are signed promptly and stored securely. This peace of mind allows you to focus more on your business and less on paperwork.

-

Can I track the status of my IRS Form IT 280 submissions?

Absolutely! airSlate SignNow allows you to track the status of your IRS Form IT 280 and other documents in real-time. You can receive notifications once the form is signed, ensuring you're always updated on its progress. This feature helps maintain transparency and accountability in your document management process.

Get more for If Yes, Submit A Copy With This Form

Find out other If Yes, Submit A Copy With This Form

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer