FORM TC201 INSTRUCTIONS for 22 2021-2026

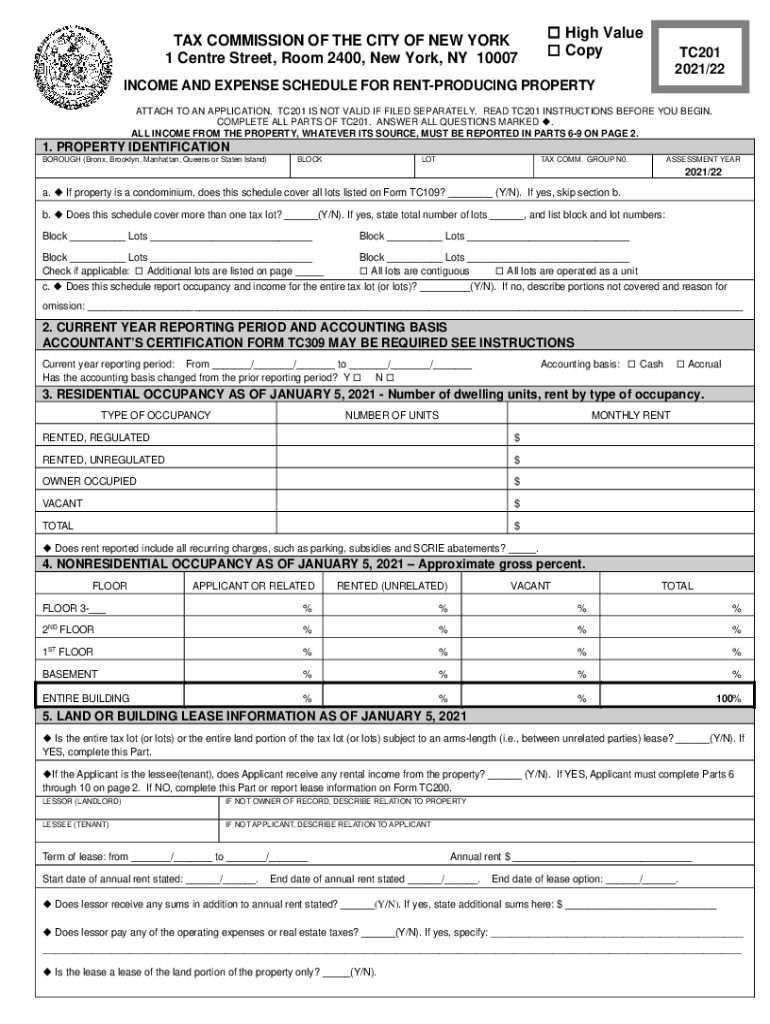

What is the TC201 form?

The TC201 form is a critical document used in New York City for tax purposes, specifically related to the transfer of ownership in real estate transactions. It serves as a declaration of the value of the property being transferred and is essential for calculating the appropriate tax obligations. Understanding the TC201 form is vital for both buyers and sellers to ensure compliance with local tax regulations.

Steps to complete the TC201 form

Completing the TC201 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the property, including its address, current ownership details, and any relevant tax identification numbers.

- Accurately assess the property's market value, as this will influence the tax calculation.

- Fill out the TC201 form, ensuring all sections are completed, including the seller's and buyer's information.

- Review the form for accuracy, verifying that all information is correct and complete before submission.

- Submit the completed form to the appropriate tax authority in New York City, either online or via mail.

Legal use of the TC201 form

The TC201 form is legally binding when executed properly. It is essential that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form must be signed by both parties involved in the transaction, and it is advisable to retain copies for personal records. Compliance with local laws regarding property transfers is crucial for ensuring that the transaction is recognized by the city.

Filing Deadlines / Important Dates

Filing deadlines for the TC201 form can vary based on the specifics of the transaction. Generally, it is recommended to submit the form promptly after the transfer of ownership occurs. Keeping track of important dates, such as the due date for tax payments associated with the transfer, is essential to avoid late fees or penalties. It is advisable to consult local tax authority guidelines for specific deadlines related to the TC201 form.

Required Documents

When completing the TC201 form, several supporting documents may be required to ensure a smooth submission process. These documents typically include:

- Proof of ownership, such as a deed or title.

- Identification numbers for both the buyer and seller.

- Any prior tax documentation related to the property.

- Additional forms that may be required by the local tax authority.

Who Issues the TC201 form

The TC201 form is issued by the New York City Department of Finance. This department oversees tax collection and compliance related to property transactions within the city. It is crucial for individuals involved in real estate transactions to familiarize themselves with the Department of Finance's requirements and procedures to ensure proper handling of the TC201 form.

Quick guide on how to complete form tc201 instructions for 202122

Complete FORM TC201 INSTRUCTIONS FOR 22 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents quickly without delays. Manage FORM TC201 INSTRUCTIONS FOR 22 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign FORM TC201 INSTRUCTIONS FOR 22 effortlessly

- Locate FORM TC201 INSTRUCTIONS FOR 22 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to missing or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and eSign FORM TC201 INSTRUCTIONS FOR 22 and facilitate excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tc201 instructions for 202122

Create this form in 5 minutes!

How to create an eSignature for the form tc201 instructions for 202122

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What are the tc201 instructions for using airSlate SignNow?

The tc201 instructions for airSlate SignNow guide users through the process of sending and eSigning documents easily. These instructions will help you navigate the platform, set up your account, and utilize key features like templates and integrations effectively.

-

How much does it cost to implement tc201 instructions with airSlate SignNow?

Implementing the tc201 instructions in airSlate SignNow is affordable, with various pricing plans available to suit different business needs. Each plan offers unique features, including document templates and advanced security options, ensuring you receive the best value.

-

What features are covered in the tc201 instructions?

The tc201 instructions include comprehensive details on features such as document creation, eSigning processes, team collaboration, and real-time tracking. By following these instructions, users can maximize the benefits of airSlate SignNow's powerful tools.

-

Are there any benefits to following the tc201 instructions when using airSlate SignNow?

Yes, following the tc201 instructions ensures that you use airSlate SignNow to its full potential, enhancing efficiency in document management. Additionally, these instructions help minimize errors and improve the overall eSigning experience for you and your clients.

-

Can I integrate other software using the tc201 instructions?

Absolutely! The tc201 instructions provide step-by-step guidance on how to integrate airSlate SignNow with various third-party applications, making it easy to streamline your workflow. Popular integrations include CRM systems and cloud storage services, which enhance productivity.

-

How do I get support for the tc201 instructions in airSlate SignNow?

You can access support for the tc201 instructions through airSlate SignNow’s dedicated help center, which offers FAQs, guides, and direct support options. If you encounter any challenges, their customer service team is available to assist you quickly.

-

Is training available for understanding the tc201 instructions?

Yes, airSlate SignNow offers training sessions to help users understand the tc201 instructions and effectively utilize all platform features. These training resources span webinars, tutorials, and one-on-one support, catering to your individual learning style.

Get more for FORM TC201 INSTRUCTIONS FOR 22

- O form

- Hunting nightmare bacteria video worksheet form

- Jokers and marbles cheat sheet form

- Letter sound fluency probes form

- Tnmhr form

- Fee voucher template form

- Noc letter format for shipping line

- 05 175 texas franchise tax annual tiered partnership report 05 175 texas franchise tax annual tiered partnership report window form

Find out other FORM TC201 INSTRUCTIONS FOR 22

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy