Instructions for Forms CT 3 A, CT 3 AATT, and CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year 2020

Understanding the CT 3 A Instructions

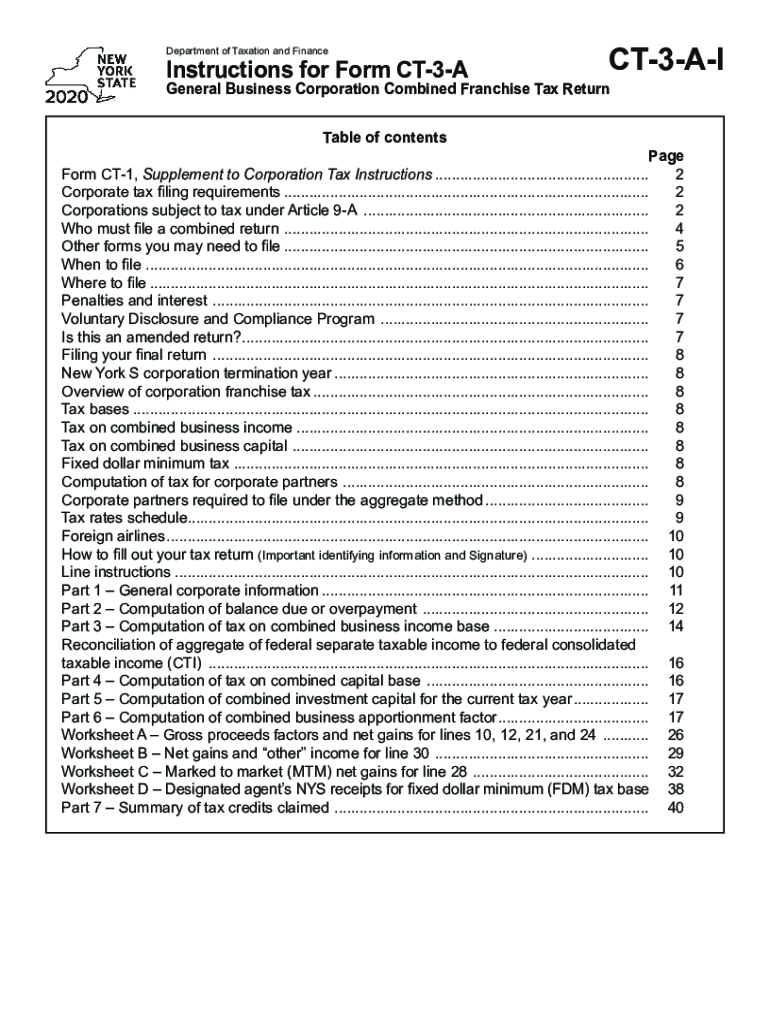

The CT 3 A instructions are essential for businesses in New York that need to file the General Business Corporation Combined Franchise Tax Return. This form is specifically designed for corporations operating in New York State, ensuring they comply with local tax regulations. The instructions detail the requirements for completing the CT 3 A, CT 3 AATT, and CT 3 AB forms, which are crucial for accurate tax reporting and compliance.

Steps to Complete the CT 3 A Instructions

Completing the CT 3 A instructions involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Review the specific requirements outlined in the instructions for the CT 3 A and related forms.

- Fill out the forms accurately, ensuring all information is complete and correct.

- Double-check calculations to avoid errors that could lead to penalties.

- Submit the completed forms by the designated deadline, either online or by mail.

Legal Use of the CT 3 A Instructions

The CT 3 A instructions provide a legal framework for businesses to report their income and pay taxes appropriately. Adhering to these guidelines ensures that the forms submitted are compliant with New York State tax laws. Failure to follow these instructions can result in penalties or legal issues, making it crucial for businesses to understand and utilize them correctly.

Filing Deadlines for the CT 3 A Instructions

Timely filing of the CT 3 A is critical to avoid penalties. The deadlines for submitting the CT 3 A instructions typically align with the end of the fiscal year for businesses. Corporations should be aware of these deadlines to ensure compliance and avoid late fees.

Required Documents for CT 3 A Instructions

To complete the CT 3 A instructions, businesses must gather several key documents:

- Previous year’s tax returns

- Financial statements including profit and loss statements

- Balance sheets

- Any additional documentation required by the New York State Department of Taxation and Finance

Examples of Using the CT 3 A Instructions

Businesses can benefit from understanding practical examples of how to use the CT 3 A instructions. For instance, a corporation that has multiple revenue streams may need to allocate income accurately across different categories as specified in the instructions. This ensures that all income is reported correctly, which is vital for tax compliance.

Quick guide on how to complete instructions for forms ct 3 a ct 3 aatt and ct 3 ab general business corporation combined franchise tax return tax year 2020

Complete Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year with ease

- Obtain Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for forms ct 3 a ct 3 aatt and ct 3 ab general business corporation combined franchise tax return tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the instructions for forms ct 3 a ct 3 aatt and ct 3 ab general business corporation combined franchise tax return tax year 2020

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What features does airSlate SignNow offer for ct 3 a i 2018?

airSlate SignNow provides an array of features for ct 3 a i 2018, including easy document eSigning, templates, document sharing, and workflow automation. These tools streamline the signing process, making it efficient and user-friendly. By leveraging these features, businesses can enhance their operations and improve turnaround times.

-

How does airSlate SignNow compare in terms of pricing for ct 3 a i 2018?

When considering pricing for ct 3 a i 2018, airSlate SignNow offers competitive plans designed to fit various business needs. Whether you are a startup or an established corporation, our pricing structure is transparent and flexible. This ensures that you can choose a plan that aligns with your organizational budget without sacrificing quality.

-

What benefits can businesses expect from using airSlate SignNow with ct 3 a i 2018?

By using airSlate SignNow in conjunction with ct 3 a i 2018, businesses can expect signNow efficiency gains and cost savings. Our platform automates the signing process, reducing the time spent on paperwork. This allows teams to focus more on core activities, thereby increasing overall productivity.

-

Are there any integrations available for airSlate SignNow and ct 3 a i 2018?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, complementing ct 3 a i 2018 effectively. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing users to streamline their workflows. By integrating these applications, you can enhance your document management experience.

-

Is airSlate SignNow user-friendly for ct 3 a i 2018 users?

Absolutely! airSlate SignNow is designed to be intuitive, making it easy for ct 3 a i 2018 users to navigate. The platform features a clean interface and straightforward functionality, which means minimal training is required. This accessibility leads to quicker adoption and optimal use across your organization.

-

How secure is airSlate SignNow when dealing with ct 3 a i 2018 documents?

Security is a top priority for airSlate SignNow, especially for handling ct 3 a i 2018 documents. Our platform employs advanced encryption methods and complies with industry standards to ensure that your documents remain protected. With features such as audit trails and two-factor authentication, you can trust that your information is secure.

-

Can airSlate SignNow help in reducing turnaround times for ct 3 a i 2018?

Yes, airSlate SignNow is specifically designed to expedite the document signing process, thereby reducing turnaround times for ct 3 a i 2018. Our platform allows users to send out documents quickly and track their status in real-time. This efficiency can signNowly enhance customer satisfaction by ensuring timely responses.

Get more for Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year

Find out other Instructions For Forms CT 3 A, CT 3 AATT, And CT 3 AB General Business Corporation Combined Franchise Tax Return Tax Year

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template