Instructions for Form CT 3 General Business Corporation Franchise 2022

What is the Instructions for Form CT 3 General Business Corporation Franchise

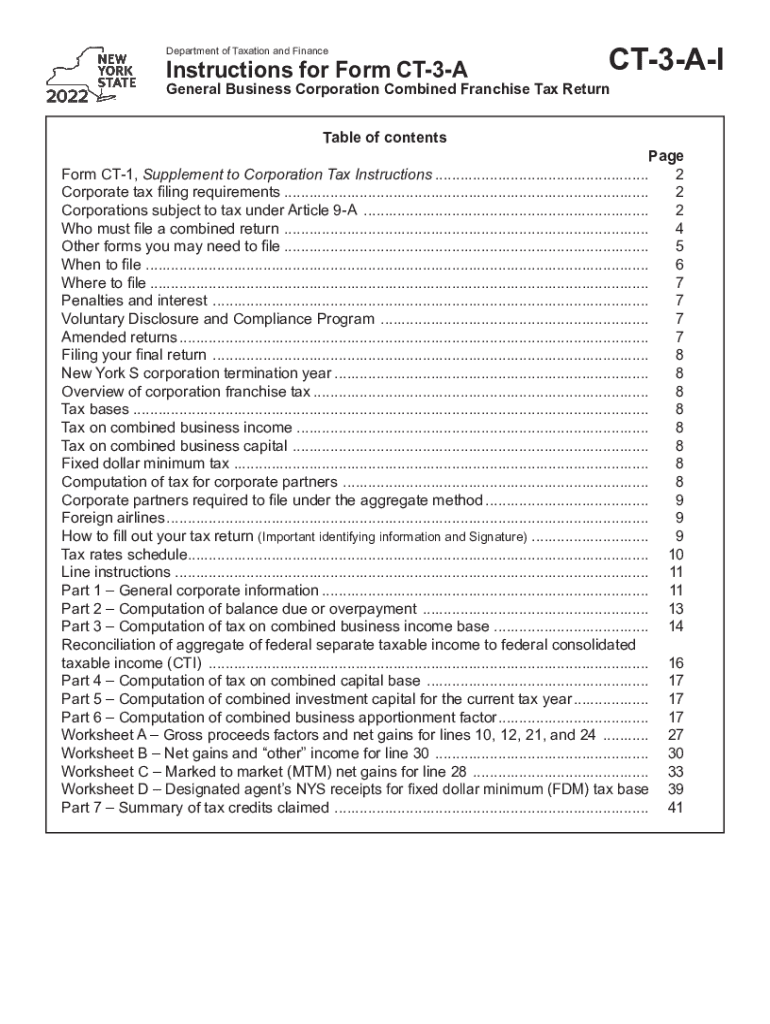

The Instructions for Form CT 3 provide essential guidance for businesses operating as general corporations in New York. This form is specifically designed for franchise tax purposes, allowing corporations to report their income and calculate their tax liability. Understanding the purpose of this form is crucial for compliance with state tax regulations. It details how to accurately report income, deductions, and credits, ensuring businesses meet their legal obligations while minimizing potential penalties.

Steps to Complete the Instructions for Form CT 3 General Business Corporation Franchise

Completing the Instructions for Form CT 3 involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, follow the step-by-step guidance provided in the instructions to accurately fill out each section of the form. Pay close attention to specific line items, as each requires precise information regarding your corporation's financial activities. After filling out the form, review it thoroughly to ensure accuracy before submission.

Key Elements of the Instructions for Form CT 3 General Business Corporation Franchise

The key elements of the Instructions for Form CT 3 include detailed sections on income reporting, allowable deductions, and tax credits. The instructions outline how to calculate the franchise tax based on the corporation's total income and provide guidance on specific adjustments that may apply. Additionally, the instructions highlight important definitions and terms that are essential for understanding the tax implications for your business.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form CT 3 is vital for compliance. Generally, the form must be filed annually, and the due date is typically the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. Late submissions may incur penalties, so it is important to mark these dates on your calendar and prepare your documents in advance.

Required Documents

To complete Form CT 3, several documents are required. These include financial statements, such as profit and loss statements, balance sheets, and any supporting documentation for deductions and credits claimed. Additionally, corporations should have prior year tax returns available for reference. Ensuring all necessary documents are compiled before starting the form will streamline the filing process and help avoid errors.

Who Issues the Form

The New York State Department of Taxation and Finance is responsible for issuing Form CT 3. This agency oversees the administration of state tax laws and ensures compliance among businesses operating within New York. The department provides resources and support for corporations to understand their tax obligations and navigate the filing process effectively.

Quick guide on how to complete instructions for form ct 3 general business corporation franchise

Effortlessly Prepare Instructions For Form CT 3 General Business Corporation Franchise on Any Device

Digital document management has become favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, as it allows you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Instructions For Form CT 3 General Business Corporation Franchise on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Edit and eSign Instructions For Form CT 3 General Business Corporation Franchise with Ease

- Obtain Instructions For Form CT 3 General Business Corporation Franchise and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form CT 3 General Business Corporation Franchise and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 3 general business corporation franchise

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 3 general business corporation franchise

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 3 I in relation to airSlate SignNow?

CT 3 I refers to the capability of airSlate SignNow to enhance document management processes through effective eSigning features. With CT 3 I, users can streamline their workflow, ensuring quick and secure signatures from anywhere.

-

How does CT 3 I improve the document signing process?

CT 3 I improves the document signing process by offering an intuitive platform that allows users to send documents for signature quickly. The system is designed with user convenience in mind, combining simplicity with robust security features.

-

What are the pricing options for airSlate SignNow's CT 3 I features?

AirSlate SignNow offers flexible pricing plans that include CT 3 I functionalities. Users can choose from monthly or annual subscriptions, with pricing tiers suitable for businesses of all sizes, ensuring cost-effective access to essential eSigning features.

-

Can I integrate airSlate SignNow with other applications using CT 3 I?

Yes, airSlate SignNow's CT 3 I features can be easily integrated with various third-party applications. This flexibility allows businesses to connect their preferred tools, enhancing their overall workflow and productivity.

-

What benefits does airSlate SignNow provide through its CT 3 I capabilities?

The primary benefits of airSlate SignNow’s CT 3 I capabilities include increased efficiency in document handling, higher levels of security for signatures, and improved compliance with legal standards. These advantages lead to reduced turnaround times and improved customer satisfaction.

-

Is airSlate SignNow suitable for small businesses looking for CT 3 I solutions?

Absolutely! airSlate SignNow’s CT 3 I solutions cater to small businesses by providing affordable pricing and easy-to-use features. This ensures that even smaller enterprises can effectively manage their document signing processes without breaking the bank.

-

How secure is the CT 3 I eSigning process on airSlate SignNow?

The eSigning process involving CT 3 I on airSlate SignNow is highly secure, utilizing advanced encryption technologies to protect sensitive information. Additionally, the platform provides compliance with various regulations to ensure that your documents are legally binding and secure.

Get more for Instructions For Form CT 3 General Business Corporation Franchise

- Sc warranty deed 497325581 form

- Quitclaim deed south carolina form

- South carolina life estate form

- At the time of decedents deathdecedents residence address was streetcity south carolina zip form

- South carolina deed 497325585 form

- Life estate deed 497325586 form

- Deed of an interest to time share from parents to children south carolina form

- Quitclaim deed from 497325588 form

Find out other Instructions For Form CT 3 General Business Corporation Franchise

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement