Instructions for Form CT 3 a Department of Taxation and 2021

What is the CT-3 A Instructions?

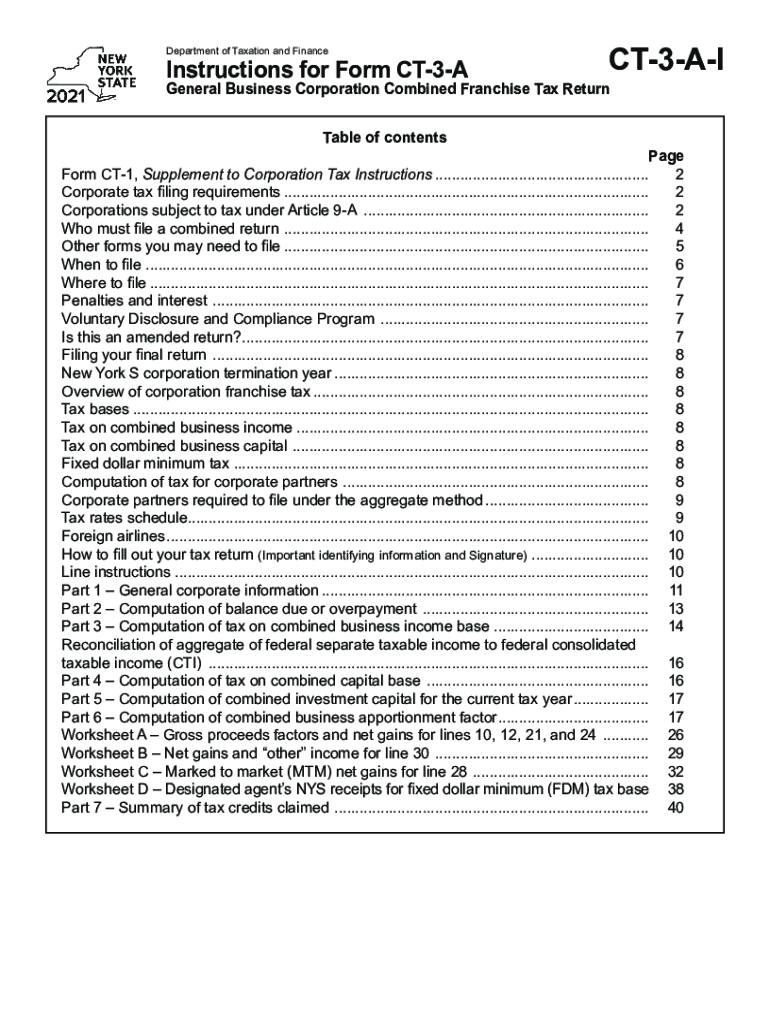

The CT-3 A instructions provide detailed guidance for completing the CT-3 A form, which is used by corporations in New York to report their income and calculate their franchise tax. This form is essential for ensuring compliance with state tax regulations. The instructions outline the necessary steps, required information, and specific calculations needed to accurately complete the form. Understanding these instructions is vital for businesses to avoid penalties and ensure correct tax filings.

Steps to Complete the CT-3 A Instructions

Completing the CT-3 A form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the CT-3 A instructions thoroughly to understand each section of the form.

- Fill out the form accurately, ensuring all figures are correct and reflect your business's financial status.

- Double-check calculations to avoid errors that could lead to penalties.

- Submit the completed form by the specified deadline, either electronically or by mail.

Key Elements of the CT-3 A Instructions

The key elements of the CT-3 A instructions include:

- Eligibility criteria for filing the CT-3 A form.

- Detailed descriptions of each section of the form, including income, deductions, and credits.

- Guidelines for calculating the franchise tax based on the business's income.

- Information on supporting documents required for submission.

- Instructions for filing methods, including electronic submission options.

Legal Use of the CT-3 A Instructions

Understanding the legal use of the CT-3 A instructions is crucial for compliance with New York state tax laws. The instructions ensure that businesses file their taxes correctly, which helps avoid legal issues related to tax evasion or inaccuracies. By following the guidelines outlined in the instructions, corporations can maintain good standing with the state and fulfill their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the CT-3 A form are critical to avoid penalties. Typically, corporations must submit their CT-3 A form by the 15th day of the third month following the end of their fiscal year. It is important to check for any changes to these deadlines annually, as they may vary based on legislative updates or specific circumstances affecting the business.

Who Issues the CT-3 A Form?

The CT-3 A form is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax compliance and ensuring that businesses adhere to state tax laws. The instructions provided with the form are designed to assist businesses in understanding their tax responsibilities and completing the form accurately.

Quick guide on how to complete instructions for form ct 3 a department of taxation and

Effortlessly Prepare Instructions For Form CT 3 A Department Of Taxation And on Any Device

Managing documents online has gained prominence among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Instructions For Form CT 3 A Department Of Taxation And on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Instructions For Form CT 3 A Department Of Taxation And

- Find Instructions For Form CT 3 A Department Of Taxation And and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to share your form via email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks on a device of your choice. Modify and electronically sign Instructions For Form CT 3 A Department Of Taxation And and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 3 a department of taxation and

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 3 a department of taxation and

How to create an e-signature for your PDF online

How to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF on Android

People also ask

-

What are the CT 3 A instructions for using airSlate SignNow?

The CT 3 A instructions provide a detailed guide on how to utilize airSlate SignNow for effective document signing. This includes steps on sending, signing, and managing documents. Following these instructions ensures a smooth experience for users, maximizing the efficiency of eSigning.

-

How much does airSlate SignNow cost for businesses looking to implement CT 3 A instructions?

airSlate SignNow offers competitive pricing tailored to different business needs, which can include guidance on CT 3 A instructions. Businesses can choose from various plans that provide valuable features to maximize their document management efficiency. For detailed pricing, visiting our pricing page or contacting our sales team is recommended.

-

What features are highlighted in the CT 3 A instructions for airSlate SignNow?

The CT 3 A instructions highlight key features such as customizable templates, automated workflows, and real-time tracking. These features are designed to enhance your document signing experience and streamline operations. By understanding these features, users can fully leverage airSlate SignNow's capabilities.

-

What benefits can users expect from following the CT 3 A instructions?

Following the CT 3 A instructions allows users to maximize their efficiency by ensuring they correctly utilize airSlate SignNow's tools. Benefits include quicker turnaround times, reduced paperwork, and improved organization of documents. These advantages lead to a more productive workflow for businesses.

-

Are there integrations mentioned in the CT 3 A instructions for airSlate SignNow?

Yes, the CT 3 A instructions include information about integrations with various software tools. airSlate SignNow seamlessly integrates with platforms like Google Drive, Dropbox, and Microsoft Office to enhance document management. These integrations allow users to streamline their processes and increase productivity.

-

Can small businesses benefit from the CT 3 A instructions for airSlate SignNow?

Absolutely! The CT 3 A instructions provide small businesses with the knowledge they need to implement airSlate SignNow effectively. This empowers them to handle document signing and management tasks efficiently without the need for complex systems or extensive training.

-

How do I get support when using airSlate SignNow with the CT 3 A instructions?

Support is readily available for users following the CT 3 A instructions. AirSlate SignNow offers various resources, including tutorials, FAQs, and customer support channels to assist with any queries. Users can contact our support team directly for any specific issues they encounter.

Get more for Instructions For Form CT 3 A Department Of Taxation And

- Ca statement of file form

- California notice support form

- Ex parte motion 497299007 form

- California notice motion 497299008 form

- Motion form court

- California stipulation agreement form

- Findings and recommendation of commissioner governmental california form

- Review of commissioners findings of fact and recommendation governmental california form

Find out other Instructions For Form CT 3 A Department Of Taxation And

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation