2550q Form PDF

What is the 2550q Form PDF

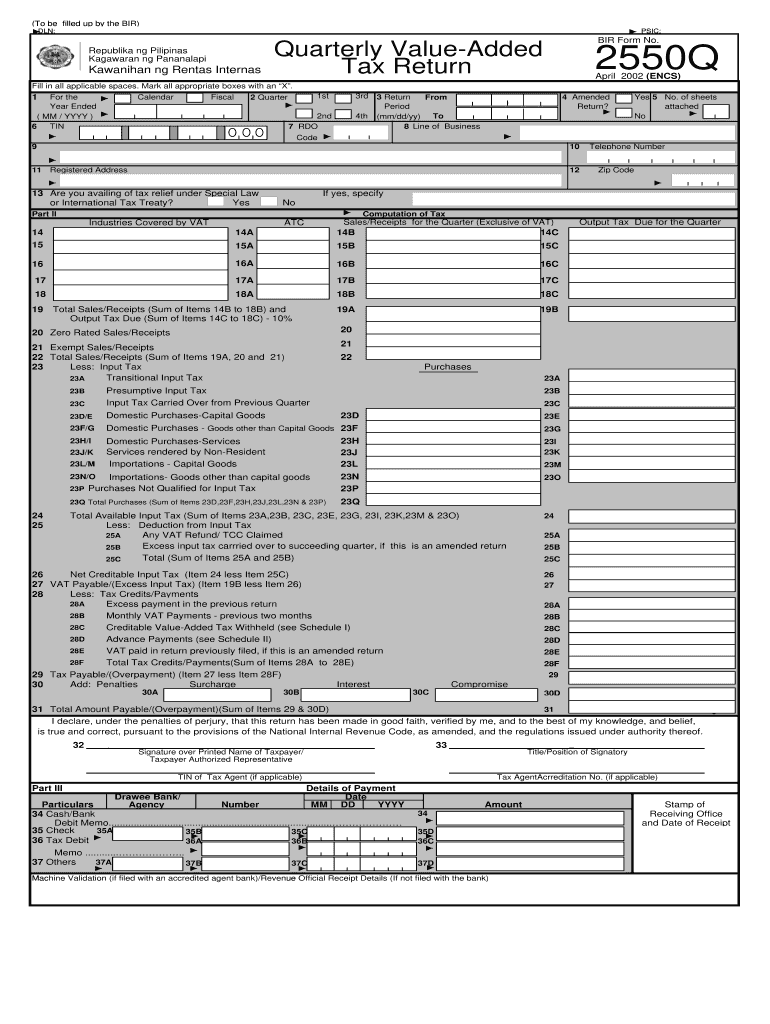

The 2550q form is a tax document used in the Philippines for the quarterly value-added tax (VAT) return. This form is essential for businesses that are registered for VAT, allowing them to report their sales, purchases, and the corresponding tax liabilities. The 2550q form PDF is a digital version that can be easily downloaded and filled out electronically, streamlining the process for taxpayers. It is crucial for ensuring compliance with tax regulations and maintaining accurate financial records.

Steps to Complete the 2550q Form PDF

Filling out the 2550q form PDF involves several key steps:

- Download the form: Obtain the latest version of the 2550q form PDF from a reliable source.

- Gather necessary information: Collect all relevant data, including sales figures, purchases, and input VAT.

- Fill out the form: Input the required information in the designated fields, ensuring accuracy to avoid penalties.

- Review the form: Double-check all entries for completeness and correctness before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the 2550q Form PDF

The 2550q form PDF is legally recognized as a valid document for reporting VAT obligations. To ensure its legal standing, it must be completed accurately and submitted within the prescribed deadlines. Compliance with local tax laws is essential to avoid penalties and maintain good standing with tax authorities. Electronic submissions are accepted, provided they meet the requirements set forth by the Bureau of Internal Revenue (BIR).

Form Submission Methods

There are several methods available for submitting the 2550q form:

- Online submission: Many taxpayers opt for electronic filing through the BIR's online portal, which allows for quicker processing.

- Mail: The completed form can be printed and mailed to the appropriate BIR office.

- In-person submission: Taxpayers may also choose to submit the form directly at their local BIR office.

Filing Deadlines / Important Dates

Timely filing of the 2550q form is critical to avoid penalties. The deadlines for submission typically fall within the first 25 days of the month following the end of each quarter. It is important to stay informed of any changes to these deadlines, as they may vary based on specific circumstances or announcements from the BIR.

Required Documents

When completing the 2550q form, certain documents are necessary to support the information provided. These may include:

- Sales invoices and receipts

- Purchase invoices and receipts

- Previous VAT returns

- Financial statements

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete 2550q form pdf

Effortlessly prepare 2550q Form Pdf on any device

The management of documents online has gained immense popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and store it securely online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly, eliminating delays. Handle 2550q Form Pdf on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to alter and electronically sign 2550q Form Pdf with ease

- Locate 2550q Form Pdf and then click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or mishandled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign 2550q Form Pdf and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2550q form pdf

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 'bir form 2550q 2007 download' and why is it important?

The 'bir form 2550q 2007 download' is a tax form used for reporting value-added tax in the Philippines. It is important for businesses to accurately file this form to comply with local tax regulations and avoid penalties.

-

How can airSlate SignNow help with the 'bir form 2550q 2007 download'?

airSlate SignNow allows users to easily fill, sign, and send the 'bir form 2550q 2007 download' electronically. This streamlines the filing process and ensures that all necessary documents are securely transmitted, reducing the chance of errors.

-

Is there a cost associated with downloading the 'bir form 2550q 2007' from airSlate SignNow?

Downloading the 'bir form 2550q 2007' template from airSlate SignNow is typically included in the subscription plan, which offers a cost-effective solution for businesses needing e-signature services. Additional features may vary based on the chosen plan.

-

What features does airSlate SignNow offer for managing the 'bir form 2550q 2007 download'?

airSlate SignNow provides features such as intuitive document editing, e-signatures, and tracking capabilities for the 'bir form 2550q 2007 download'. These features make it easier to manage and complete your tax documentation efficiently.

-

Can I integrate airSlate SignNow with other software for managing the 'bir form 2550q 2007 download'?

Yes, airSlate SignNow offers integrations with various third-party applications that can help streamline your workflow around the 'bir form 2550q 2007 download'. This allows you to automate processes and enhance productivity.

-

What are the benefits of using airSlate SignNow for the 'bir form 2550q 2007 download'?

Using airSlate SignNow for the 'bir form 2550q 2007 download' offers numerous benefits such as enhanced security, ease of use, and time-saving features. Businesses can ensure compliance while streamlining their documentation processes.

-

Is my data safe when using airSlate SignNow for the 'bir form 2550q 2007 download'?

Absolutely! airSlate SignNow prioritizes data security and uses industry-standard encryption methods to protect your information. This commitment ensures that your 'bir form 2550q 2007 download' and other documents are secure and confidential.

Get more for 2550q Form Pdf

Find out other 2550q Form Pdf

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free