Guarantor Form

What is the Guarantor Form

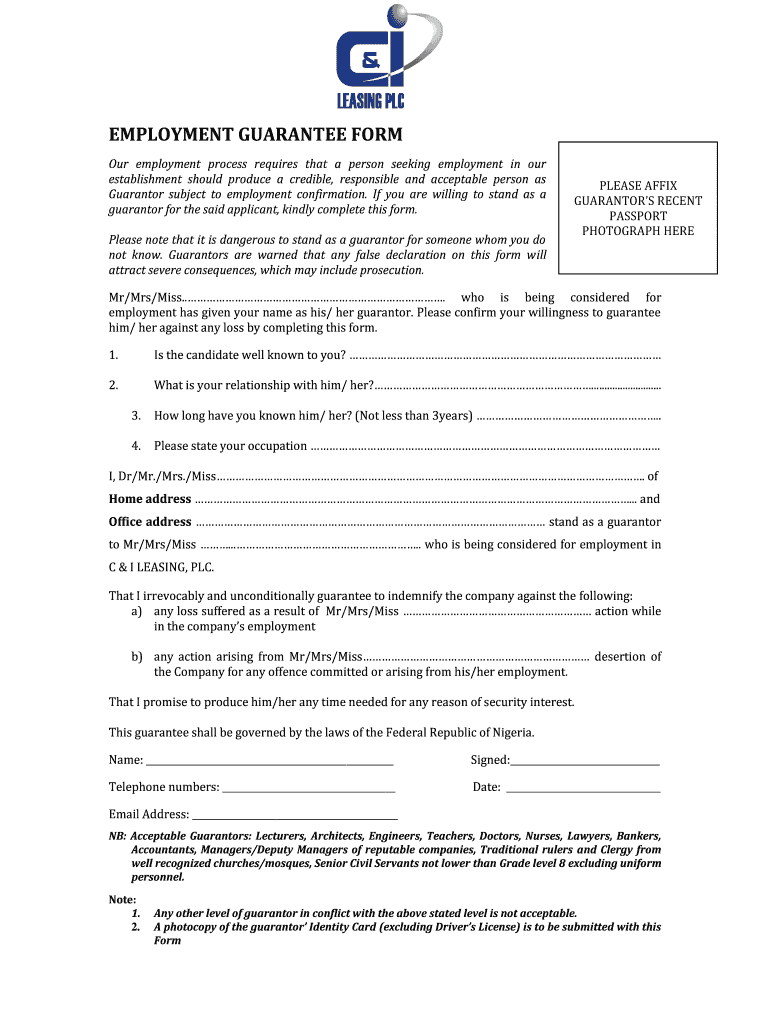

The guarantor form is a legal document used to establish a guarantee for a loan or lease agreement. It involves a third party, known as the guarantor, who agrees to be responsible for the debt or obligations of the primary borrower in case of default. This form is essential in various contexts, including rental agreements and loan applications, as it provides security to lenders or landlords by ensuring that they have recourse in the event of non-payment.

Key elements of the Guarantor Form

Several key elements must be included in a guarantor form to ensure its validity and effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and contact information of the borrower, guarantor, and lender or landlord.

- Details of the Obligation: Specify the nature of the obligation, including the amount of the loan or lease, and any relevant terms and conditions.

- Signature Section: Provide space for the guarantor's signature, which indicates their acceptance of the terms and conditions outlined in the form.

- Legal Clauses: Include any necessary legal language that outlines the rights and responsibilities of the parties involved.

Steps to complete the Guarantor Form

Completing a guarantor form involves several straightforward steps:

- Gather Information: Collect all necessary information about the borrower, guarantor, and the financial obligation.

- Fill Out the Form: Accurately complete the form with the required details, ensuring that all information is correct and up to date.

- Review the Terms: Carefully read through the terms and conditions to understand the responsibilities being assumed.

- Sign the Document: The guarantor must sign the form in the designated area to validate their agreement.

- Submit the Form: Provide the completed form to the lender or landlord as required, ensuring that copies are kept for personal records.

Legal use of the Guarantor Form

The legal use of a guarantor form is crucial for its enforceability. In the United States, the form must comply with relevant laws and regulations, including the ESIGN Act, which governs electronic signatures. It is important that the form is executed properly, with all parties fully understanding their obligations. A legally valid guarantor form can protect the interests of both the lender and the guarantor, ensuring that all parties are aware of their rights and responsibilities.

Examples of using the Guarantor Form

The guarantor form is commonly used in various scenarios, including:

- Rental Agreements: Landlords often require a guarantor for tenants with insufficient credit history or income.

- Loan Applications: Financial institutions may ask for a guarantor to secure a loan for individuals with limited credit.

- Business Leases: Companies may need a guarantor to assure landlords of payment when entering into lease agreements.

Form Submission Methods (Online / Mail / In-Person)

Submitting a guarantor form can be done through various methods, depending on the requirements of the lender or landlord. Common submission methods include:

- Online Submission: Many organizations allow electronic submission of forms via secure portals.

- Mail: Traditional mailing of the completed form is still a common practice, especially for formal agreements.

- In-Person Submission: Some situations may require the guarantor to submit the form in person, particularly for notarization purposes.

Quick guide on how to complete guarantor form 84224266

Complete Guarantor Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Guarantor Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Guarantor Form seamlessly

- Find Guarantor Form and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Guarantor Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the guarantor form 84224266

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What are guarantors and how do they work in airSlate SignNow?

Guarantors in airSlate SignNow refer to individuals who can provide assurance on the legitimacy of a document or transaction. They enhance trust and security by validating the identity of the signers. By including guarantors, businesses can ensure that documents carry an additional level of credibility and reliability.

-

How can I add guarantors to my documents in airSlate SignNow?

To add guarantors in airSlate SignNow, simply include their details during the eSignature process. You can assign the role of a guarantor to specific individuals, allowing them to verify or endorse the document. This feature is easily accessible in the document settings, making it straightforward for users.

-

Are there any additional costs for using guarantors in airSlate SignNow?

Using guarantors in airSlate SignNow comes at no additional cost beyond your standard subscription. Our pricing plans are designed to be cost-effective, giving you the flexibility to utilize all features, including adding guarantors, without hidden fees. This allows you to manage your document security economically.

-

What benefits do guarantors provide in electronic signatures?

Guarantors add an essential layer of trust to electronic signatures by verifying the identities of signers. Their involvement can enhance the legal enforceability of documents and mitigate the risk of fraud. By using guarantors, businesses can foster confidence in their agreements and transactions.

-

Can I customize the role of guarantors in my document workflows?

Yes, airSlate SignNow allows you to customize the roles of guarantors within your document workflows. You can specify what actions they can take, such as viewing or signing documents. This flexibility ensures that your processes align with your business needs and enhances operational efficiency.

-

What types of documents can have guarantors in airSlate SignNow?

Any document that requires legal acknowledgment or authority can benefit from having guarantors in airSlate SignNow. This includes contracts, agreements, and any legally binding paperwork. By including guarantors, you increase the credibility of a wide range of documents.

-

How do guarantors enhance the eSigning experience for my clients?

Guarantors improve the eSigning experience by providing reassurance to clients about the document's authenticity. Knowing that there are responsible individuals confirming their identity can make clients more comfortable during the signing process. This leads to a smoother and more trustworthy transaction for everyone involved.

Get more for Guarantor Form

Find out other Guarantor Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors