Kentucky Form 720S Kentucky S Corporation Income Tax 2019-2026

What is the Kentucky Form 720S Kentucky S Corporation Income Tax

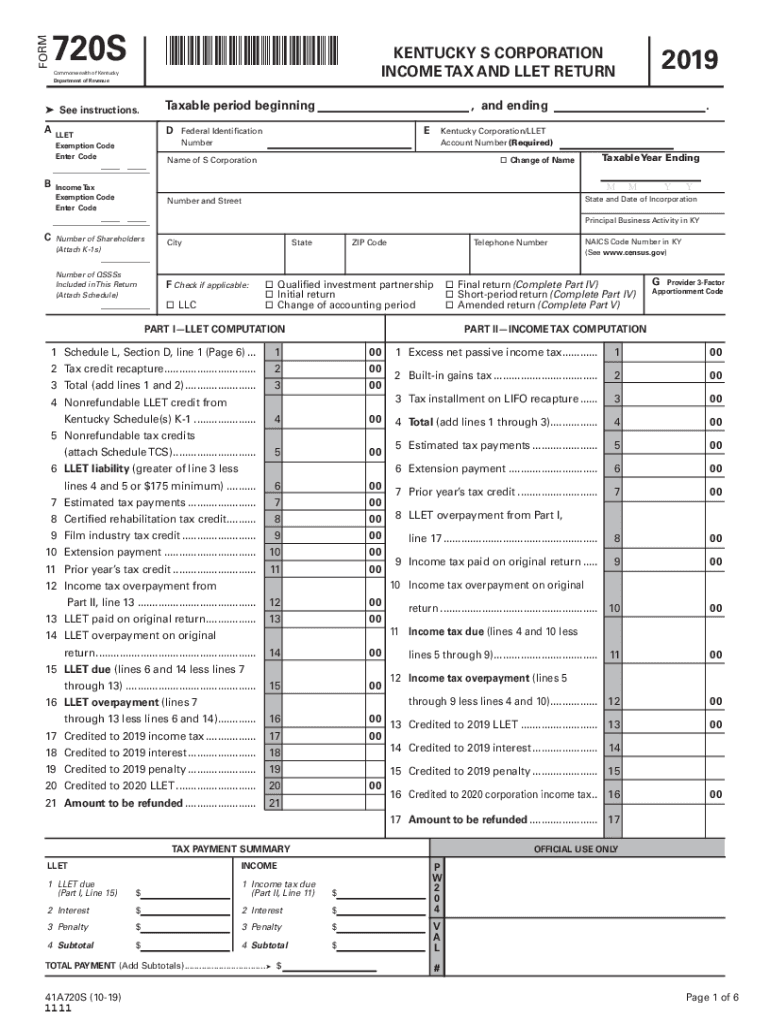

The Kentucky Form 720S is a tax form specifically designed for S corporations operating within the state. This form is used to report income, gains, losses, deductions, and credits for S corporations. Unlike traditional corporations, S corporations pass their income directly to shareholders, avoiding double taxation at the corporate level. Understanding the purpose and requirements of Form 720S is essential for compliance and accurate tax reporting.

Steps to complete the Kentucky Form 720S Kentucky S Corporation Income Tax

Completing the Kentucky Form 720S involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by reporting total income, deductions, and credits. Be sure to calculate the tax liability accurately. After completing the form, review it for any errors before submission. Finally, ensure that all signatures are included to validate the submission.

Filing Deadlines / Important Dates

It is crucial for S corporations to be aware of filing deadlines for the Kentucky Form 720S. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing helps avoid penalties and interest on unpaid taxes.

Legal use of the Kentucky Form 720S Kentucky S Corporation Income Tax

The legal use of the Kentucky Form 720S is governed by state tax laws and regulations. This form must be submitted to the Kentucky Department of Revenue and is essential for ensuring compliance with state tax obligations. Properly completing and filing this form allows S corporations to fulfill their legal responsibilities and avoid potential penalties for non-compliance. It is important to adhere to all state-specific rules when using this form.

Key elements of the Kentucky Form 720S Kentucky S Corporation Income Tax

Key elements of the Kentucky Form 720S include sections for reporting income, deductions, and credits. The form requires detailed information about the corporation's financial activities, including gross receipts, cost of goods sold, and various expenses. Additionally, it includes a section for calculating the corporation's tax liability and any applicable credits. Understanding these elements is vital for accurate reporting and compliance with tax laws.

How to obtain the Kentucky Form 720S Kentucky S Corporation Income Tax

The Kentucky Form 720S can be obtained directly from the Kentucky Department of Revenue's website. It is available in a downloadable format, allowing businesses to print and complete the form. Additionally, physical copies may be available at local tax offices. Ensuring you have the most current version of the form is essential for accurate filing.

Quick guide on how to complete kentucky form 720s kentucky s corporation income tax

Complete Kentucky Form 720S Kentucky S Corporation Income Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Kentucky Form 720S Kentucky S Corporation Income Tax on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Kentucky Form 720S Kentucky S Corporation Income Tax with ease

- Find Kentucky Form 720S Kentucky S Corporation Income Tax and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunting, or mistakes that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Kentucky Form 720S Kentucky S Corporation Income Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky form 720s kentucky s corporation income tax

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 720s kentucky s corporation income tax

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is an llet number lookup?

An llet number lookup is a process that allows users to find detailed information associated with a specific llet number. This can include legal descriptions, ownership records, and property details. Utilizing airSlate SignNow can simplify document signing related to these lookups, enhancing efficiency in your workflow.

-

How can airSlate SignNow assist with llet number lookups?

airSlate SignNow enhances the llet number lookup by allowing users to send and eSign documents effortlessly. Whether you are handling real estate transactions or property management, our platform streamlines the process, ensuring that all parties can access necessary documentation promptly.

-

Is airSlate SignNow cost-effective for businesses needing llet number lookups?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing llet number lookups. Our pricing plans are designed to cater to different business sizes, ensuring you only pay for what you need. This efficiency translates into signNow savings over time.

-

What features does airSlate SignNow offer for llet number lookups?

airSlate SignNow comes equipped with features like document templates, real-time collaboration, and cloud storage that are ideal for llet number lookups. These tools not only improve the accuracy of your documentation but also speed up the overall process, making it seamless for users.

-

Are there integrations available for llet number lookup processes?

Yes, airSlate SignNow integrates with various third-party applications that can facilitate llet number lookup processes. This ensures that you can work with the tools you're comfortable with while still enhancing document management. These integrations help centralize your workflow effectively.

-

What are the benefits of using airSlate SignNow for llet number lookups?

Using airSlate SignNow for llet number lookups offers numerous benefits, including a user-friendly interface and digital security for your documents. You can streamline operations, reduce turnaround times, and ensure compliance with necessary regulations. This makes it a preferred choice for businesses.

-

Is it easy to eSign documents related to llet number lookups with airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to eSign documents related to llet number lookups. Our platform is designed to be intuitive, allowing users to sign from any device, so you can finalize important agreements quickly and efficiently.

Get more for Kentucky Form 720S Kentucky S Corporation Income Tax

Find out other Kentucky Form 720S Kentucky S Corporation Income Tax

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free