Tds Challan 281 Excel Format

What is the TDS Challan 281 Excel Format

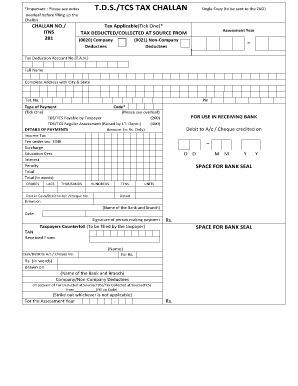

The TDS Challan 281 Excel format is a specific document used for the payment of Tax Deducted at Source (TDS) on certain payments. This format allows taxpayers to efficiently fill out the necessary information required for TDS payments related to salaries, interest, and other specified payments. The Excel format simplifies the data entry process, making it easier for users to calculate and report their TDS obligations accurately. By using this format, taxpayers can streamline their compliance with tax regulations and ensure timely payments.

How to use the TDS Challan 281 Excel Format

Using the TDS Challan 281 Excel format involves several straightforward steps. First, download the Excel template designed for the TDS Challan 281. Open the file and input the required details, such as the TAN (Tax Deduction and Collection Account Number), the amount of TDS being paid, and the relevant financial year. Ensure all fields are filled out accurately to avoid issues during submission. After completing the form, save your changes and proceed to make the payment through the designated bank or online portal.

Steps to complete the TDS Challan 281 Excel Format

To complete the TDS Challan 281 Excel format, follow these steps:

- Download the TDS Challan 281 Excel template from a reliable source.

- Open the Excel file and locate the fields for inputting information.

- Enter your TAN, the payment amount, and the applicable financial year.

- Double-check all entries for accuracy to prevent errors.

- Save the completed document on your device.

- Use the saved file to make the payment at your bank or through an online payment gateway.

Key elements of the TDS Challan 281 Excel Format

Several key elements are essential when filling out the TDS Challan 281 Excel format. These include:

- TAN: The Tax Deduction and Collection Account Number is a unique identifier for the taxpayer.

- Payment Amount: The total amount of TDS being remitted.

- Financial Year: The relevant financial year for which the TDS is being paid.

- Bank Details: Information about the bank through which the payment will be made.

- Challan Serial Number: A unique number assigned to the challan for tracking purposes.

Legal use of the TDS Challan 281 Excel Format

The TDS Challan 281 Excel format is legally recognized for the payment of TDS in the United States. When filled out correctly and submitted in accordance with IRS guidelines, it serves as a valid proof of tax payment. Compliance with the legal requirements surrounding TDS payments is crucial to avoid penalties and ensure proper tax reporting. Using a reliable platform for filling out and submitting the challan can enhance the legal validity of the document.

Form Submission Methods (Online / Mail / In-Person)

The TDS Challan 281 can be submitted through various methods to ensure convenience for taxpayers. These methods include:

- Online Submission: Taxpayers can make payments through authorized online banking portals, which allows for immediate processing and confirmation.

- Mail Submission: In some cases, taxpayers may choose to send a printed version of the challan along with payment to the appropriate tax authority.

- In-Person Submission: Payments can also be made directly at designated banks that accept TDS payments, where the challan will be stamped as proof of payment.

Quick guide on how to complete tds challan 281 excel format

Effortlessly prepare Tds Challan 281 Excel Format on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Tds Challan 281 Excel Format on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Tds Challan 281 Excel Format with ease

- Obtain Tds Challan 281 Excel Format and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Tds Challan 281 Excel Format and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tds challan 281 excel format

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is TDS Challan 281 Excel format?

The TDS Challan 281 Excel format is a standardized file format used for filing tax deducted at source (TDS) payments with the Income Tax Department of India. It allows users to easily enter necessary details and generate a challan that complies with government regulations. By using this format, businesses can streamline their tax filing process.

-

How can airSlate SignNow help with TDS Challan 281 Excel format?

airSlate SignNow simplifies the process of managing and eSigning TDS Challan 281 Excel format documents. With its intuitive interface, users can quickly upload, edit, and sign their challans, ensuring accuracy and compliance. Additionally, it provides secure storage for all tax-related documents.

-

Is there a cost associated with using airSlate SignNow for TDS Challan 281 Excel format?

Yes, airSlate SignNow offers several pricing plans to fit different business needs while providing cost-effective solutions for managing TDS Challan 281 Excel format. Pricing varies based on features and usage, allowing businesses to select a plan that best suits their requirements. You can check the pricing details on our website.

-

What features does airSlate SignNow offer for TDS Challan 281 Excel format?

airSlate SignNow includes features such as document management, eSignature capabilities, and seamless collaboration, all tailored for TDS Challan 281 Excel format. Users can easily track the status of their documents, set reminders for filing deadlines, and ensure that all necessary fields are filled out properly. This helps maintain compliance and reduces the chances of errors.

-

Can I integrate airSlate SignNow with other tools for TDS Challan 281 Excel format?

Absolutely! airSlate SignNow offers integrations with various software applications to facilitate the processing of TDS Challan 281 Excel format. Whether you use accounting software, CRMs, or other business tools, these integrations ensure a smooth workflow and better management of your documents. Check our integrations page for more details.

-

How does airSlate SignNow ensure the security of my TDS Challan 281 Excel format documents?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your TDS Challan 281 Excel format documents. We prioritize the privacy and security of our users, ensuring that your sensitive information is safeguarded against unauthorized access. Regular audits and compliance with industry standards further enhance the security of our platform.

-

What support does airSlate SignNow provide for TDS Challan 281 Excel format users?

Our support team is dedicated to assisting users with any inquiries related to TDS Challan 281 Excel format. We offer comprehensive resources, including tutorials, FAQs, and direct customer service for personalized help. Whether you need help navigating the platform or resolving technical issues, our team is here to support you.

Get more for Tds Challan 281 Excel Format

Find out other Tds Challan 281 Excel Format

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form