Income Tax Statement 2023

What is the Income Tax Statement

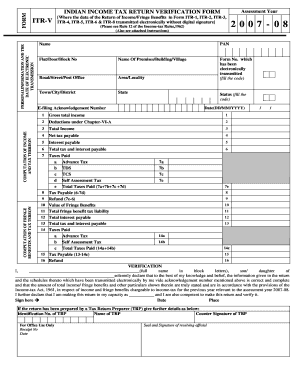

The Income Tax Statement is a crucial document that summarizes an individual's or business's taxable income for a specific tax year. It typically includes details such as total earnings, deductions, and credits, which are necessary for calculating the amount of tax owed or the refund due. This statement is essential for taxpayers in the United States, as it serves as the foundation for filing annual tax returns with the Internal Revenue Service (IRS).

How to Obtain the Income Tax Statement

To obtain an Income Tax Statement, individuals can request it from their employer or financial institution. Employers are required to provide a W-2 form, which details an employee's earnings and taxes withheld. Self-employed individuals may need to compile their income statements from various sources, such as 1099 forms. Additionally, taxpayers can access their tax transcripts directly from the IRS website, which provides a summary of their tax filings.

Steps to Complete the Income Tax Statement

Completing the Income Tax Statement involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income records.

- Calculate total income by adding all sources of earnings.

- Identify eligible deductions and credits to reduce taxable income.

- Fill out the appropriate tax forms, ensuring all information is accurate.

- Review the completed statement for errors before submission.

Key Elements of the Income Tax Statement

Several key elements are essential to include in the Income Tax Statement:

- Personal Information: Name, address, and Social Security number.

- Income Details: Total income from all sources, including wages, interest, and dividends.

- Deductions: Itemized or standard deductions that reduce taxable income.

- Tax Credits: Any applicable credits that can lower the overall tax liability.

- Tax Calculation: The final tax amount owed or the refund expected.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Income Tax Statement. Taxpayers must ensure they adhere to the current tax laws, which may change annually. The IRS website offers resources, including instructions for various forms and updates on tax rates and deductions. It is crucial to stay informed about any changes to avoid penalties or issues with tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Statement are critical to avoid penalties. Typically, individual tax returns are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments and extensions, which can provide additional time for filing but may require timely payments to avoid interest and penalties.

Create this form in 5 minutes or less

Find and fill out the correct income tax statement

Create this form in 5 minutes!

How to create an eSignature for the income tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Income Tax Statement and why is it important?

An Income Tax Statement is a document that summarizes your earnings and tax obligations for a specific period. It is essential for filing your taxes accurately and ensuring compliance with tax regulations. Using airSlate SignNow, you can easily create and manage your Income Tax Statement digitally.

-

How can airSlate SignNow help with my Income Tax Statement?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Income Tax Statement. This streamlines the process, reduces paperwork, and ensures that your documents are securely stored and easily accessible. With our solution, you can focus more on your finances and less on administrative tasks.

-

What are the pricing options for using airSlate SignNow for Income Tax Statements?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have all the necessary features to manage your Income Tax Statement efficiently. Visit our pricing page for detailed information.

-

Is airSlate SignNow secure for handling sensitive Income Tax Statements?

Yes, airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption and security protocols to protect your sensitive Income Tax Statements and other documents. You can trust that your information is safe while using our eSigning services.

-

Can I integrate airSlate SignNow with other software for managing Income Tax Statements?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to streamline your workflow and manage your Income Tax Statements alongside other financial documents, enhancing efficiency and productivity.

-

What features does airSlate SignNow offer for creating Income Tax Statements?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and document tracking. These tools make it easy to create professional Income Tax Statements quickly and ensure that all parties can sign them electronically, saving time and resources.

-

How does eSigning an Income Tax Statement work with airSlate SignNow?

eSigning an Income Tax Statement with airSlate SignNow is simple and efficient. You upload your document, add the necessary fields for signatures, and send it to the required parties. They can sign electronically from any device, making the process fast and convenient.

Get more for Income Tax Statement

Find out other Income Tax Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors