Tax Attribute Carryovers Tax Alaska 2020

What is the Tax Attribute Carryovers Tax Alaska

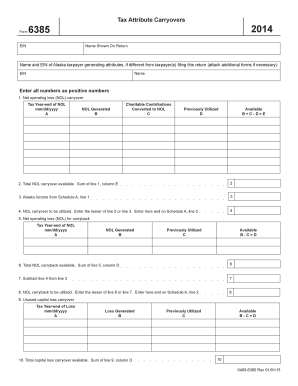

The Tax Attribute Carryovers Tax Alaska is a form that allows taxpayers to carry forward certain tax attributes to future tax years. This includes unused credits, deductions, and losses that can be applied to reduce taxable income in subsequent years. Understanding this form is crucial for individuals and businesses looking to optimize their tax liabilities in Alaska.

How to use the Tax Attribute Carryovers Tax Alaska

To effectively use the Tax Attribute Carryovers Tax Alaska, taxpayers must first determine which tax attributes are eligible for carryover. This involves reviewing prior year tax returns to identify unused credits or losses. Once identified, taxpayers can complete the form by accurately reporting these attributes, ensuring compliance with state regulations. It is advisable to consult a tax professional for guidance on the specific calculations and entries required.

Steps to complete the Tax Attribute Carryovers Tax Alaska

Completing the Tax Attribute Carryovers Tax Alaska involves several key steps:

- Gather necessary documentation, including prior year tax returns and records of any unused credits or deductions.

- Identify the specific tax attributes eligible for carryover.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, whether electronically or via mail.

Legal use of the Tax Attribute Carryovers Tax Alaska

The legal use of the Tax Attribute Carryovers Tax Alaska is governed by state tax laws. Taxpayers must adhere to specific guidelines to ensure that the carryover attributes are valid. This includes maintaining accurate records and ensuring that the attributes being carried over comply with the state's tax regulations. Non-compliance can lead to penalties or disallowance of the carryover attributes.

State-specific rules for the Tax Attribute Carryovers Tax Alaska

Alaska has unique rules regarding the carryover of tax attributes. These rules dictate the types of attributes that can be carried forward, the duration for which they can be carried, and any limitations that may apply. It is essential for taxpayers to familiarize themselves with these state-specific regulations to ensure proper filing and maximize tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Attribute Carryovers Tax Alaska are typically aligned with the state tax return deadlines. Taxpayers should be aware of these dates to avoid late penalties. It is advisable to check the Alaska Department of Revenue website for the most current information on filing deadlines and any changes that may occur annually.

Quick guide on how to complete tax attribute carryovers tax alaska

Effortlessly Prepare Tax Attribute Carryovers Tax Alaska on Any Device

Online document administration has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tax Attribute Carryovers Tax Alaska on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Tax Attribute Carryovers Tax Alaska with Ease

- Obtain Tax Attribute Carryovers Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or errors necessitating the printing of new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you select. Edit and electronically sign Tax Attribute Carryovers Tax Alaska and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax attribute carryovers tax alaska

Create this form in 5 minutes!

How to create an eSignature for the tax attribute carryovers tax alaska

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What are Tax Attribute Carryovers in Alaska?

Tax Attribute Carryovers in Tax Alaska refer to certain tax benefits that can be utilized in future tax periods. This includes things like net operating losses, tax credits, and other deductions that can be carried over to offset taxable income. Understanding these carryovers is crucial for maximizing your tax benefits in Alaska.

-

How do Tax Attribute Carryovers benefit businesses in Alaska?

Tax Attribute Carryovers provide businesses in Tax Alaska with signNow financial opportunities by allowing them to offset future tax liabilities with past losses or credits. This can result in substantial tax savings, helping businesses invest more in growth. Leveraging these carryovers effectively is essential for a strategic tax planning approach.

-

Are there any costs associated with utilizing Tax Attribute Carryovers in Alaska?

While the Tax Attribute Carryovers themselves do not incur direct costs, businesses may need professional assistance to navigate the complexities of tax law in Tax Alaska. Hiring tax professionals or using software solutions can help maximize these carryovers, though it does involve some investment. Overall, the financial benefits often outweigh the associated costs.

-

What features does airSlate SignNow offer to assist with Tax Attribute Carryovers?

airSlate SignNow provides robust features such as document signing and management that can help simplify the workflow for tax professionals dealing with Tax Attribute Carryovers in Tax Alaska. By streamlining document processes, users can reduce time spent on administration and focus more on strategic tax planning. The ease of use enhances compliance and efficiency.

-

Can airSlate SignNow integrate with tax software for managing Tax Attribute Carryovers?

Yes, airSlate SignNow can integrate seamlessly with various tax software solutions. This integration simplifies the handling of Tax Attribute Carryovers in Tax Alaska by allowing users to manage their documents and eSign forms directly within their existing systems. This connectivity enhances productivity and accuracy in tax-related tasks.

-

How can I ensure compliance when using Tax Attribute Carryovers in Alaska?

To ensure compliance with Tax Attribute Carryovers in Tax Alaska, businesses should stay updated on state and federal tax regulations. Utilizing the right tools, like airSlate SignNow, can help maintain proper documentation and eSignature records, which are vital for audits. Consulting with tax professionals is also advisable to navigate complex rules effectively.

-

What are the common challenges in managing Tax Attribute Carryovers?

Common challenges in managing Tax Attribute Carryovers in Tax Alaska include tracking carryover amounts, understanding eligibility requirements, and adhering to changing tax laws. Businesses may also face difficulties in documenting the correct information needed for future tax filings. Leveraging solutions like airSlate SignNow can help mitigate these challenges by providing organized documentation.

Get more for Tax Attribute Carryovers Tax Alaska

Find out other Tax Attribute Carryovers Tax Alaska

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document