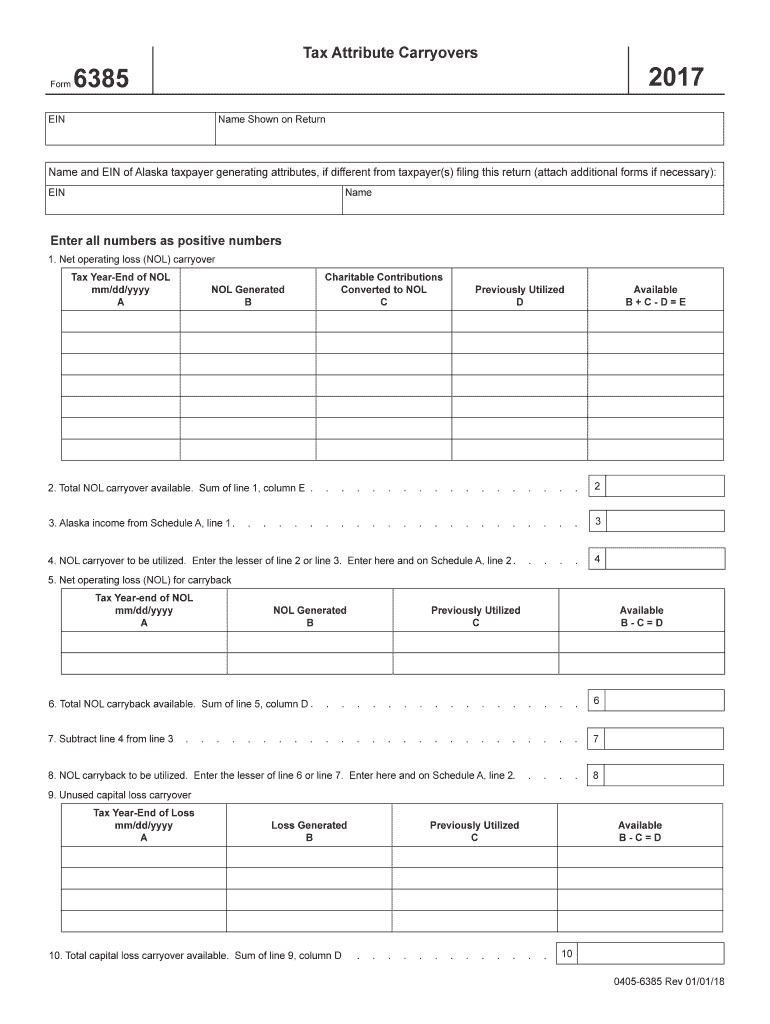

Name and EIN of Alaska Taxpayer Generating Attributes, If Different from Taxpayers Filing This Return Attach Additional Forms 2017

What is the Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms

The Name and EIN of Alaska taxpayer generating attributes refer to the specific identification details required when filing certain tax documents in Alaska. The Employer Identification Number (EIN) is a unique number assigned by the IRS to businesses for tax purposes. This form is essential for accurately reporting income and ensuring compliance with state and federal tax regulations. If the taxpayer generating the attributes differs from the individual or entity filing the return, additional forms may be necessary to clarify this distinction and ensure proper tax processing.

Steps to complete the Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms

Completing the Name and EIN of Alaska taxpayer generating attributes involves several key steps:

- Gather necessary information, including the full legal name of the taxpayer and the corresponding EIN.

- Determine if the taxpayer generating the attributes is different from the filer. If so, prepare to attach additional forms.

- Fill out the required sections of the tax form accurately, ensuring that all names and EINs are correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms

The legal use of the Name and EIN of Alaska taxpayer generating attributes is crucial for maintaining compliance with tax laws. This information must be accurately reported to avoid potential legal issues, such as penalties or audits. The IRS requires that the EIN be used exclusively for the entity it is assigned to, ensuring that tax obligations are met correctly. If the taxpayer generating the attributes differs from the filer, additional forms must be attached to clarify the relationship and responsibilities, ensuring that all parties are compliant with tax regulations.

Required Documents

When completing the Name and EIN of Alaska taxpayer generating attributes, several documents may be required:

- Taxpayer Identification Number (TIN) or Employer Identification Number (EIN).

- Proof of identity for the taxpayer, such as a driver's license or state ID.

- Any additional forms that clarify the relationship between the taxpayer and the filer, if applicable.

- Previous tax returns or documentation that supports the current filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Name and EIN of Alaska taxpayer generating attributes. It is essential to refer to the latest IRS publications and instructions related to tax filings. These guidelines outline the requirements for reporting taxpayer information, including the necessity of attaching additional forms if the taxpayer generating the attributes differs from the individual filing the return. Following these guidelines helps ensure compliance and reduces the risk of errors during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Name and EIN of Alaska taxpayer generating attributes vary depending on the type of tax return being submitted. Generally, individual tax returns are due on April fifteenth, while corporate returns may have different deadlines. It is important to be aware of these dates to avoid late fees or penalties. Additionally, if you are attaching additional forms, ensure that they are submitted by the same deadline as the primary return to maintain compliance.

Quick guide on how to complete name and ein of alaska taxpayer generating attributes if different from taxpayers filing this return attach additional forms if

Effortlessly prepare Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms with minimal effort

- Locate Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or mismanaged documents, exhausting form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct name and ein of alaska taxpayer generating attributes if different from taxpayers filing this return attach additional forms if

Create this form in 5 minutes!

How to create an eSignature for the name and ein of alaska taxpayer generating attributes if different from taxpayers filing this return attach additional forms if

How to generate an eSignature for the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If online

How to create an electronic signature for the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If in Chrome

How to make an eSignature for signing the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If in Gmail

How to make an eSignature for the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If from your smart phone

How to make an eSignature for the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If on iOS devices

How to create an electronic signature for the Name And Ein Of Alaska Taxpayer Generating Attributes If Different From Taxpayers Filing This Return Attach Additional Forms If on Android devices

People also ask

-

What is the importance of the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms' in tax filing?

The 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms' is critical for accurately filing taxes in Alaska. It ensures that the correct taxpayer information is associated with the return, minimizing the risk of errors. Proper documentation can help facilitate processing and reduce the chance of audits.

-

How does airSlate SignNow assist with the completion of the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms'?

airSlate SignNow simplifies the process of completing the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms' with its intuitive eSigning platform. Users can easily fill, sign, and send forms electronically, reducing the hassle of paper forms. This efficiency streamlines your tax filing process.

-

Can airSlate SignNow integrate with other tax software to manage EIN and taxpayer information?

Yes, airSlate SignNow can seamlessly integrate with various tax software to help manage the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms'. This integration enables users to transfer data efficiently, ensuring accuracy and compliance. By bridging software, you have a cohesive toolset for your tax filings.

-

What are the benefits of using airSlate SignNow for electronic signing of tax documents?

Using airSlate SignNow for electronic signing offers numerous benefits, including increased speed, improved accuracy, and enhanced security. You can eSign documents like the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms' from anywhere, saving valuable time. Plus, the platform is cost-effective, making it suitable for businesses of all sizes.

-

Is there a limit to the number of documents I can sign with airSlate SignNow?

airSlate SignNow does not impose a strict limit on the number of documents you can send or sign, including the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms'. This flexibility allows businesses to manage their document workflow efficiently without worrying about extra costs per document. Pricing plans cater to different usage levels, accommodating diverse needs.

-

How does airSlate SignNow ensure the security of sensitive tax information?

airSlate SignNow prioritizes the security of your documents by utilizing advanced encryption and secure storage solutions. With features like multi-factor authentication, user data remains protected, including the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms'. This commitment to security helps build trust with our users.

-

What pricing options are available for airSlate SignNow users?

airSlate SignNow offers a variety of pricing plans designed to meet different business needs, including monthly and annual options. Each plan provides features to support handling documents like the 'Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms'. Businesses can select a plan based on their expected usage and budget.

Get more for Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms

- Sanc registration receipt form

- Social development narritive forms

- Online recertification form for foodstampsfor laurinburg nc

- Dss 5023 direct deposit enrollment authorization form info dhhs state nc

- Dss 5169 consent of child for adoption stepparent adoption info dhhs state nc form

- What is a dma 9006 form

- Dss 5102 form

- Critical incident reporting form north carolina division of info dhhs state nc

Find out other Name And EIN Of Alaska Taxpayer Generating Attributes, If Different From Taxpayers Filing This Return attach Additional Forms

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will