Tire Fees Alaska Department of Revenue Tax Division State of 2012

What is the Tire Fees Alaska Department Of Revenue Tax Division State Of

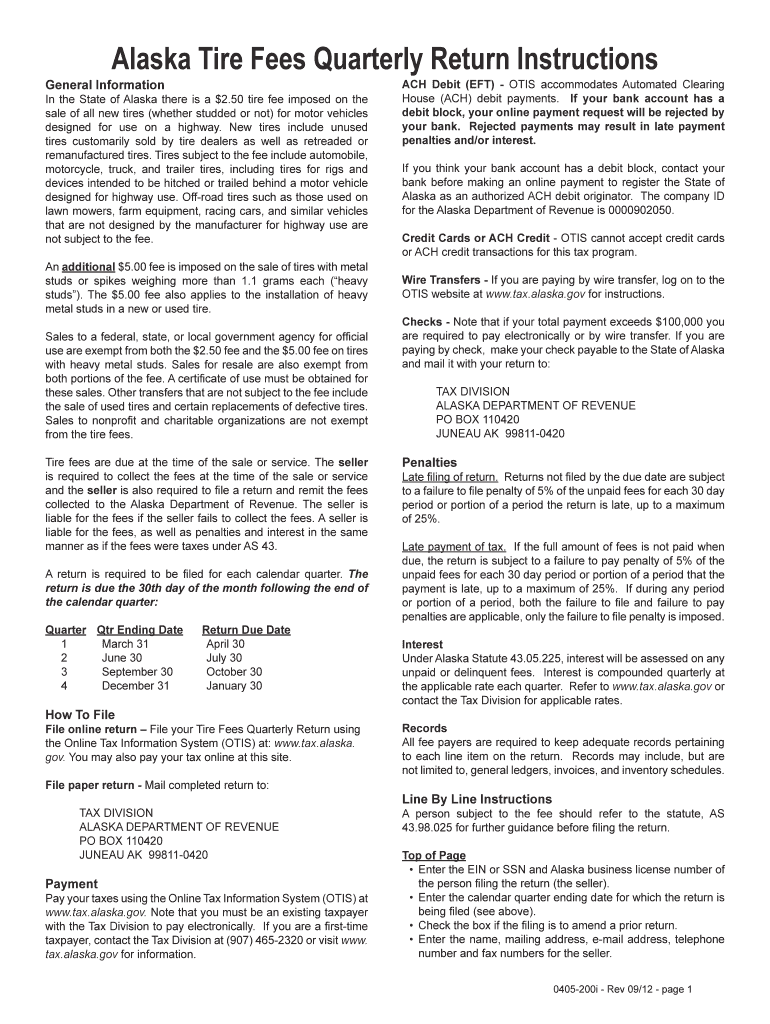

The Tire Fees Alaska Department of Revenue Tax Division form is a specific document required for the collection of tire fees in the state of Alaska. This form is essential for businesses and individuals who sell or distribute tires within the state. It ensures compliance with state regulations regarding the environmental management of used tires, which can pose significant disposal challenges. By properly completing this form, sellers contribute to the funding of recycling and waste management programs aimed at reducing the environmental impact of discarded tires.

How to use the Tire Fees Alaska Department Of Revenue Tax Division State Of

To effectively use the Tire Fees Alaska Department of Revenue Tax Division form, individuals and businesses must first obtain the form from the Alaska Department of Revenue website or their local tax office. After acquiring the form, it is important to fill it out accurately, providing all required information, such as the number of tires sold and the corresponding fees. Once completed, the form can be submitted according to the instructions provided, ensuring that all necessary fees are paid on time to avoid penalties.

Steps to complete the Tire Fees Alaska Department Of Revenue Tax Division State Of

Completing the Tire Fees Alaska Department of Revenue Tax Division form involves several key steps:

- Obtain the form from the Alaska Department of Revenue.

- Fill in your business information, including name, address, and contact details.

- Indicate the total number of tires sold during the reporting period.

- Calculate the total tire fees based on the number of tires sold.

- Review the form for accuracy and completeness.

- Submit the form along with any required payments by the specified deadline.

Legal use of the Tire Fees Alaska Department Of Revenue Tax Division State Of

The Tire Fees Alaska Department of Revenue Tax Division form is legally binding when completed and submitted in accordance with state regulations. It serves as a formal declaration of tire sales and the associated fees owed to the state. Compliance with this form is crucial for businesses to avoid legal repercussions, including fines or penalties for non-compliance. Additionally, proper documentation helps maintain transparency and accountability in environmental management practices related to tire disposal.

State-specific rules for the Tire Fees Alaska Department Of Revenue Tax Division State Of

Each state has specific regulations governing the collection and remittance of tire fees. In Alaska, businesses must adhere to the guidelines set forth by the Department of Revenue. This includes understanding the fee structure, which may vary based on the type and quantity of tires sold. It is essential for businesses to stay informed about any changes in legislation or fee rates to ensure compliance and avoid potential legal issues.

Penalties for Non-Compliance

Failure to comply with the requirements of the Tire Fees Alaska Department of Revenue Tax Division form can result in significant penalties. Businesses may face fines for late submissions or inaccurate reporting of tire sales. Additionally, repeated non-compliance can lead to further legal action, including the suspension of business licenses. It is important for businesses to prioritize timely and accurate completion of this form to mitigate risks associated with non-compliance.

Quick guide on how to complete tire fees alaska department of revenue tax division state of

Effortlessly Prepare Tire Fees Alaska Department Of Revenue Tax Division State Of on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Tire Fees Alaska Department Of Revenue Tax Division State Of on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Tire Fees Alaska Department Of Revenue Tax Division State Of with Ease

- Find Tire Fees Alaska Department Of Revenue Tax Division State Of and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the specialized tools that airSlate SignNow offers for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tire Fees Alaska Department Of Revenue Tax Division State Of to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tire fees alaska department of revenue tax division state of

Create this form in 5 minutes!

How to create an eSignature for the tire fees alaska department of revenue tax division state of

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What are Tire Fees in Alaska?

Tire Fees are specific charges implemented by the Alaska Department of Revenue Tax Division State Of, aimed at managing waste tire disposal and promoting environmental safety. These fees are applied during the sale of new tires and are used to fund recycling programs. Understanding these fees is crucial for compliance and to support state initiatives.

-

How are Tire Fees calculated in Alaska?

The Tire Fees are calculated based on the type and number of tires purchased, as specified by the Alaska Department of Revenue Tax Division State Of. Retailers add these fees to the cost of new tires at the point of sale. It's important for consumers to be aware of these fees to understand the total price of their tire purchases.

-

What is the purpose of Tire Fees charged by the Alaska Department of Revenue?

The primary purpose of Tire Fees, as imposed by the Alaska Department of Revenue Tax Division State Of, is to fund the disposal and recycling of waste tires, thus protecting the environment. These fees ensure that old tires are processed safely and do not become pollutants. By paying these fees, consumers contribute to sustainable practices.

-

How can I pay the Tire Fees in Alaska?

You can pay Tire Fees at the point of sale when purchasing new tires from authorized retailers. Retailers will include these fees in your transaction total, and they are responsible for remitting them to the Alaska Department of Revenue Tax Division State Of. Always ask the retailer for a detailed receipt to verify the Tire Fees included.

-

Are Tire Fees refundable in Alaska?

Generally, Tire Fees are non-refundable as they are levied by the Alaska Department of Revenue Tax Division State Of to support environmental initiatives. However, specific circumstances may be eligible for a refund, such as the return of unused tires. It is advisable to consult with the retailer or the Tax Division for detailed information.

-

What happens if I don’t pay Tire Fees in Alaska?

Failing to pay Tire Fees when required may result in penalties or fines as stipulated by the Alaska Department of Revenue Tax Division State Of. Retailers are obligated to collect these fees, and non-compliance can have legal repercussions. It’s crucial to include these fees in your tire purchases to avoid any issues.

-

Can Tire Fees in Alaska change?

Yes, Tire Fees can change based on regulations set by the Alaska Department of Revenue Tax Division State Of. Changes may arise from new environmental policies or budget needs for waste management programs. It’s essential to stay informed about any alterations in the fee structure to understand your financial obligations.

Get more for Tire Fees Alaska Department Of Revenue Tax Division State Of

Find out other Tire Fees Alaska Department Of Revenue Tax Division State Of

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice