Tax Alaska 2015-2026

What is the Tax Alaska

The Tax Alaska form is a document used by residents and businesses in Alaska to report their income and calculate their tax obligations. It is essential for ensuring compliance with state tax laws and regulations. This form is designed to capture various types of income, deductions, and credits that may apply to individuals and entities within Alaska. Understanding the specifics of this form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents, including income statements, previous tax returns, and any applicable deduction records. Next, fill out the form by entering your income details, deductions, and credits in the designated sections. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form electronically.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach. Follow these steps:

- Gather necessary documents, including W-2s, 1099s, and receipts for deductions.

- Fill in personal information such as your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim deductions and credits applicable to your situation.

- Review the form for any errors or omissions.

- Sign the form electronically or by hand, ensuring compliance with signature requirements.

- Submit the completed form to the appropriate state tax agency.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws, which outline the requirements for filing and signing the document. To be considered legally binding, the form must be completed accurately and submitted on time. Additionally, using a secure eSignature solution ensures that the signature is valid and complies with electronic signature laws, such as the ESIGN Act and UETA. This legal framework supports the use of electronic documents in place of traditional paper forms, provided that all necessary conditions are met.

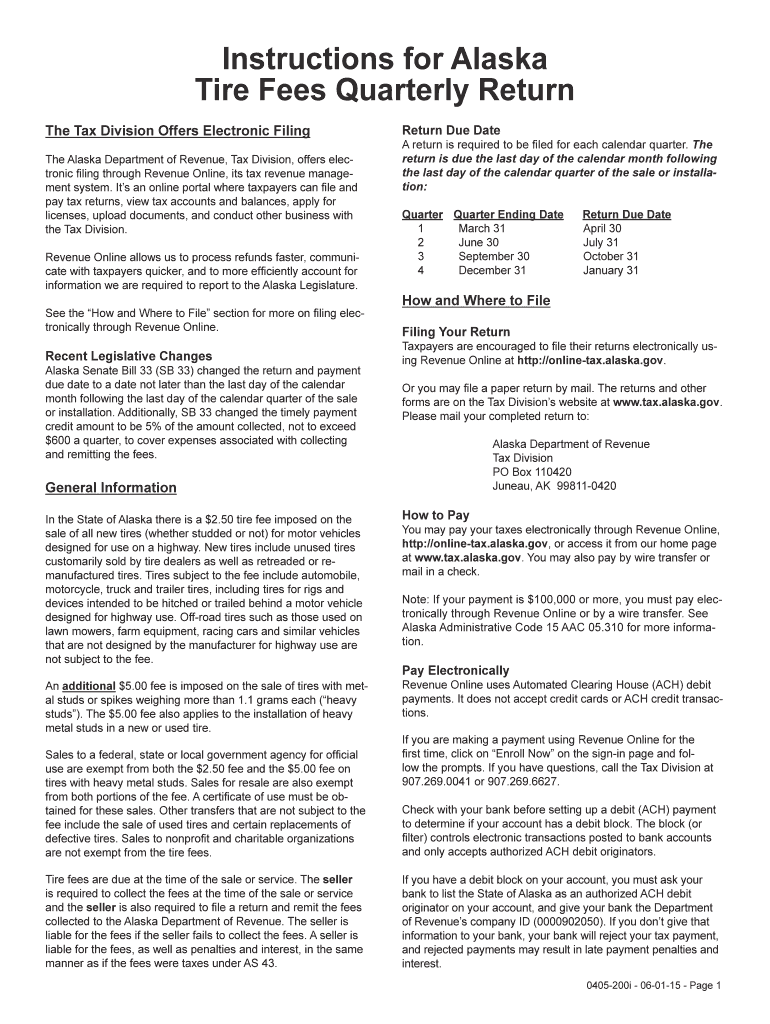

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical for compliance. Typically, the deadline for submitting the form aligns with the federal tax filing date, which is usually April fifteenth. However, it is essential to check for any state-specific extensions or changes that may apply. Marking these dates on your calendar can help avoid late fees and penalties associated with missed deadlines.

Required Documents

When completing the Tax Alaska form, certain documents are required to substantiate your income and deductions. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant documentation for credits claimed

Having these documents ready can streamline the process and ensure accurate reporting.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for tax collection and enforcement, ensuring that residents comply with state tax laws. The department provides resources and guidance for completing the form, as well as information on where to submit it. Understanding the role of the issuing authority can help taxpayers navigate the filing process more effectively.

Quick guide on how to complete tax alaska 6967313

Complete Tax Alaska effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Tax Alaska with ease

- Find Tax Alaska and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Alaska and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967313

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967313

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a digital signature solution that allows businesses to send and eSign documents easily. For those handling Tax Alaska filings and paperwork, this platform streamlines the process, ensuring compliance and efficiency. It provides a secure way to manage tax-related documents online, which is crucial during the busy tax season.

-

How can airSlate SignNow help with Tax Alaska documentation?

With airSlate SignNow, users can create, send, and eSign documents relevant to Tax Alaska efficiently. The platform features templates specifically designed for tax documents, which can reduce the risk of errors. This not only saves time but also ensures that all necessary forms are correctly filled and submitted.

-

What are the pricing options for airSlate SignNow concerning Tax Alaska users?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses dealing with Tax Alaska. Each plan is competitively priced to provide cost-effective solutions without sacrificing features. Customers can choose a plan based on their volume of transactions and specific requirements related to tax filing.

-

Can I integrate airSlate SignNow with my existing accounting software for Tax Alaska?

Yes, airSlate SignNow offers integration capabilities with numerous accounting software and tax preparation tools. This allows users to manage their Tax Alaska documents seamlessly without disrupting their current workflow. Integrations enhance efficiency by automating document uploads and eSigning processes.

-

What security features does airSlate SignNow offer for Tax Alaska-related documents?

airSlate SignNow prioritizes security, providing features such as encryption and secure cloud storage for Tax Alaska documents. These measures ensure that sensitive tax information is protected against unauthorized access. Additionally, the platform complies with industry standards to safeguard personal and financial information.

-

Is airSlate SignNow user-friendly for handling Tax Alaska forms?

Absolutely! airSlate SignNow is designed to be intuitive and easy to navigate, making it user-friendly for those managing Tax Alaska forms. Even users with minimal tech experience can quickly learn to send and eSign documents. The straightforward interface minimizes distractions and simplifies the tax documentation process.

-

What benefits do businesses gain from using airSlate SignNow for Tax Alaska?

Businesses using airSlate SignNow for Tax Alaska can enjoy increased efficiency and reduced turnaround times on document processing. The platform also enhances accuracy by minimizing manual input errors associated with traditional paper forms. Overall, using SignNow can lead to signNow time and cost savings for tax-related tasks.

Get more for Tax Alaska

- Dss 5015 form

- Phs 7047 form

- Form 956a appointment or withdrawal of an authorised recipient

- Manalapan medical centermulti specialty clinic form

- Contact us ivy pediatrics pa pediatrics for family health form

- Consent for chemotherapy biologic therapy bhumcmdbbnetb humcmd form

- Healthy kids epsdt visit forms

- Trauma assessment referral process tarp screening instrument form

Find out other Tax Alaska

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure