Florida F 1065 Form 2016

What is the Florida F 1065 Form

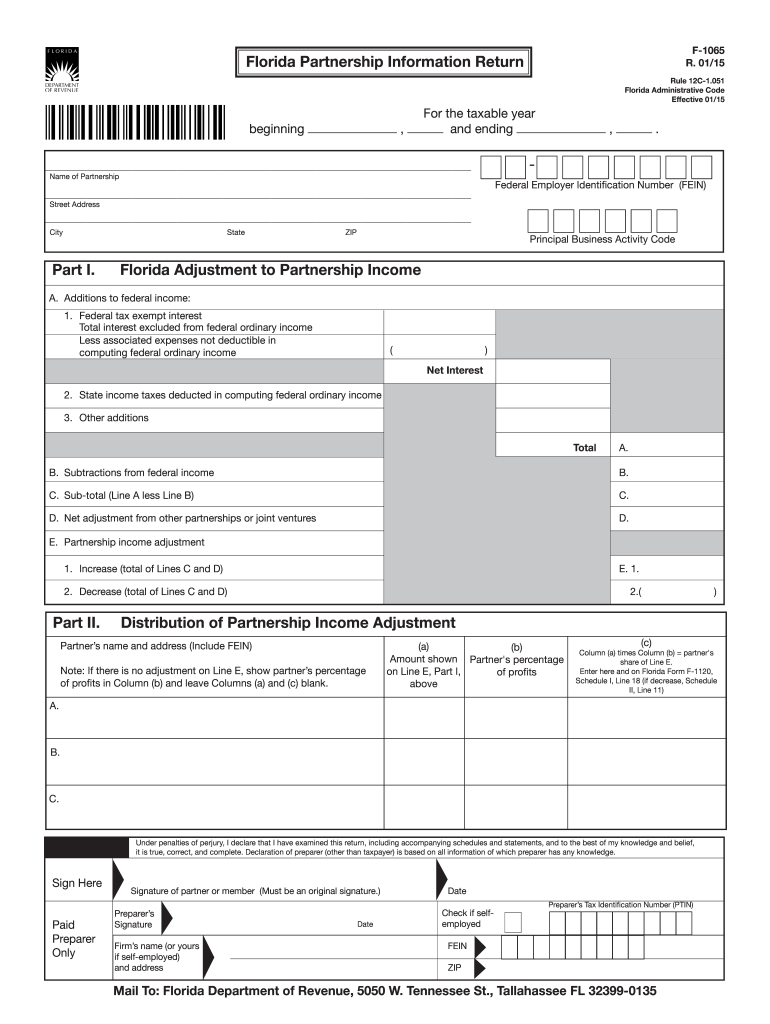

The Florida F 1065 Form is a tax document used by partnerships operating in the state of Florida. This form is essential for reporting income, deductions, and credits of the partnership to the Florida Department of Revenue. It serves as a means for partnerships to disclose their financial activities and ensure compliance with state tax laws. By filing the Florida F 1065 Form, partnerships can accurately report their earnings and share this information with their partners, who will then report their respective shares of income on their individual tax returns.

How to use the Florida F 1065 Form

Using the Florida F 1065 Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation. Next, fill out the form with the required information, including the partnership's name, address, and federal employer identification number (EIN). Ensure that all income and deductions are clearly reported. Once completed, review the form for accuracy before submitting it to the Florida Department of Revenue. It is important to keep a copy for your records and provide necessary information to each partner for their tax filings.

Steps to complete the Florida F 1065 Form

Completing the Florida F 1065 Form involves a systematic approach:

- Gather all financial documents related to the partnership's income and expenses.

- Enter the partnership's identifying information, including the name, address, and EIN.

- Report total income earned by the partnership during the tax year.

- List all allowable deductions, including operating expenses and other eligible costs.

- Calculate the partnership's taxable income by subtracting total deductions from total income.

- Complete any additional schedules required for specific deductions or credits.

- Review the entire form for accuracy and completeness before submission.

Legal use of the Florida F 1065 Form

The Florida F 1065 Form is legally recognized as a valid document for reporting partnership income to the state. To ensure its legal standing, the form must be filled out accurately and submitted on time, adhering to Florida tax laws. Electronic signatures are accepted, provided that they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. This legal framework ensures that electronically signed documents are treated the same as traditional paper documents.

Filing Deadlines / Important Dates

Filing deadlines for the Florida F 1065 Form are crucial for compliance. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is important to be aware of any changes in deadlines or extensions that may apply, especially in light of special circumstances or changes in tax law.

Form Submission Methods

The Florida F 1065 Form can be submitted through various methods to accommodate different preferences. Partnerships have the option to file the form electronically via the Florida Department of Revenue's online portal, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the state. In-person submissions may also be possible at designated offices, depending on local regulations and procedures.

Quick guide on how to complete 2014 florida f 1065 2014 form

Complete Florida F 1065 Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and efficiently. Handle Florida F 1065 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Florida F 1065 Form with ease

- Locate Florida F 1065 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only moments and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Florida F 1065 Form and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 florida f 1065 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 florida f 1065 2014 form

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Florida F 1065 Form?

The Florida F 1065 Form is a tax return that partnerships must file in Florida, detailing their income, deductions, and tax liability. It allows for reporting of profits and losses to the state authorities. Completing the Florida F 1065 Form accurately is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Florida F 1065 Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Florida F 1065 Form. Our solution streamlines the document management process, ensuring that your submissions are timely and secure. With airSlate SignNow, you can focus on your business while we handle your eSigning needs.

-

What are the pricing options for airSlate SignNow related to the Florida F 1065 Form?

airSlate SignNow offers various pricing plans to fit businesses of all sizes looking to manage their Florida F 1065 Form. Our plans are cost-effective, providing essential features at competitive rates. You can choose from monthly or annual subscriptions based on your needs.

-

Does airSlate SignNow provide templates for the Florida F 1065 Form?

Yes, airSlate SignNow offers customizable templates for the Florida F 1065 Form. These templates help streamline your document preparation process, ensuring you include all necessary information. Utilizing our templates can save time and reduce errors when filing.

-

What are the benefits of using airSlate SignNow for the Florida F 1065 Form?

Using airSlate SignNow for the Florida F 1065 Form offers benefits such as enhanced security, document tracking, and improved workflow efficiency. Our eSigning solution simplifies the process of getting documents signed, saving you time and ensuring compliance. Experience convenience and confidence with your tax filing.

-

Can I integrate airSlate SignNow with other software for the Florida F 1065 Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing for easy handling of the Florida F 1065 Form. These integrations facilitate data synchronization and ensure that your documents are always up-to-date and accessible.

-

Is airSlate SignNow secure for filing the Florida F 1065 Form?

Yes, airSlate SignNow prioritizes security for all documents, including the Florida F 1065 Form. Our platform uses advanced encryption and compliance measures to protect your sensitive information. You can trust that your data is safe when using airSlate SignNow.

Get more for Florida F 1065 Form

Find out other Florida F 1065 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online