How to Get a Tax Exempt Certificate Florida Form 2017

What is the How To Get A Tax Exempt Certificate Florida Form

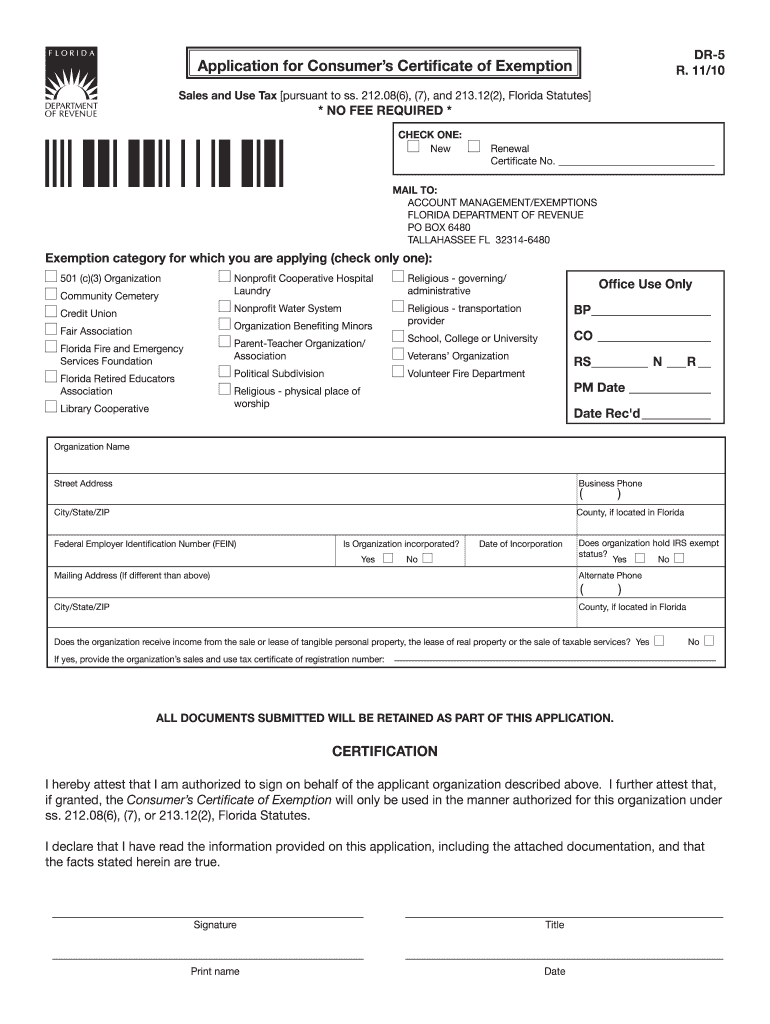

The How To Get A Tax Exempt Certificate Florida Form is a document that allows eligible organizations to claim exemption from sales tax in the state of Florida. This form is essential for non-profit organizations, government entities, and certain educational institutions that meet specific criteria. By obtaining this certificate, these entities can make purchases without paying sales tax, thereby reducing their overall operational costs. The form must be filled out accurately and submitted to the appropriate state authorities to ensure compliance with Florida tax regulations.

Steps to complete the How To Get A Tax Exempt Certificate Florida Form

Completing the How To Get A Tax Exempt Certificate Florida Form involves several key steps:

- Gather necessary information about your organization, including its legal name, address, and type of entity.

- Determine your eligibility for tax exemption based on Florida's criteria for non-profit status or other qualifying categories.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Provide supporting documentation, such as proof of non-profit status or other relevant certifications.

- Review the completed form for accuracy before submission.

How to obtain the How To Get A Tax Exempt Certificate Florida Form

The How To Get A Tax Exempt Certificate Florida Form can be obtained through the Florida Department of Revenue's website. Organizations can access the form in a downloadable format, which can be filled out electronically or printed for manual completion. It is important to ensure that you are using the most current version of the form, as updates may occur. Additionally, local tax offices may provide physical copies of the form upon request.

Legal use of the How To Get A Tax Exempt Certificate Florida Form

The legal use of the How To Get A Tax Exempt Certificate Florida Form is governed by state tax laws. Organizations must ensure that they meet the eligibility requirements set forth by the Florida Department of Revenue. Misuse of the certificate, such as using it for personal purchases or for entities that do not qualify, can lead to penalties and legal repercussions. It is essential to maintain accurate records of all transactions made under the exemption to ensure compliance during audits.

Eligibility Criteria

To qualify for the tax exemption in Florida, organizations must meet specific eligibility criteria. Generally, eligible entities include:

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government agencies at the federal, state, or local level.

- Educational institutions that are accredited by the state.

Organizations must provide appropriate documentation to prove their status and eligibility when applying for the tax exempt certificate.

Form Submission Methods

The How To Get A Tax Exempt Certificate Florida Form can be submitted through various methods, depending on the preferences of the organization:

- Online: Some forms may be submitted electronically through the Florida Department of Revenue's online portal.

- Mail: Completed forms can be mailed to the appropriate tax office as indicated on the form.

- In-Person: Organizations may also submit the form in person at designated tax offices for immediate processing.

Quick guide on how to complete how to get a tax exempt certificate florida 2010 form

Prepare How To Get A Tax Exempt Certificate Florida Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage How To Get A Tax Exempt Certificate Florida Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign How To Get A Tax Exempt Certificate Florida Form without hassle

- Find How To Get A Tax Exempt Certificate Florida Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign How To Get A Tax Exempt Certificate Florida Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to get a tax exempt certificate florida 2010 form

Create this form in 5 minutes!

How to create an eSignature for the how to get a tax exempt certificate florida 2010 form

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a Tax Exempt Certificate in Florida?

A Tax Exempt Certificate in Florida allows qualified organizations to make tax-free purchases on certain items. To get this certificate, you must meet specific criteria set by the Florida Department of Revenue. Understanding how to get a tax exempt certificate Florida form is essential for non-profits and other eligible entities looking to save on sales tax.

-

How can I apply for a Tax Exempt Certificate in Florida?

You can apply for a Tax Exempt Certificate in Florida by submitting the appropriate form to the Florida Department of Revenue. The application process can be streamlined by using digital tools like airSlate SignNow, which simplifies document management. Knowing how to get a tax exempt certificate Florida form efficiently can save time and ensure compliance.

-

What documents are needed to obtain a Tax Exempt Certificate in Florida?

To obtain a Tax Exempt Certificate in Florida, you typically need proof of your organization's tax-exempt status and the completed application form. Specific requirements may vary based on your organization's type. Familiarity with how to get a tax exempt certificate Florida form is crucial to gather the correct documentation and expedite the approval process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including the Tax Exempt Certificate, offers signNow benefits like easy document eSigning, tracking capabilities, and enhanced security. The platform is designed to streamline the process, making it simple for users to learn how to get a tax exempt certificate Florida form faster and more efficiently. Plus, it is a cost-effective solution for businesses.

-

Is there a fee for obtaining a Tax Exempt Certificate in Florida?

There is no fee required to obtain a Tax Exempt Certificate in Florida. However, organizations must ensure they follow the correct procedures and submit accurate information. Knowing how to get a tax exempt certificate Florida form correctly is vital to avoid potential issues that could delay the process.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate with various accounting software platforms, making it easier to manage tax documentation. These integrations allow seamless import and export of signed forms, simplifying record-keeping. If you want to know how to get a tax exempt certificate Florida form while maintaining excellent accounting practices, airSlate SignNow is a valuable tool.

-

How long does it take to receive the Tax Exempt Certificate in Florida?

The time to receive a Tax Exempt Certificate in Florida can vary, but applications are typically processed within a few weeks. Factors such as completeness of the application and current processing volumes can affect timelines. Understanding how to get a tax exempt certificate Florida form thoroughly will help ensure everything is in order for a quicker response.

Get more for How To Get A Tax Exempt Certificate Florida Form

Find out other How To Get A Tax Exempt Certificate Florida Form

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter