Georgia 500 Tax Form 2018

What is the Georgia 500 Tax Form

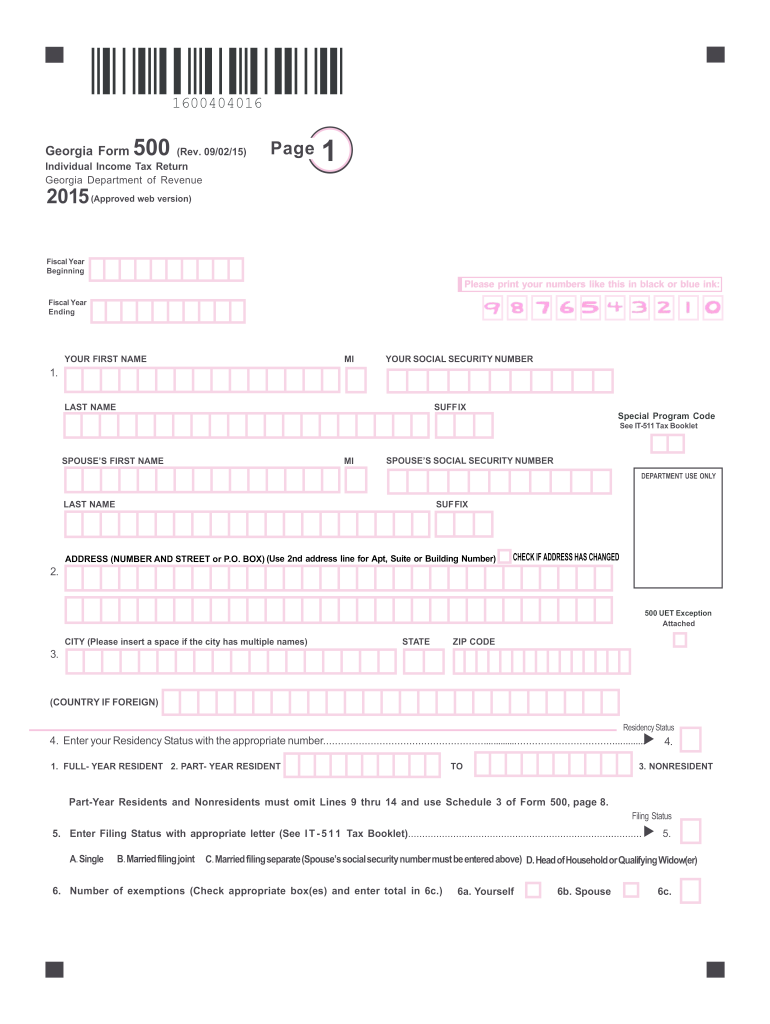

The Georgia 500 Tax Form is a crucial document used by residents of Georgia to report their state income taxes. This form is specifically designed for individuals who need to file their state tax returns, detailing their income, deductions, and credits. It is essential for ensuring compliance with Georgia tax laws and for determining the amount of tax owed or refund due. The form must be completed accurately to avoid penalties and ensure proper processing by the Georgia Department of Revenue.

How to use the Georgia 500 Tax Form

Using the Georgia 500 Tax Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and records of any deductions or credits you plan to claim. Next, fill out the form by entering your personal information, income details, and any applicable deductions. After completing the form, review it thoroughly for accuracy. Finally, submit the form either electronically or by mail, depending on your preference and the options available.

Steps to complete the Georgia 500 Tax Form

Completing the Georgia 500 Tax Form involves a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other earnings.

- Calculate your deductions and credits, ensuring you have documentation to support each claim.

- Determine your total tax liability or refund amount based on the information provided.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline.

Legal use of the Georgia 500 Tax Form

The Georgia 500 Tax Form is legally binding when completed and submitted in compliance with state tax regulations. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, electronic submissions must adhere to the eSignature laws established under the ESIGN Act and UETA, which recognize electronic signatures as legally binding. It is important to maintain accurate records of the submission for future reference and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Georgia 500 Tax Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters, which may prompt extensions.

Form Submission Methods (Online / Mail / In-Person)

The Georgia 500 Tax Form can be submitted through various methods to accommodate taxpayer preferences:

- Online: Many taxpayers opt to file electronically through the Georgia Department of Revenue's e-filing system or authorized tax software.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Georgia Department of Revenue.

- In-Person: Taxpayers may also choose to submit their forms in person at designated tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete 2015 georgia 500 tax form

Effortlessly Prepare Georgia 500 Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without hurdles. Manage Georgia 500 Tax Form on any device with airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Georgia 500 Tax Form

- Locate Georgia 500 Tax Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Georgia 500 Tax Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 georgia 500 tax form

Create this form in 5 minutes!

How to create an eSignature for the 2015 georgia 500 tax form

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Georgia 500 Tax Form?

The Georgia 500 Tax Form is used by residents and businesses in Georgia to report their income tax liability. It is essential for ensuring compliance with state tax regulations. Understanding how to fill out the Georgia 500 Tax Form accurately can help you avoid penalties.

-

How can airSlate SignNow assist with the Georgia 500 Tax Form?

airSlate SignNow simplifies the process of signing and sending the Georgia 500 Tax Form electronically. Our user-friendly platform allows you to eSign documents securely, ensuring that you can submit your tax form swiftly and efficiently. This feature helps maintain compliance and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the Georgia 500 Tax Form?

Yes, airSlate SignNow offers a variety of pricing plans designed to cater to different business needs. Each plan includes features that support the eSigning and document management of forms like the Georgia 500 Tax Form. Our solutions are cost-effective, providing great value for businesses of all sizes.

-

What are the benefits of using airSlate SignNow for the Georgia 500 Tax Form?

Using airSlate SignNow for the Georgia 500 Tax Form offers several benefits, including speed, security, and ease of use. You can complete and sign your tax form from anywhere, reducing the risk of postal delays. Additionally, electronic signatures are legally binding, ensuring your submissions meet regulatory requirements.

-

Can I integrate airSlate SignNow with other applications for my Georgia 500 Tax Form needs?

Yes, airSlate SignNow can be integrated with various applications, enhancing your workflow for handling the Georgia 500 Tax Form. Whether you use CRM systems or financial software, our platform supports seamless integration to streamline the document signing process and improve efficiency.

-

How secure is airSlate SignNow for eSigning the Georgia 500 Tax Form?

airSlate SignNow employs robust security measures to protect your documents, including the Georgia 500 Tax Form. We use encryption and secure servers to ensure that your data is safe during the signing and storage processes. This commitment to security helps instill confidence in our users regarding the confidentiality of their information.

-

What is the process for eSigning the Georgia 500 Tax Form with airSlate SignNow?

The process of eSigning your Georgia 500 Tax Form with airSlate SignNow is simple and straightforward. After uploading your form, you can add your signature and any other required information. Once completed, you can send the document directly to your tax authority or other recipients, ensuring a hassle-free submission.

Get more for Georgia 500 Tax Form

Find out other Georgia 500 Tax Form

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now