Il Form 2019

What is the Il Form

The Il Form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Il Form is essential for compliance with federal tax regulations.

How to use the Il Form

Using the Il Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are correct and complete. Once filled, review the form for accuracy before submitting it to the IRS, either electronically or via mail.

Steps to complete the Il Form

Completing the Il Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including W-2s, 1099s, and any other relevant financial records.

- Fill out personal information, including your name, address, and Social Security number.

- Report income accurately, ensuring to include all sources of income.

- Calculate deductions and credits applicable to your situation.

- Review all entries for accuracy before submission.

Legal use of the Il Form

The Il Form must be used in accordance with IRS regulations to be considered legally binding. It is crucial to ensure that all information provided is truthful and accurate. Misrepresentation or errors can lead to penalties or audits. Additionally, using a reliable eSignature solution can help ensure that the submission is compliant with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Il Form vary depending on the type of taxpayer and the specific tax year. Generally, individual taxpayers must submit their forms by April 15 of the following year. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid late fees and penalties.

Required Documents

To complete the Il Form accurately, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Il Form can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission via the IRS e-file system, which is often the fastest method.

- Mailing a paper copy to the appropriate IRS address, which may take longer for processing.

- In-person submission at designated IRS offices, although this option may require an appointment.

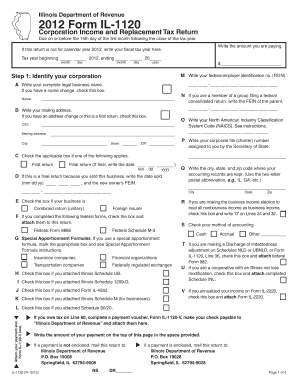

Quick guide on how to complete 2012 il form

Effortlessly Prepare Il Form on Any Device

Online document management has gained signNow traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Il Form across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Editing and eSigning Il Form Made Simple

- Locate Il Form and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Il Form while ensuring smooth communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 il form

Create this form in 5 minutes!

How to create an eSignature for the 2012 il form

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Il Form and how does it relate to airSlate SignNow?

Il Form is a digital solution that enables users to fill out and sign documents electronically. With airSlate SignNow, businesses can utilize Il Form to streamline their document management processes, ensuring timely signatures without the hassle of paper.

-

How does pricing work for airSlate SignNow with Il Form?

airSlate SignNow offers flexible pricing plans tailored to different business needs. By integrating Il Form, users can benefit from cost-effective solutions that fit their budget while enjoying robust features to enhance document signing and management.

-

What key features does airSlate SignNow offer with Il Form?

When using airSlate SignNow, Il Form includes features such as customizable templates, automated reminders, and secure cloud storage. These features help users efficiently manage their documents and ensure that they are signed promptly.

-

Can I integrate Il Form with other applications?

Yes, airSlate SignNow allows seamless integration with various third-party applications to enhance your workflow. Users can integrate Il Form with CRM systems, cloud storage services, and productivity tools for a more streamlined document management experience.

-

What benefits does Il Form provide for remote teams?

Il Form streamlines the document signing process for remote teams by enabling easy access from anywhere. With airSlate SignNow, team members can collaborate and sign documents in real-time, ensuring that business operations continue smoothly, regardless of location.

-

Is Il Form secure for sensitive documents?

Absolutely! airSlate SignNow ensures that all documents signed using Il Form are protected with advanced encryption methods. This guarantees that sensitive information remains confidential, providing peace of mind for businesses handling critical documents.

-

Can Il Form help reduce paperwork in my business?

Yes, integrating Il Form through airSlate SignNow signNowly reduces paperwork by digitizing your document processes. This not only cuts down on paper usage but also improves efficiency and reduces the time spent on manual tasks related to paperwork.

Get more for Il Form

- How to fill out a mvd confidential record release form

- Gtd todoist setup guide pdf form

- Sample letter request for phd supervisor pdf form

- Stop sign petition template form

- Arkansas boat bill of sale form

- Horse transport contract template 295365905 form

- Throne chair rental contract form

- Remedial training plan form

Find out other Il Form

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document