941 X Form 2020

What is the 941 X Form

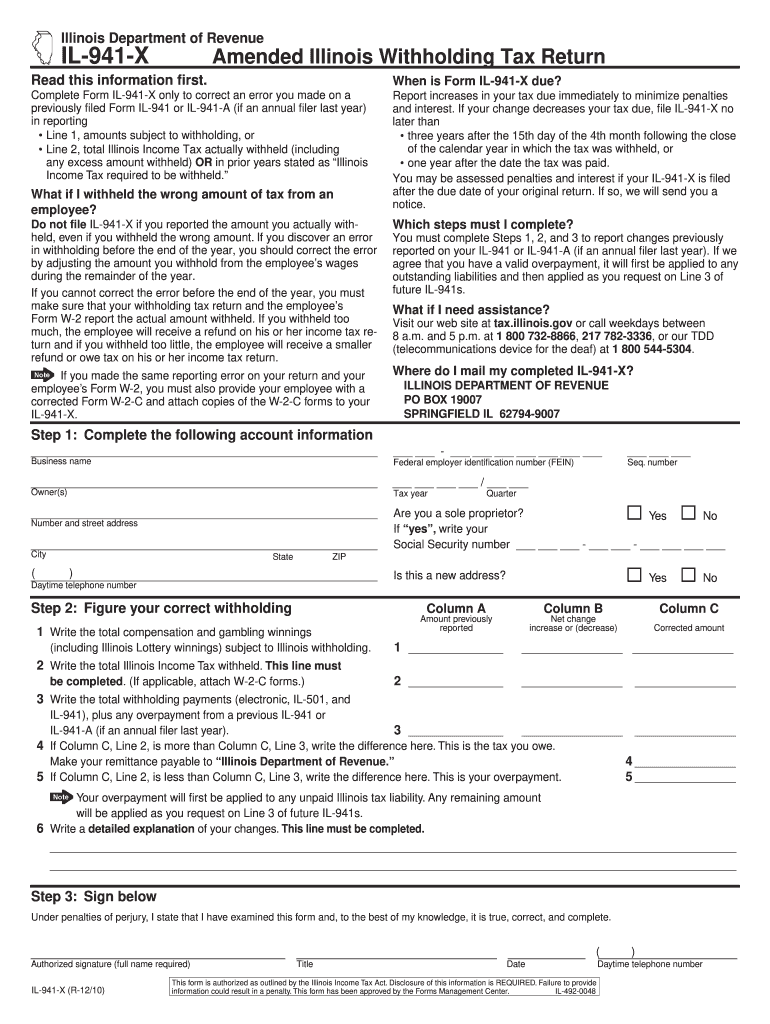

The 941 X Form is an essential tax document used by employers in the United States to amend their previously filed Form 941, which reports payroll taxes. This form allows businesses to correct errors related to income, Social Security, and Medicare taxes. The 941 X Form is crucial for ensuring that the IRS has accurate information regarding an employer's tax obligations, helping to avoid potential penalties or issues during audits.

How to use the 941 X Form

Using the 941 X Form involves several key steps. First, gather all relevant information from your original Form 941. Identify the specific errors that need correction, such as incorrect wage amounts or tax calculations. Next, fill out the 941 X Form by providing the correct information in the appropriate sections. It is important to clearly indicate the changes made and explain the reasons for these adjustments. Once completed, submit the form to the IRS following the guidelines for filing amended returns.

Steps to complete the 941 X Form

Completing the 941 X Form requires careful attention to detail. Follow these steps:

- Obtain a copy of your original Form 941.

- Identify the errors that need correction.

- Fill out the 941 X Form, ensuring to use the correct tax year and quarter.

- Provide accurate figures for the corrected amounts.

- Include an explanation for each change in the designated section.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS via mail or electronically, if applicable.

Legal use of the 941 X Form

The legal use of the 941 X Form is governed by IRS regulations, ensuring that all amendments to payroll tax filings are compliant with federal tax laws. Employers must use this form to correct any discrepancies in their payroll tax reporting. Proper use of the 941 X Form not only helps maintain compliance but also protects businesses from potential penalties associated with inaccurate filings.

Filing Deadlines / Important Dates

Filing deadlines for the 941 X Form are critical to avoid penalties. Typically, the form must be filed within three years of the original filing date of Form 941. It is advisable to check the IRS guidelines for any updates regarding specific deadlines, especially if you are amending multiple quarters or tax years.

Form Submission Methods (Online / Mail / In-Person)

The 941 X Form can be submitted to the IRS through various methods. While electronic filing is not available for this form, it can be mailed to the appropriate address based on the employer's location. Ensure that you use the correct mailing address provided by the IRS for amended returns. In-person submission is generally not an option for this form, as it is primarily processed through mail.

Quick guide on how to complete 941 x 2010 form

Prepare 941 X Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage 941 X Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign 941 X Form with ease

- Find 941 X Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Edit and eSign 941 X Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941 x 2010 form

Create this form in 5 minutes!

How to create an eSignature for the 941 x 2010 form

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 941 X Form, and why is it important?

The 941 X Form is an amended version of the IRS Form 941, used to correct errors on previously filed payroll tax returns. It's important for businesses to ensure accurate reporting of payroll taxes, as mistakes can lead to penalties. By using airSlate SignNow, you can quickly eSign and submit your 941 X Form electronically, ensuring compliance and reducing processing time.

-

How does airSlate SignNow support the completion of the 941 X Form?

airSlate SignNow provides a user-friendly platform that allows businesses to easily fill out and eSign the 941 X Form. With features like templates and electronic signatures, you can streamline the correction process and ensure the form is completed accurately. This efficiency helps you save time and avoid common filing errors associated with paper forms.

-

Is there a cost to use airSlate SignNow for the 941 X Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The plans are cost-effective and allow you to manage your documents and signatures securely. Pricing typically depends on the number of users and features you require, making it affordable to address your 941 X Form needs.

-

Can I integrate airSlate SignNow with other accounting software for 941 X Form submission?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting and payroll software systems, making it easy to handle your 941 X Form submissions. By connecting with your existing tools, you can enhance productivity and ensure that your documents are properly managed and securely sent for eSigning.

-

What are the benefits of using airSlate SignNow for the 941 X Form?

Using airSlate SignNow for your 941 X Form provides several benefits, including faster processing times and enhanced document security. The eSigning feature ensures that your amendments are legally binding, while also providing a convenient way to track the status of your form. This operational efficiency can signNowly reduce the stress associated with tax filings.

-

How secure is the information submitted with the 941 X Form on airSlate SignNow?

AirSlate SignNow prioritizes the security of your data, implementing advanced encryption and security protocols to protect your information. All completed 941 X Forms are stored securely and can only be accessed by authorized users. This commitment to security means you can confidently eSign and manage sensitive tax documents.

-

Are there any features specific to managing the 941 X Form on airSlate SignNow?

Yes, airSlate SignNow offers specific features that enhance the management of your 941 X Form, such as customizable templates and document routing functionalities. These tools allow you to collaborate effectively with your team members and ensure that all necessary signatures are collected before submission. This reduces delays and improves overall accuracy.

Get more for 941 X Form

- Building permit application form pdf 380593701

- Printable food combining chart form

- Bni visitor sign in sheet form

- Padi divemaster application form

- Telpas student rating roster form

- Quick assessment for dysarthria pdf form

- Isabelle christenson memorial scholarship form

- Fun daze field trip permission and medical release form flpc

Find out other 941 X Form

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online