IL 990 T V PDF Use Your Mouse or Tab Key to Move 2021-2026

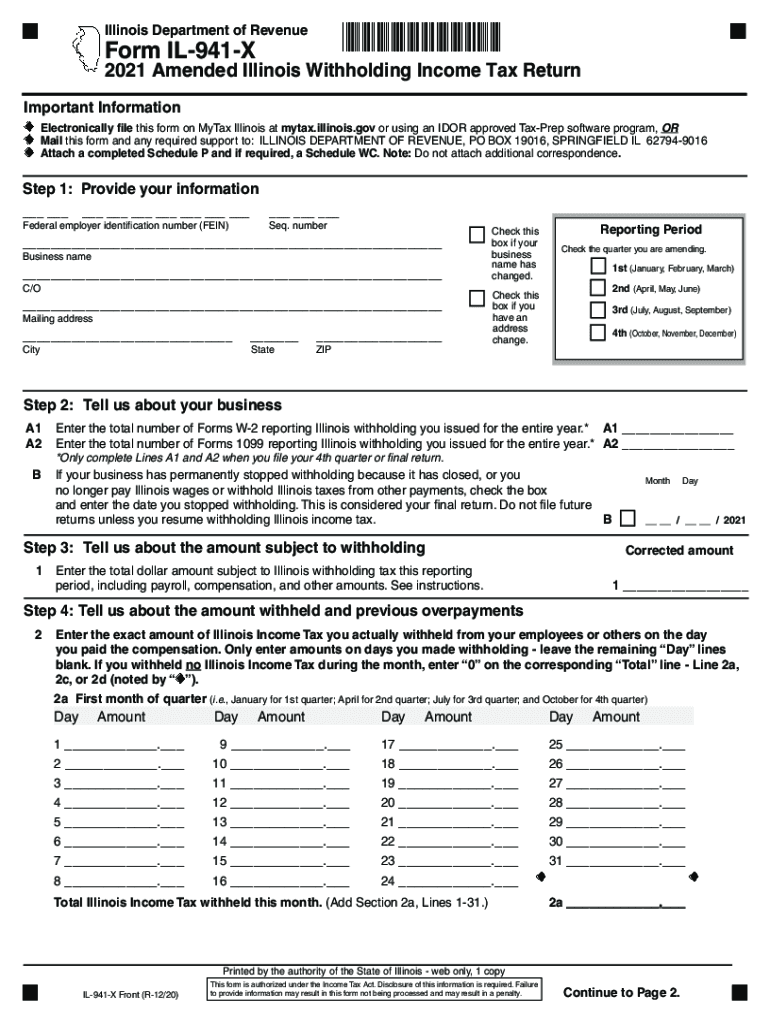

What is the IL 941?

The IL 941 is a tax form used by employers in Illinois to report and pay state income tax withheld from employees' wages. This form is essential for compliance with state tax laws and helps ensure that the correct amount of tax is remitted to the Illinois Department of Revenue. It is typically filed quarterly and includes information about the total wages paid, the amount of tax withheld, and any adjustments necessary for accurate reporting.

Steps to Complete the IL 941

Completing the IL 941 involves several key steps to ensure accuracy and compliance:

- Gather all necessary payroll records for the reporting period.

- Calculate the total wages paid to employees during the quarter.

- Determine the total amount of state income tax withheld from those wages.

- Fill out the IL 941 form accurately, entering the calculated figures.

- Review the form for any errors or omissions before submission.

Filing Deadlines and Important Dates

Employers must be aware of the filing deadlines for the IL 941 to avoid penalties. The form is due on the last day of the month following the end of each quarter. Specifically, the deadlines are:

- First Quarter (January - March): Due April 30

- Second Quarter (April - June): Due July 31

- Third Quarter (July - September): Due October 31

- Fourth Quarter (October - December): Due January 31

Form Submission Methods

The IL 941 can be submitted in various ways to accommodate different preferences. Employers can choose to file the form:

- Online through the Illinois Department of Revenue's e-filing system.

- By mail, sending a completed paper form to the appropriate address.

- In-person at designated state offices, if preferred.

Penalties for Non-Compliance

Failure to file the IL 941 on time or inaccuracies in reporting can lead to penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Possible audits by the Illinois Department of Revenue, leading to further scrutiny of payroll practices.

Who Issues the Form

The IL 941 is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers. It provides guidance and support for completing the form and addressing any issues that may arise during the filing process.

Quick guide on how to complete 2019 il 990 t vpdf use your mouse or tab key to move

Complete IL 990 T V pdf Use Your Mouse Or Tab Key To Move effortlessly on any gadget

Online document administration has become favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents promptly without holdups. Manage IL 990 T V pdf Use Your Mouse Or Tab Key To Move on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to adjust and eSign IL 990 T V pdf Use Your Mouse Or Tab Key To Move without any hassle

- Obtain IL 990 T V pdf Use Your Mouse Or Tab Key To Move and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your demands in document management in just a few clicks from any device you choose. Edit and eSign IL 990 T V pdf Use Your Mouse Or Tab Key To Move and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 il 990 t vpdf use your mouse or tab key to move

Create this form in 5 minutes!

How to create an eSignature for the 2019 il 990 t vpdf use your mouse or tab key to move

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the il 941 form and why is it important?

The il 941 form is a crucial state tax document that helps businesses report their employee withholding tax. Understanding how to properly fill and file the il 941 is essential to avoid penalties and maintain compliance. airSlate SignNow can simplify this process by providing an efficient way to eSign and manage your documents.

-

How can airSlate SignNow assist with filing the il 941?

airSlate SignNow provides businesses with a streamlined platform to prepare, sign, and send the il 941 form electronically. This ensures that you can quickly complete your tax reporting with the necessary signatures and prevents delays in submission. Our solution is designed for ease of use, making tax compliance simpler.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit the needs of different businesses, making it a cost-effective choice for managing documents like the il 941 form. Our plans can cater to small businesses to larger enterprises, ensuring you have access to essential eSigning features without overspending. Visit our pricing page to explore the options.

-

Can I integrate airSlate SignNow with my existing software?

Yes! airSlate SignNow supports integrations with various software applications to streamline your workflow, including accounting and HR systems which often use the il 941 form. This means you can easily send and eSign documents directly from your existing tools, enhancing productivity and efficiency.

-

What features does airSlate SignNow provide for document management?

With airSlate SignNow, you gain access to robust features such as customizable templates, automated workflows, and secure cloud storage for all your documents, including the il 941 form. These features not only simplify document management but also enhance collaboration among team members and clients.

-

Is airSlate SignNow secure for handling sensitive documents like the il 941?

Absolutely! airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards, ensuring your il 941 form and other sensitive information are safe. Rest assured that your data is protected while you manage your documents electronically.

-

How can using airSlate SignNow improve my business processes?

By implementing airSlate SignNow for eSigning documents such as the il 941 form, you can streamline your processes and reduce paper waste. This not only saves time but also enhances efficiency and accuracy in document management, allowing your team to focus on more critical business functions.

Get more for IL 990 T V pdf Use Your Mouse Or Tab Key To Move

- Sample fmla denial letter to employee form

- Manager evaluation form pdf

- L188 contractor form

- Humana out of network vision claim form

- Pnb self declaration form

- Alohacare credentialing email form alohacare

- Skilled nursing facility advance beneficary notice of non coverage form

- Employee direct deposit authorization form i employee hereby authorize my employer and its agents including financial

Find out other IL 990 T V pdf Use Your Mouse Or Tab Key To Move

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document