Il 941 X 2019

What is the IL 941 X?

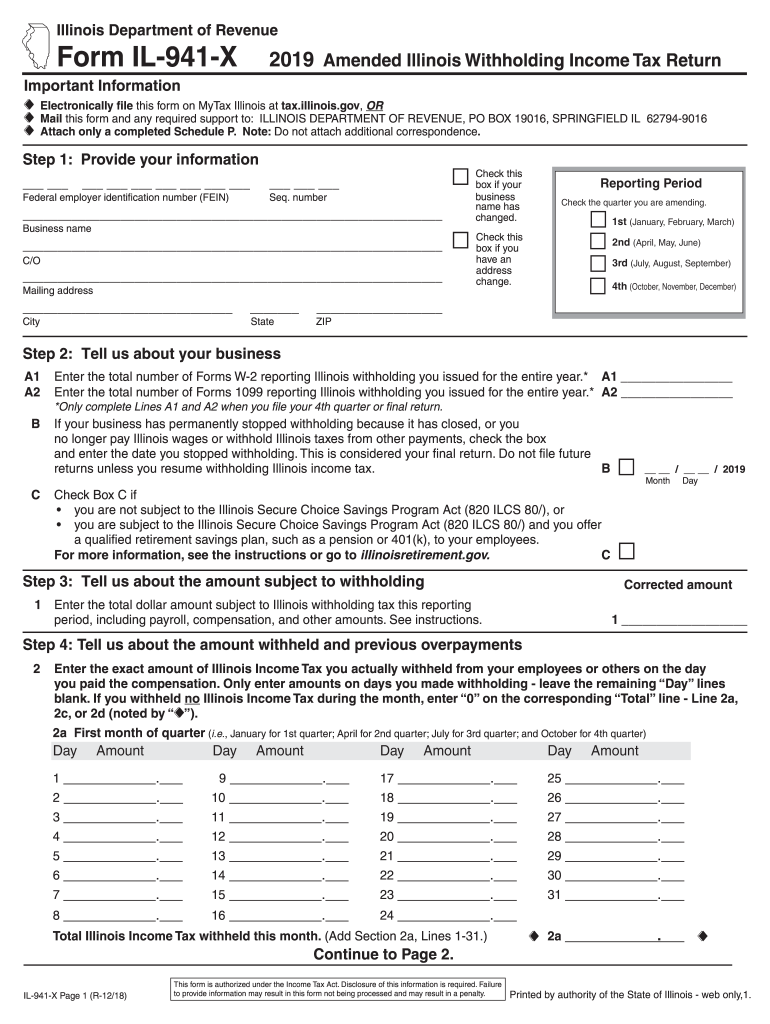

The IL 941 X is a corrected version of the Illinois Employer's Quarterly Tax Return, specifically designed for employers who need to amend previously filed returns. This form is essential for correcting errors related to withheld income tax, unemployment insurance tax, or any discrepancies in reported wages. By submitting the IL 941 X, employers can ensure compliance with state tax regulations and avoid potential penalties associated with incorrect filings.

Steps to Complete the IL 941 X

Completing the IL 941 X involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all relevant documentation, including previous IL 941 filings and any supporting records for the corrections.

- Clearly indicate the tax period for which you are making corrections in the designated section of the form.

- Provide the corrected amounts for wages, taxes withheld, and any adjustments necessary for accurate reporting.

- Sign and date the form to certify that the information provided is true and complete.

- Submit the completed form to the Illinois Department of Revenue, either online or via mail, following the specified submission guidelines.

Legal Use of the IL 941 X

The IL 941 X is legally recognized as a valid document for correcting previous tax filings in Illinois. To ensure its legal standing, employers must adhere to the guidelines set forth by the Illinois Department of Revenue. This includes submitting the form within the appropriate time frame and ensuring that all corrections are accurately reflected. Proper use of the IL 941 X can help prevent legal complications related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IL 941 X are crucial for maintaining compliance with state tax laws. Employers should be aware of the following important dates:

- Corrections must be filed within three years of the original due date of the return being amended.

- For quarterly returns, the IL 941 X should be submitted by the end of the month following the quarter in which the error was discovered.

Staying informed about these deadlines helps avoid penalties and ensures that all tax obligations are met in a timely manner.

Required Documents

When filing the IL 941 X, employers should prepare and include the following documents:

- Previous IL 941 filings that require correction.

- Supporting documentation that substantiates the corrections, such as payroll records or tax payment receipts.

- Any correspondence from the Illinois Department of Revenue regarding previous filings.

Having these documents ready can facilitate a smoother correction process and help ensure compliance with state regulations.

Form Submission Methods

The IL 941 X can be submitted through various methods, providing flexibility for employers. The available submission options include:

- Online submission through the Illinois Department of Revenue's e-filing system, which allows for immediate processing.

- Mailing a paper version of the form to the appropriate address provided by the Illinois Department of Revenue.

- In-person submission at local tax offices, which may be beneficial for those needing assistance or clarification on the form.

Choosing the right submission method can help ensure that the corrections are processed efficiently.

Quick guide on how to complete il dor il 941 x 2019

Effortlessly prepare Il 941 X on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Manage Il 941 X on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and electronically sign Il 941 X without hassle

- Find Il 941 X and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Il 941 X and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il dor il 941 x 2019

Create this form in 5 minutes!

How to create an eSignature for the il dor il 941 x 2019

How to generate an electronic signature for the Il Dor Il 941 X 2019 online

How to create an electronic signature for your Il Dor Il 941 X 2019 in Chrome

How to generate an electronic signature for putting it on the Il Dor Il 941 X 2019 in Gmail

How to create an eSignature for the Il Dor Il 941 X 2019 right from your mobile device

How to generate an electronic signature for the Il Dor Il 941 X 2019 on iOS

How to make an electronic signature for the Il Dor Il 941 X 2019 on Android OS

People also ask

-

What is the cost of using airSlate SignNow for 2012 il businesses?

airSlate SignNow offers flexible pricing plans tailored for 2012 il businesses, ensuring cost-effective solutions that fit your budget. You can choose from monthly or annual subscriptions, providing added savings. Each plan includes essential features to simplify your document signing needs.

-

What features does airSlate SignNow offer for 2012 il users?

For 2012 il users, airSlate SignNow provides a wide array of features including customizable templates, mobile access, and audit trails for enhanced security. These features aim to streamline the signing process, making it more efficient for businesses. Additionally, you can integrate with other tools that your team may already use.

-

How does airSlate SignNow benefit businesses located in 2012 il?

Businesses in 2012 il can signNowly benefit from airSlate SignNow by improving their workflow efficiency. The platform allows for quick document turnaround with electronic signatures, reducing the delays associated with traditional methods. This leads to faster deal closures and improved customer satisfaction.

-

Can airSlate SignNow integrate with other software commonly used in 2012 il?

Yes, airSlate SignNow easily integrates with various popular software applications utilized by businesses in 2012 il, such as CRM and project management tools. This integration helps create a seamless experience, allowing you to manage documents without disrupting your existing workflow. Explore our integration options to find the best fit for your operations.

-

Is there a free trial available for airSlate SignNow for 2012 il users?

Absolutely! airSlate SignNow offers a free trial for 2012 il users, allowing you to experience our features without any commitment. This trial period is designed to give you a firsthand look at how our platform can simplify your document signing process. Sign up today to explore the possibilities!

-

What security measures does airSlate SignNow implement for users in 2012 il?

Security is a priority for airSlate SignNow, especially for businesses in 2012 il. We implement advanced encryption, two-factor authentication, and comprehensive audit trails to keep your documents safe. You can trust that your sensitive data is protected throughout the signing process.

-

What mobile features does airSlate SignNow provide for 2012 il businesses?

airSlate SignNow offers robust mobile features tailored for 2012 il businesses, enabling users to sign documents on-the-go. The mobile app is designed for ease of use, allowing you to manage and send documents from your smartphone or tablet. This flexibility supports today's fast-paced business environment.

Get more for Il 941 X

Find out other Il 941 X

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure