Illinois Department of Revenue 941 X Form 2020

What is the Illinois Department Of Revenue 941 X Form

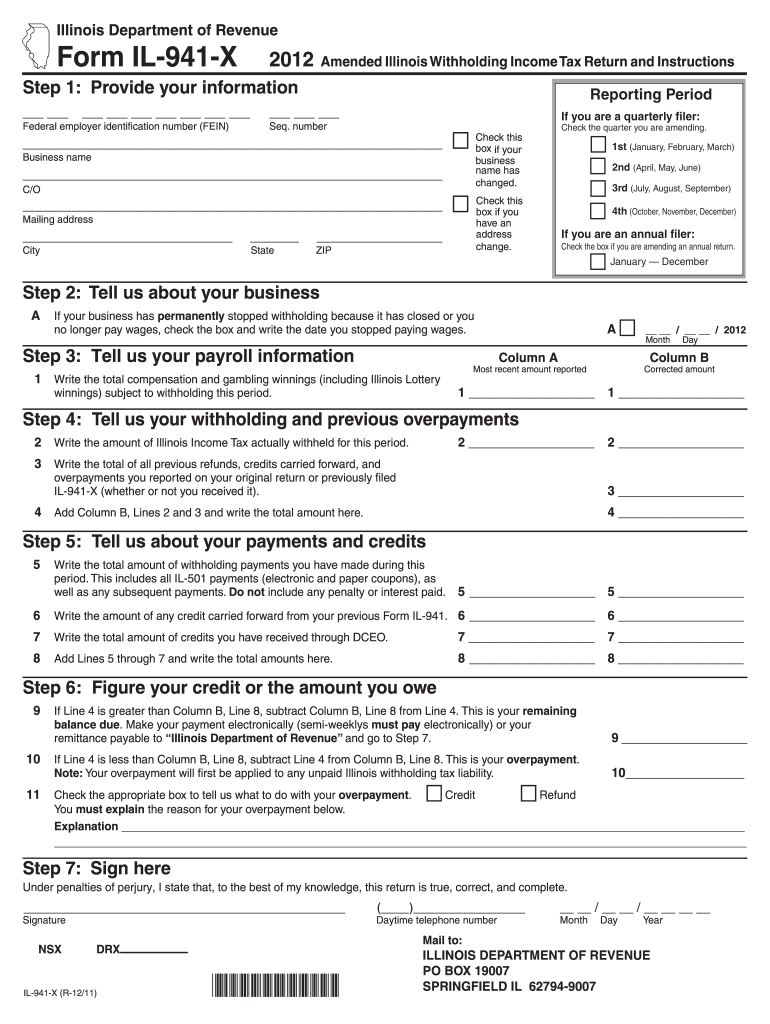

The Illinois Department Of Revenue 941 X Form is a critical document used by employers to amend their previously filed Illinois Employee Income Tax Withholding Forms. This form allows businesses to correct errors related to employee wages, withholding amounts, and tax credits. It is essential for ensuring that the state tax records accurately reflect the correct information, which can prevent potential penalties or issues with compliance.

How to use the Illinois Department Of Revenue 941 X Form

To effectively use the Illinois Department Of Revenue 941 X Form, employers must first obtain the correct version of the form from the Illinois Department of Revenue website. After downloading the form, carefully review the instructions provided. Fill in the necessary details, including the employer's information and the specific corrections being made. Once completed, the form can be submitted either electronically or via mail, depending on the preferred method of filing.

Steps to complete the Illinois Department Of Revenue 941 X Form

Completing the Illinois Department Of Revenue 941 X Form involves several key steps:

- Download the form from the Illinois Department of Revenue's official website.

- Enter the employer's name, address, and identification number at the top of the form.

- Identify the tax period for which corrections are being made.

- Clearly indicate the specific errors and provide the corrected information in the designated sections.

- Review the completed form for accuracy before submission.

Legal use of the Illinois Department Of Revenue 941 X Form

The Illinois Department Of Revenue 941 X Form is legally binding when completed correctly. It must adhere to the guidelines established by the Illinois Department of Revenue, including accurate reporting of employee wages and taxes withheld. Submitting this form ensures compliance with state tax laws and protects employers from potential legal repercussions associated with incorrect filings.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Illinois Department Of Revenue 941 X Form. Generally, the form should be filed as soon as errors are identified, but it is crucial to submit it within the timeframes outlined by the Illinois Department of Revenue to avoid penalties. Keeping track of these deadlines helps ensure compliance and prevents unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Department Of Revenue 941 X Form can be submitted through various methods, providing flexibility for employers. The form can be filed electronically via the Illinois Department of Revenue's online portal, which is often the quickest option. Alternatively, employers may choose to mail the completed form to the appropriate address or submit it in person at designated state offices. Each method has its own processing times and requirements, so employers should select the one that best suits their needs.

Quick guide on how to complete illinois department of revenue 2012 941 x form

Effortlessly prepare Illinois Department Of Revenue 941 X Form on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Illinois Department Of Revenue 941 X Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Illinois Department Of Revenue 941 X Form effortlessly

- Find Illinois Department Of Revenue 941 X Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, boring form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within just a few clicks from any device you choose. Modify and electronically sign Illinois Department Of Revenue 941 X Form to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois department of revenue 2012 941 x form

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue 2012 941 x form

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Illinois Department Of Revenue 941 X Form?

The Illinois Department Of Revenue 941 X Form is an amended employer's quarterly tax return form. It allows businesses to correct mistakes made on previously submitted 941 forms. Utilizing the Illinois Department Of Revenue 941 X Form ensures accurate tax reporting and compliance with state regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue 941 X Form?

airSlate SignNow provides a seamless platform to electronically sign and send the Illinois Department Of Revenue 941 X Form. Our user-friendly interface simplifies the document management process, allowing businesses to quickly prepare and submit their forms while maintaining compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for the Illinois Department Of Revenue 941 X Form?

airSlate SignNow offers a cost-effective solution for managing the Illinois Department Of Revenue 941 X Form and other documents. Our pricing plans are designed to fit different business needs, providing flexibility and scalability without compromising on features or support.

-

What features does airSlate SignNow offer for the Illinois Department Of Revenue 941 X Form?

airSlate SignNow includes features such as electronic signatures, document templates, and automated workflows specifically tailored for the Illinois Department Of Revenue 941 X Form. Additionally, users can track document statuses in real-time and ensure secure storage for all important tax documents.

-

Can I integrate airSlate SignNow with my current accounting software for the Illinois Department Of Revenue 941 X Form?

Yes, airSlate SignNow offers seamless integrations with various accounting software solutions, enhancing your ability to manage the Illinois Department Of Revenue 941 X Form efficiently. This integration allows for smoother data transfer, ensuring that all tax information is accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for the Illinois Department Of Revenue 941 X Form?

Using airSlate SignNow for the Illinois Department Of Revenue 941 X Form offers numerous benefits including enhanced efficiency, reduced paper usage, and quicker turnaround times. Moreover, businesses can reduce the risk of errors and ensure compliance with state regulations through streamlined document handling.

-

Is airSlate SignNow user-friendly for those unfamiliar with the Illinois Department Of Revenue 941 X Form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible even for those who may not be familiar with the Illinois Department Of Revenue 941 X Form. Our intuitive platform provides step-by-step guidance, ensuring that all users can complete their forms confidently.

Get more for Illinois Department Of Revenue 941 X Form

Find out other Illinois Department Of Revenue 941 X Form

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document