Form Il 941 2020

What is the Form IL-941

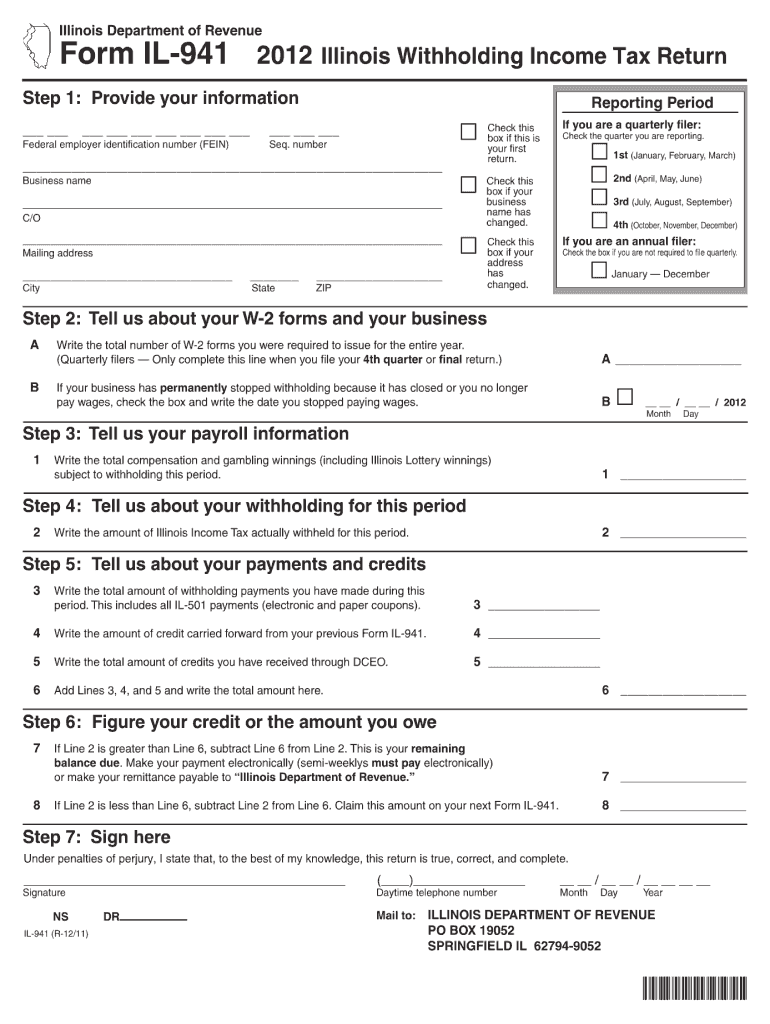

The Form IL-941 is a crucial document used by employers in the state of Illinois to report and pay withholding taxes. This form is specifically designed for businesses that withhold income taxes from employees' wages. It serves as a summary of the total amount of income tax withheld and provides necessary information to the Illinois Department of Revenue. Understanding this form is essential for compliance with state tax regulations.

How to use the Form IL-941

Using the Form IL-941 involves several key steps. Employers must accurately complete the form to report the total amount of Illinois income tax withheld from employee wages. This includes entering information such as the employer's name, address, and federal employer identification number (FEIN). After filling out the form, it must be submitted along with the payment for the withheld taxes. Keeping accurate records of the amounts withheld is vital for future reference and compliance.

Steps to complete the Form IL-941

Completing the Form IL-941 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business details and employee wage data.

- Enter your business name, address, and FEIN in the designated fields.

- Report the total amount of income tax withheld from employees' wages for the reporting period.

- Calculate any penalties or interest if applicable.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form IL-941

The Form IL-941 is legally binding when completed and submitted according to Illinois tax laws. It must be filed on time to avoid penalties. Employers are responsible for ensuring that the information reported is accurate and that all taxes withheld are remitted to the state. Compliance with the legal requirements surrounding this form helps maintain good standing with the Illinois Department of Revenue.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form IL-941. Typically, this form is due on a quarterly basis. The specific due dates for filing are:

- For the first quarter: April 30

- For the second quarter: July 31

- For the third quarter: October 31

- For the fourth quarter: January 31 of the following year

Filing on time is crucial to avoid penalties and ensure compliance with state tax regulations.

Form Submission Methods

The Form IL-941 can be submitted through various methods to accommodate different preferences. Employers can choose to file the form online using the Illinois Department of Revenue's e-filing system. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated offices, allowing for direct interaction with tax officials.

Quick guide on how to complete form il 941 2012

Complete Form Il 941 with ease on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Form Il 941 on any platform with the airSlate SignNow Android or iOS applications and improve any document-related task today.

How to modify and eSign Form Il 941 effortlessly

- Locate Form Il 941 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form Il 941 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 941 2012

Create this form in 5 minutes!

How to create an eSignature for the form il 941 2012

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form Il 941 and why do I need it?

Form Il 941 is a crucial tax document used by employers in Illinois to report wages, salaries, and taxes withheld. Filing this form accurately is essential to ensure compliance with state tax laws and avoid penalties. Using airSlate SignNow can streamline the eSigning process for this form, making it easier for businesses to manage their documentation.

-

How does airSlate SignNow help withForm Il 941?

airSlate SignNow offers a user-friendly platform to create, send, and eSign Form Il 941 efficiently. With our electronic signature features, you can expedite the approval process and ensure that all necessary parties sign the document promptly. This convenience helps you stay organized while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for Form Il 941?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs when managing Form Il 941. Our cost-effective solutions allow you to save time and resources while ensuring secure eSigning and document management. Check our website for detailed pricing options.

-

What features does airSlate SignNow provide for Form Il 941?

airSlate SignNow includes features such as document templates, automated workflows, and secure storage for managing Form Il 941. Additionally, our real-time collaboration tools enable multiple users to work on documents seamlessly. These features streamline the eSigning process and enhance productivity.

-

Can I integrate airSlate SignNow with other software for Form Il 941?

Absolutely! airSlate SignNow integrates with popular software platforms such as Google Workspace, Salesforce, and more. This integration allows you to manage Form Il 941 and other documents effortlessly within your existing workflow, enhancing efficiency and improving team collaboration.

-

What are the benefits of eSigning Form Il 941 with airSlate SignNow?

eSigning Form Il 941 with airSlate SignNow provides a secure, fast, and legally binding solution for document signing. It eliminates the need for physical paperwork and reduces processing times signNowly. This not only saves you time but also ensures your documents are accessible from any device.

-

How can I ensure the security of my Form Il 941 when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure access controls to protect your Form Il 941 and other sensitive documents. Additionally, our platform provides audit trails to track the signing process, ensuring transparency and compliance.

Get more for Form Il 941

Find out other Form Il 941

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple