Illinois Department of Revenue Reg 3 C Form 2016

What is the Illinois Department Of Revenue Reg 3 C Form

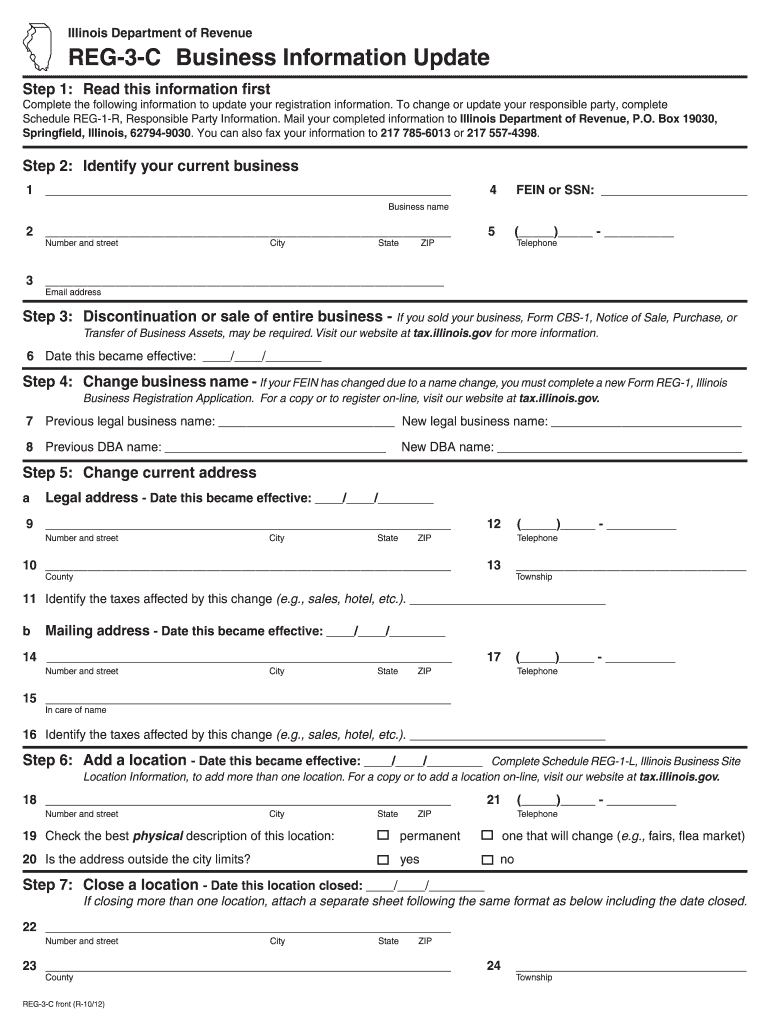

The Illinois Department Of Revenue Reg 3 C Form is a specific document used for tax purposes within the state of Illinois. This form is primarily utilized by businesses to report and claim certain tax credits or exemptions. Understanding its purpose is essential for compliance with state tax regulations. The form is designed to streamline the reporting process, ensuring that businesses can effectively communicate their tax obligations and entitlements to the Illinois Department of Revenue.

How to use the Illinois Department Of Revenue Reg 3 C Form

Using the Illinois Department Of Revenue Reg 3 C Form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Illinois Department of Revenue website or through authorized channels. Next, gather all necessary information, including your business details and any supporting documentation required for your claims. Once the form is filled out accurately, it can be submitted according to the guidelines provided by the state, either electronically or through traditional mail.

Steps to complete the Illinois Department Of Revenue Reg 3 C Form

Completing the Illinois Department Of Revenue Reg 3 C Form requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the form from the Illinois Department of Revenue website.

- Fill in your business information, including name, address, and tax identification number.

- Provide details regarding the tax credits or exemptions you are claiming.

- Attach any required supporting documents that validate your claims.

- Review the completed form for accuracy before submission.

Legal use of the Illinois Department Of Revenue Reg 3 C Form

The Illinois Department Of Revenue Reg 3 C Form is legally binding when completed and submitted according to state regulations. To ensure its legal use, it is important to comply with all relevant tax laws and guidelines. This includes providing accurate information and maintaining proper documentation to support your claims. Misuse or inaccuracies in the form can lead to penalties or legal repercussions, making it vital to approach the completion and submission process with diligence.

Key elements of the Illinois Department Of Revenue Reg 3 C Form

Several key elements are essential for the Illinois Department Of Revenue Reg 3 C Form. These include:

- Business Information: Accurate details about the business, including its legal name and tax identification number.

- Claimed Tax Credits: Specific credits or exemptions being claimed, which must be clearly outlined.

- Supporting Documentation: Any necessary documents that substantiate the claims made on the form.

- Signature: A signature from an authorized representative of the business, confirming the accuracy of the information provided.

Form Submission Methods

The Illinois Department Of Revenue Reg 3 C Form can be submitted through various methods to accommodate different preferences. Businesses can choose to file the form electronically via the Illinois Department of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate department. In-person submissions may also be possible, depending on local regulations and office availability. Each method has specific guidelines, so it is important to follow the instructions provided with the form.

Quick guide on how to complete illinois department of revenue reg 3 c 2012 form

Effortlessly Prepare Illinois Department Of Revenue Reg 3 C Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed papers, allowing you to find the appropriate form and securely store it in the cloud. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage Illinois Department Of Revenue Reg 3 C Form across any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Illinois Department Of Revenue Reg 3 C Form with Ease

- Obtain Illinois Department Of Revenue Reg 3 C Form and click Get Form to begin.

- Use the available tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Create your signature using the Sign tool, a process that takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details, then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new copies of documents to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Illinois Department Of Revenue Reg 3 C Form while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue reg 3 c 2012 form

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Illinois Department Of Revenue Reg 3 C Form?

The Illinois Department Of Revenue Reg 3 C Form is a crucial document that businesses must use for certain tax-related purposes. This form is specifically designed to help ensure compliance with state revenue regulations. Completing it accurately is essential for avoiding potential penalties.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Reg 3 C Form?

airSlate SignNow streamlines the process of completing and submitting the Illinois Department Of Revenue Reg 3 C Form. With its user-friendly interface, users can quickly create, sign, and send this important document digitally. This eliminates the need for paper forms, making the process more efficient.

-

Is there a cost associated with using airSlate SignNow for the Illinois Department Of Revenue Reg 3 C Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. The pricing plans are flexible, allowing you to choose an option that best fits your company’s needs and budget. Investing in this service can save you time and reduce errors when handling the Illinois Department Of Revenue Reg 3 C Form.

-

Can multiple users collaborate on the Illinois Department Of Revenue Reg 3 C Form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Illinois Department Of Revenue Reg 3 C Form simultaneously. This feature enhances team productivity and ensures that every relevant party can contribute to the document's completion, ensuring accuracy and compliance.

-

What features does airSlate SignNow offer for document management, specifically for the Illinois Department Of Revenue Reg 3 C Form?

airSlate SignNow offers a range of features including templates, e-signatures, and real-time tracking for documents like the Illinois Department Of Revenue Reg 3 C Form. These features simplify the document management process, making it easier to keep track of submissions and avoid any compliance issues. Additionally, you can store and access all your important forms securely in one place.

-

Is it easy to integrate airSlate SignNow with my existing systems for handling the Illinois Department Of Revenue Reg 3 C Form?

Yes, airSlate SignNow is designed to integrate smoothly with various existing systems, making it easy to manage the Illinois Department Of Revenue Reg 3 C Form. Whether you're using CRM, ERP, or other document management systems, integration helps maintain workflow consistency and efficiency. This ensures a seamless user experience.

-

What are the benefits of using airSlate SignNow for the Illinois Department Of Revenue Reg 3 C Form compared to traditional methods?

Using airSlate SignNow for the Illinois Department Of Revenue Reg 3 C Form offers numerous benefits over traditional methods. It reduces paperwork, minimizes errors, and accelerates the signing process, allowing for quick submission and compliance. Additionally, it enhances security with encrypted signatures, ensuring your documents are protected.

Get more for Illinois Department Of Revenue Reg 3 C Form

- Hipaa form 100012839

- P45 template word form

- Ar tx border city exemption form

- California vehicle registration template form

- Mankind the story of all of us episode 5 worksheet answers form

- Allergy test sheet form

- Identity theft police report template form

- Marion cole application icas foundation icasfoundation form

Find out other Illinois Department Of Revenue Reg 3 C Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors