Claim for Homestead Property Tax Standard Supplemental Deduction 2020

Understanding the Claim for Homestead Property Tax Standard Supplemental Deduction

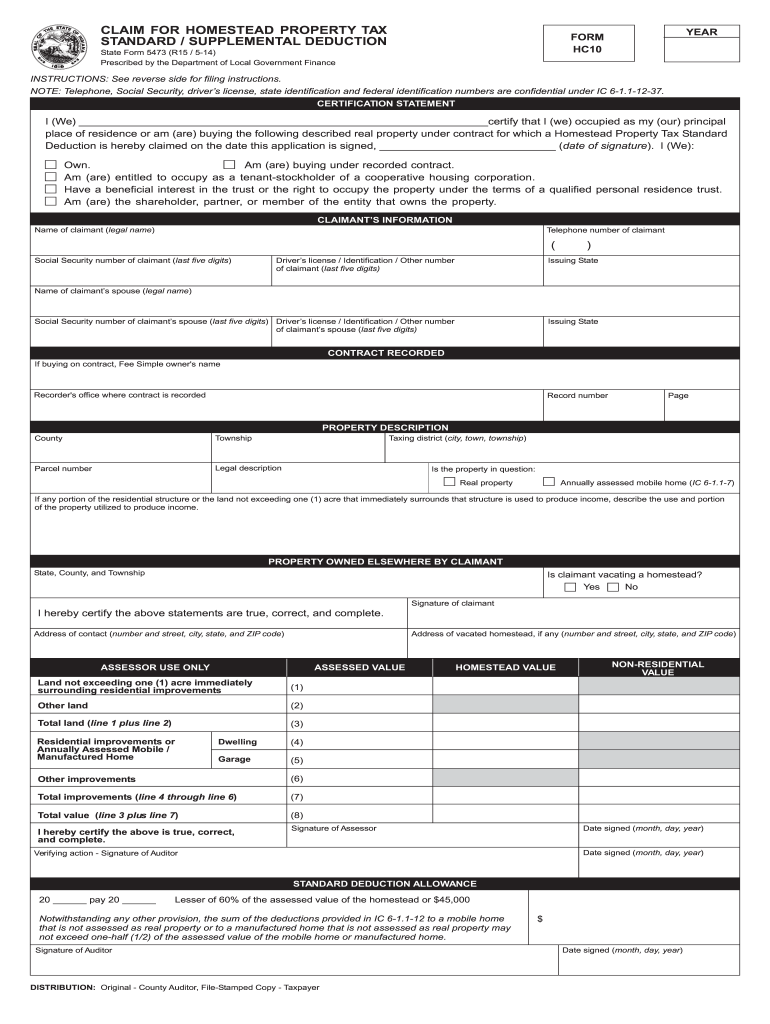

The Claim for Homestead Property Tax Standard Supplemental Deduction is a legal document that allows homeowners to reduce their property tax burden. This deduction is typically available to individuals who occupy their property as their primary residence. The purpose of this claim is to provide financial relief to homeowners, ensuring that property taxes are fair and manageable. Understanding the eligibility criteria and the specifics of the claim is essential for homeowners looking to benefit from this deduction.

Steps to Complete the Claim for Homestead Property Tax Standard Supplemental Deduction

Completing the Claim for Homestead Property Tax Standard Supplemental Deduction involves several key steps:

- Gather necessary documentation, including proof of residency and ownership.

- Fill out the claim form accurately, ensuring all information is complete.

- Submit the completed form by the specified deadline to your local tax authority.

- Keep a copy of the submitted form for your records.

Following these steps carefully will help ensure that your claim is processed smoothly and efficiently.

Eligibility Criteria for the Claim for Homestead Property Tax Standard Supplemental Deduction

To qualify for the Claim for Homestead Property Tax Standard Supplemental Deduction, homeowners must meet specific eligibility criteria. Generally, applicants must:

- Own and occupy the property as their primary residence.

- Meet any income limits set by the state or local jurisdiction.

- Submit the claim within the designated filing period.

It is important to check local regulations, as eligibility can vary by state.

Required Documents for the Claim for Homestead Property Tax Standard Supplemental Deduction

When filing the Claim for Homestead Property Tax Standard Supplemental Deduction, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of property ownership, like a deed or mortgage statement.

- Evidence of residency, such as utility bills or rental agreements.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods for the Claim for Homestead Property Tax Standard Supplemental Deduction

Homeowners can submit the Claim for Homestead Property Tax Standard Supplemental Deduction through various methods, including:

- Online submission via the local tax authority's website.

- Mailing a physical copy of the form to the appropriate office.

- In-person delivery at designated tax offices.

Choosing the most convenient method can help ensure timely processing of your claim.

State-Specific Rules for the Claim for Homestead Property Tax Standard Supplemental Deduction

Each state has its own rules and regulations regarding the Claim for Homestead Property Tax Standard Supplemental Deduction. These may include:

- Different eligibility requirements based on residency duration.

- Varied deduction amounts or percentage reductions in property taxes.

- Specific deadlines for filing claims that differ from other states.

Homeowners should familiarize themselves with their state’s guidelines to maximize their benefits.

Quick guide on how to complete claim for homestead property tax standard supplemental deduction

Effortlessly Prepare Claim For Homestead Property Tax Standard Supplemental Deduction on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required forms and securely maintain them online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Claim For Homestead Property Tax Standard Supplemental Deduction on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Claim For Homestead Property Tax Standard Supplemental Deduction with Ease

- Obtain Claim For Homestead Property Tax Standard Supplemental Deduction and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your selected device. Modify and electronically sign Claim For Homestead Property Tax Standard Supplemental Deduction to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for homestead property tax standard supplemental deduction

Create this form in 5 minutes!

How to create an eSignature for the claim for homestead property tax standard supplemental deduction

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What does 'vacating a homestead meaning' refer to?

Vacating a homestead meaning involves the legal process of leaving a primary residence after a sale or foreclosure. It typically requires notifying the appropriate parties and completing any necessary legal documents. Understanding this term is crucial for homeowners looking to transition smoothly out of their property.

-

How can airSlate SignNow help with vacating a homestead meaning?

AirSlate SignNow offers a user-friendly platform for eSigning important documents related to vacating a homestead. By streamlining the document signing process, users can ensure all necessary paperwork is completed efficiently and securely. This ease of use is particularly beneficial during transitions that involve property changes.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans to cater to different business needs, starting from a basic tier to advanced options. Each plan includes features essential for managing documents related to vacating a homestead meaning and more. Additionally, you can explore a free trial to evaluate the service before committing.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes robust features, such as customizable templates, document sharing, and real-time collaboration. These tools make it easier for users to manage their processes related to vacating a homestead meaning efficiently. Furthermore, the platform is designed to be intuitive, allowing all users to navigate and complete tasks without any hassle.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow integrates with a variety of popular software applications, enhancing workflow efficiency. This capability allows users to connect their document signing with platforms they already use, which is particularly beneficial when dealing with vacating a homestead meaning. Integration minimizes wasted time and ensures all data is synchronized seamlessly.

-

What are the benefits of using airSlate SignNow for signing documents?

Using airSlate SignNow for signing documents comes with several advantages, including security, ease of use, and accessibility. This is especially relevant to topics like vacating a homestead meaning, where important documents must be signed quickly and securely. The platform also offers advanced tracking features, so users can monitor the status of their signed documents.

-

Is airSlate SignNow compliant with legal standards?

Absolutely, airSlate SignNow is compliant with various legal standards, ensuring that all eSignatures are legally binding. This compliance is crucial for processes involving vacating a homestead meaning, where legal documents play a signNow role. Users can confidently use the platform knowing they are adhering to industry regulations.

Get more for Claim For Homestead Property Tax Standard Supplemental Deduction

- Emotional stability questionnaire esq pdf form

- Kyc access bank form

- Borang permohonan visa malaysia form

- Flight ticket form

- Engineering supervisor form rt3199

- Stolen vehicle report form 14215

- Office of land surveys manual caltrans state of california form

- Dpd 3002 request for photographs maps as built plans or other form

Find out other Claim For Homestead Property Tax Standard Supplemental Deduction

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast