CLAIM for HOMESTEAD PROPERTY TAX CREDIT 2023-2026

What is the claim for homestead property tax credit?

The claim for homestead property tax credit is a financial benefit provided to homeowners in Indiana. This credit reduces the amount of property taxes owed on a primary residence, making homeownership more affordable. The credit is designed to assist eligible homeowners by lowering their taxable property value, which can significantly decrease their overall tax burden. Understanding this credit is essential for homeowners looking to maximize their financial benefits under Indiana law.

Eligibility criteria for the claim for homestead property tax credit

To qualify for the claim for homestead property tax credit in Indiana, homeowners must meet specific eligibility criteria. These include:

- The property must be the homeowner's primary residence.

- The homeowner must be an individual, not a business entity.

- The homeowner must have owned the property as of the assessment date.

- The property must not be used for commercial purposes.

Meeting these criteria is crucial to ensure that homeowners can take advantage of the tax credit and reduce their property tax liability.

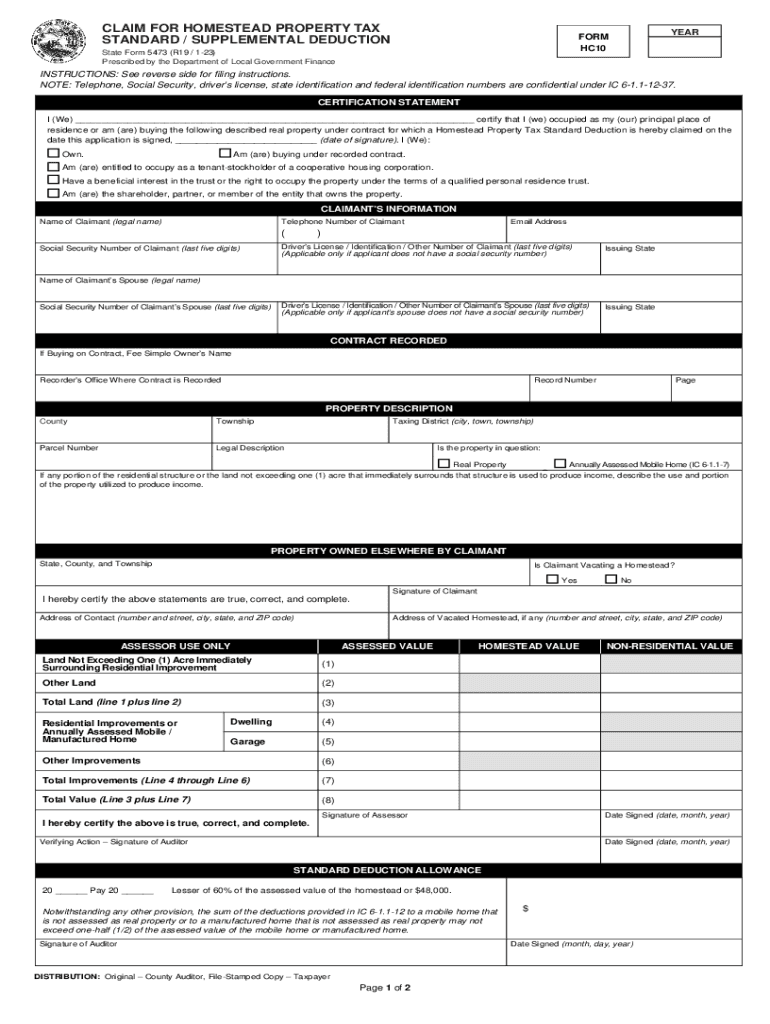

Steps to complete the claim for homestead property tax credit

Completing the claim for homestead property tax credit involves several straightforward steps:

- Obtain the Indiana homestead exemption form from your local county assessor's office or online.

- Fill out the form with accurate information regarding your property and personal details.

- Provide any required documentation, such as proof of ownership and residency.

- Submit the completed form to your county assessor's office by the specified deadline.

Following these steps ensures that your claim is processed efficiently, allowing you to benefit from the credit as soon as possible.

Required documents for the claim for homestead property tax credit

When applying for the claim for homestead property tax credit, homeowners must provide specific documents to verify their eligibility. These documents typically include:

- Proof of ownership, such as a deed or mortgage statement.

- Identification, like a driver's license or state ID.

- Any other documentation requested by the county assessor's office.

Having these documents ready can expedite the application process and ensure compliance with local requirements.

Form submission methods for the claim for homestead property tax credit

Homeowners can submit their claim for homestead property tax credit through various methods, depending on their preference and local regulations. Common submission methods include:

- Online submission via the county assessor's website.

- Mailing the completed form to the local county assessor's office.

- In-person submission at the county assessor's office.

Choosing the most convenient method can help streamline the process and ensure timely processing of the claim.

Key elements of the claim for homestead property tax credit

Understanding the key elements of the claim for homestead property tax credit is vital for homeowners. Important aspects include:

- The amount of the credit can vary based on the assessed value of the property.

- Homeowners must reapply for the credit if they move or change their primary residence.

- The credit is typically applied to the property tax bill, reducing the amount owed.

Being aware of these elements can help homeowners navigate the process and maximize their potential savings.

Quick guide on how to complete claim for homestead property tax credit

Complete CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT effortlessly on any device

Online document handling has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT without stress

- Find CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for homestead property tax credit

Create this form in 5 minutes!

How to create an eSignature for the claim for homestead property tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana homestead exemption form?

The Indiana homestead exemption form is a legal document that allows eligible homeowners in Indiana to apply for property tax deductions. This form helps in reducing the tax burden by providing exemptions based on the residence's assessed value. Completing this form correctly ensures that homeowners benefit from potential savings.

-

How can I obtain the Indiana homestead exemption form?

You can obtain the Indiana homestead exemption form online through the Indiana Department of Local Government Finance website or visit your local county assessor's office. It's crucial to ensure you have the latest version of the form and any required documents. Utilizing platforms like airSlate SignNow can streamline the signing and submission process.

-

What are the eligibility requirements for the Indiana homestead exemption form?

To qualify for the Indiana homestead exemption form, you must own and reside in the property as your primary residence. Additional requirements may include income limits and ownership duration. It's essential to review the specific criteria set by your local county to ensure your eligibility.

-

What are the benefits of filing the Indiana homestead exemption form?

Filing the Indiana homestead exemption form can signNowly reduce your property taxes, providing financial relief to homeowners. The exemptions can vary based on assessments, potentially saving you hundreds or thousands of dollars annually. This financial advantage can also enhance your property's affordability.

-

Is there a fee to file the Indiana homestead exemption form?

There is no fee to file the Indiana homestead exemption form itself, making it an accessible option for homeowners. However, local governments may have specific regulations or additional forms that could incur costs. Always check with your county assessor for precise details.

-

Can I file the Indiana homestead exemption form online?

Yes, many counties in Indiana allow you to file the Indiana homestead exemption form online, which simplifies the application process. Utilizing digital platforms can help in ensuring timely submission and tracking. AirSlate SignNow can assist in not only signing but also securely sending your form electronically.

-

What documents do I need to submit with the Indiana homestead exemption form?

When submitting the Indiana homestead exemption form, you typically need to include proof of residency, such as a driver's license or utility bill. Additionally, properties may require documentation proving ownership. Specific requirements can vary by county, so verify with local guidelines.

Get more for CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT

- Nbi authorization letter sample form

- Car accident report sample pdf form

- Ps form 3801 22808

- Phonics assessment form

- Pre incident survey template form

- Next steps small claimscomplaint for money owed form

- Saveprintclearrules appendix xxviia notice this i form

- Mobile home real estate excise tax affidavit form

Find out other CLAIM FOR HOMESTEAD PROPERTY TAX CREDIT

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now