Indiana Homestead Tax Form 2015

What is the Indiana Homestead Tax Form

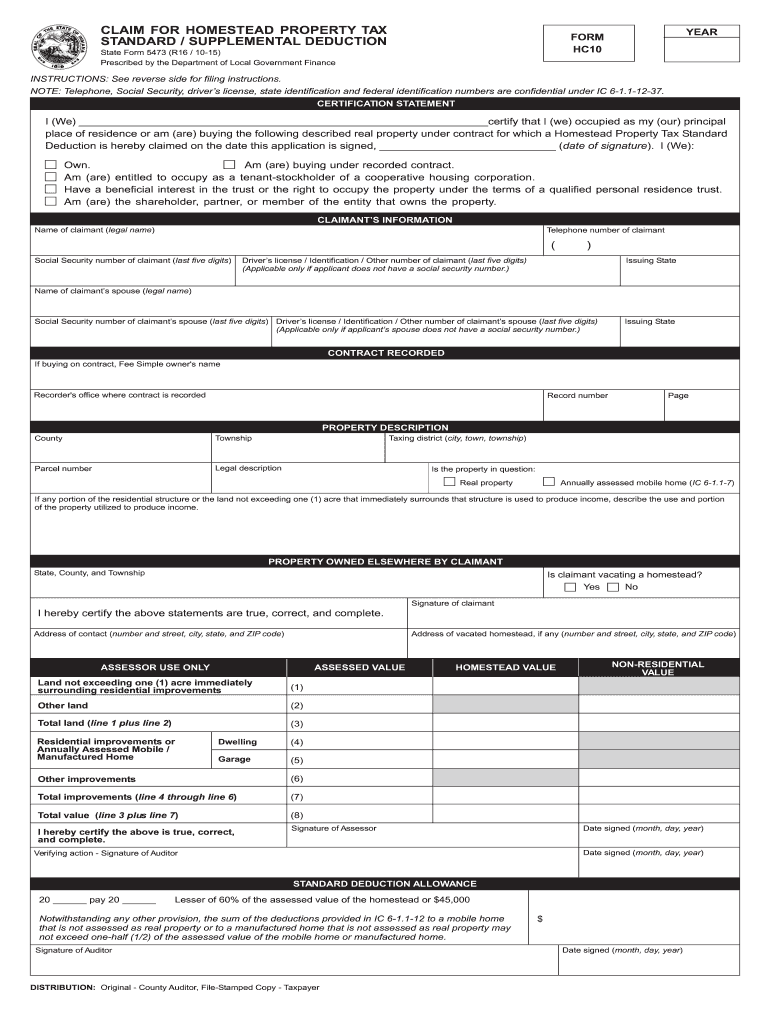

The Indiana Homestead Tax Form is a crucial document that allows homeowners in Indiana to apply for a homestead exemption. This exemption can significantly reduce the property tax burden for eligible homeowners by providing a deduction from the assessed value of their primary residence. The form is specifically designed for individuals who own and occupy their homes as their primary residence, enabling them to benefit from tax savings offered by the state.

How to use the Indiana Homestead Tax Form

To effectively utilize the Indiana Homestead Tax Form, homeowners must first ensure they meet the eligibility criteria. Once eligibility is confirmed, the form should be completed with accurate information regarding the property and the homeowner's details. It is essential to provide supporting documentation, such as proof of residency and ownership. After filling out the form, it can be submitted to the local county assessor's office for review and approval.

Steps to complete the Indiana Homestead Tax Form

Completing the Indiana Homestead Tax Form involves several key steps:

- Gather necessary documents, including proof of identity and residency.

- Fill out the form with accurate property information and personal details.

- Review the form for completeness and accuracy.

- Submit the completed form to the local county assessor's office.

It is recommended to keep a copy of the submitted form for personal records.

Eligibility Criteria

To qualify for the Indiana Homestead Tax exemption, applicants must meet specific eligibility criteria. These typically include:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property.

- The property must not be used for rental or business purposes.

- Applicants must provide valid identification and proof of residency.

Meeting these criteria ensures that homeowners can take advantage of the tax benefits associated with the homestead exemption.

Form Submission Methods

The Indiana Homestead Tax Form can be submitted through various methods to accommodate different preferences. Homeowners can choose to file the form:

- Online through the local county assessor's website, if available.

- By mail, sending the completed form to the appropriate county office.

- In person, delivering the form directly to the county assessor's office.

Each submission method has its own advantages, so homeowners should select the one that best fits their needs.

Legal use of the Indiana Homestead Tax Form

The Indiana Homestead Tax Form is legally binding once submitted and approved by the local county assessor's office. It is essential for homeowners to understand that providing false information on the form can result in penalties or loss of the exemption. Compliance with all state regulations regarding the homestead exemption is crucial to ensure the benefits are maintained.

Quick guide on how to complete indiana homestead tax 2015 form

Prepare Indiana Homestead Tax Form effortlessly on any device

Managing documents online has gained immense popularity among companies and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents swiftly without any delays. Manage Indiana Homestead Tax Form on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

How to modify and eSign Indiana Homestead Tax Form with ease

- Locate Indiana Homestead Tax Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all details and click the Done button to save your updates.

- Select how you wish to submit your form, whether by email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Revise and eSign Indiana Homestead Tax Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana homestead tax 2015 form

Create this form in 5 minutes!

How to create an eSignature for the indiana homestead tax 2015 form

How to create an electronic signature for your Indiana Homestead Tax 2015 Form online

How to create an eSignature for your Indiana Homestead Tax 2015 Form in Google Chrome

How to create an eSignature for putting it on the Indiana Homestead Tax 2015 Form in Gmail

How to create an electronic signature for the Indiana Homestead Tax 2015 Form from your smart phone

How to create an electronic signature for the Indiana Homestead Tax 2015 Form on iOS devices

How to generate an electronic signature for the Indiana Homestead Tax 2015 Form on Android

People also ask

-

What is the Indiana Homestead Tax Form and why is it important?

The Indiana Homestead Tax Form is a crucial document for homeowners in Indiana that allows them to claim homestead deductions on their property taxes. By completing this form, homeowners can potentially lower their property tax bills signNowly. Understanding how to fill out and submit the Indiana Homestead Tax Form is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with the Indiana Homestead Tax Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Indiana Homestead Tax Form. With our solution, you can quickly complete and share the form with relevant parties, ensuring a hassle-free submission process. This streamlines the management of important tax documents while keeping everything secure.

-

Is there a cost associated with using airSlate SignNow for the Indiana Homestead Tax Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features that facilitate the completion of the Indiana Homestead Tax Form. Our plans are cost-effective and designed to provide value by simplifying document management and eSigning processes. You can choose a plan that suits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Indiana Homestead Tax Form?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and document sharing options specifically designed for forms like the Indiana Homestead Tax Form. These tools enhance productivity and ensure that the form is completed accurately and efficiently. Plus, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Indiana Homestead Tax Form?

Yes, airSlate SignNow offers seamless integrations with various business applications that can help in managing the Indiana Homestead Tax Form. This includes CRM systems, cloud storage solutions, and more, allowing you to streamline your workflow and keep all your documents organized in one place. Integrating these tools enhances efficiency and simplifies your tax preparation process.

-

What benefits does eSigning the Indiana Homestead Tax Form provide?

eSigning the Indiana Homestead Tax Form with airSlate SignNow offers several benefits, including faster processing times, enhanced security, and the convenience of signing from anywhere. This digital approach eliminates the need for physical paperwork, reduces errors, and allows you to complete the form quickly, ensuring you meet deadlines without stress.

-

How secure is the process of sending the Indiana Homestead Tax Form through airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. When sending the Indiana Homestead Tax Form, we utilize advanced encryption protocols to protect your information during transmission and storage. You can confidently manage sensitive tax documents knowing they are safeguarded against unauthorized access.

Get more for Indiana Homestead Tax Form

- Gabelli coverdell funds online ap form

- Sf 26 fillable 2008 form

- Direct deposit authorization for electronic funds transfer minnesota form

- Butler county community college transcripts form

- Vons club savings form

- Attention the industrial commission of ohio form

- Application form herndon police

- Publication 3676 b en sp rev 12 irs certified volunteers providing tax preparation english spanish form

Find out other Indiana Homestead Tax Form

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now