DLGF Deduction Forms 2020

What is the Indiana Homestead Exemption Form?

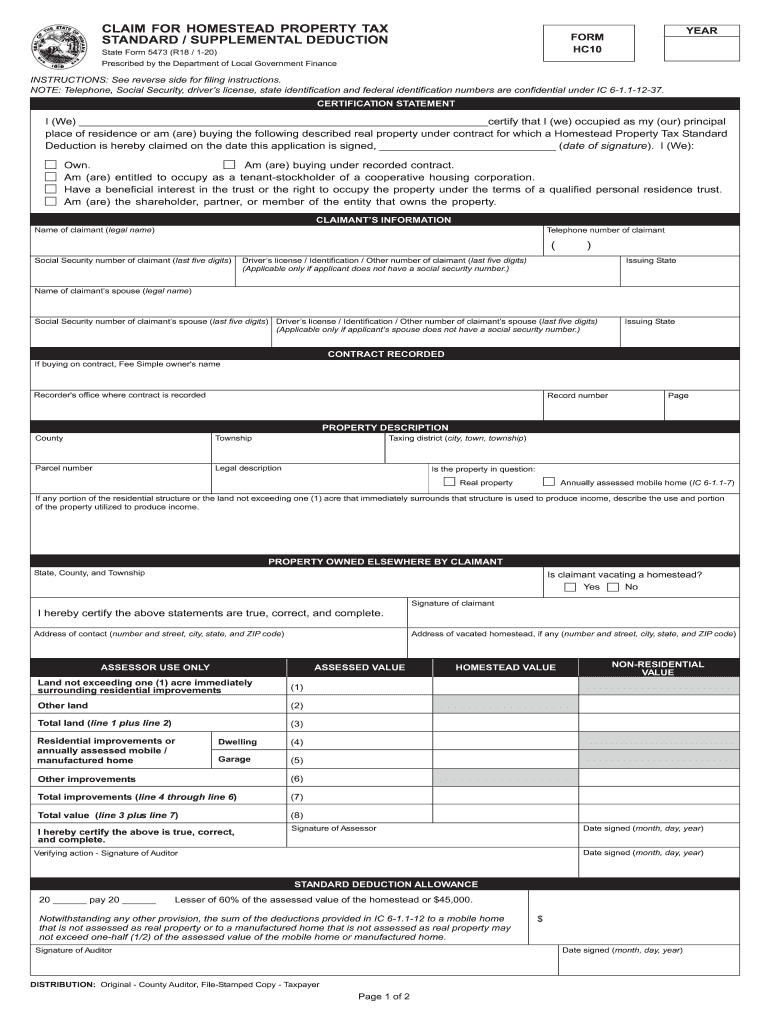

The Indiana homestead exemption form is a crucial document that allows homeowners in Indiana to apply for property tax deductions on their primary residence. This exemption can significantly reduce the taxable value of a home, resulting in lower property tax bills. The Indiana homestead exemption application is designed to provide financial relief to homeowners, making it an essential part of property tax management in the state. By completing this form, eligible homeowners can take advantage of the Indiana homestead deduction, which is part of the broader Indiana homestead act.

Eligibility Criteria for the Indiana Homestead Exemption

To qualify for the Indiana homestead exemption, applicants must meet specific criteria. The property must be the applicant's primary residence, and the homeowner must be an individual, not a business entity. Additionally, the applicant must have owned the property as of January 1 of the assessment year for which they are applying. There may also be income limitations and other requirements based on local regulations. Understanding these criteria is vital for homeowners seeking to apply for the homestead exemption in Indiana.

Steps to Complete the Indiana Homestead Exemption Form

Completing the Indiana homestead exemption form involves several key steps:

- Gather necessary documentation, including proof of ownership and residency.

- Obtain the Indiana homestead exemption application, also known as state form 5473.

- Fill out the form accurately, providing all required information, such as property details and personal identification.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate county assessor's office by the specified deadline.

Following these steps ensures that the application process is smooth and increases the likelihood of approval for the homestead exemption.

Form Submission Methods for the Indiana Homestead Exemption

Homeowners can submit the Indiana homestead exemption form through various methods. The most common submission methods include:

- Online submission through the county assessor's website, if available.

- Mailing the completed form to the local county assessor's office.

- In-person submission at the county assessor's office during business hours.

Each submission method has its own advantages, and homeowners should choose the one that best fits their needs and circumstances.

Required Documents for the Indiana Homestead Exemption Application

When applying for the Indiana homestead exemption, certain documents are typically required to support the application. These may include:

- Proof of ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Evidence of residency, such as utility bills or lease agreements.

Providing these documents helps verify eligibility and ensures a smoother application process.

Legal Use of the Indiana Homestead Exemption Form

The Indiana homestead exemption form is legally binding once completed and submitted according to state regulations. It is essential for homeowners to understand that submitting false information or failing to meet eligibility criteria may result in penalties, including the denial of the exemption or additional tax liabilities. Adhering to legal guidelines is crucial for maintaining compliance with Indiana property tax laws.

Quick guide on how to complete dlgf deduction forms

Complete DLGF Deduction Forms effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage DLGF Deduction Forms on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and eSign DLGF Deduction Forms without hassle

- Obtain DLGF Deduction Forms and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or hide sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign DLGF Deduction Forms to ensure effective communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dlgf deduction forms

Create this form in 5 minutes!

How to create an eSignature for the dlgf deduction forms

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Indiana homestead exemption form?

The Indiana homestead exemption form is a legal document that homeowners use to qualify for property tax exemptions on their primary residence. By filing this form, homeowners can potentially reduce their property tax burden and benefit from various tax breaks available under Indiana law.

-

How can I obtain the Indiana homestead exemption form?

You can easily obtain the Indiana homestead exemption form through your local county assessor's office or the official Indiana state website. It’s available online for download, making it convenient for homeowners to access and complete the necessary paperwork.

-

What are the eligibility requirements for the Indiana homestead exemption form?

To qualify for the Indiana homestead exemption form, you must own and occupy the property as your primary residence. Additionally, you must meet specific criteria regarding age, income, and disability status, which may vary by county.

-

Is there a fee to file the Indiana homestead exemption form?

There is no fee to file the Indiana homestead exemption form in Indiana. It’s a straightforward process designed to assist homeowners in reducing their property taxes, ensuring that the filing is accessible and cost-effective for all eligible applicants.

-

How often do I need to submit the Indiana homestead exemption form?

Once you have successfully filed the Indiana homestead exemption form and qualified, you typically do not need to resubmit it annually. However, you should notify your local assessor’s office if there are any changes to your ownership status or residency.

-

What happens if I miss the deadline to file the Indiana homestead exemption form?

If you miss the deadline to file the Indiana homestead exemption form, you may forfeit your eligibility for tax exemptions for that year. It’s crucial to stay informed about filing deadlines to ensure you can take advantage of the potential tax savings.

-

Can I file the Indiana homestead exemption form online?

Yes, many counties in Indiana allow homeowners to file the Indiana homestead exemption form online through their official portals. This online option streamlines the process, making it more convenient and efficient for applicants.

Get more for DLGF Deduction Forms

Find out other DLGF Deduction Forms

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document