K 4 Fillable Form 2018-2026

What is the K-4 Fillable Form

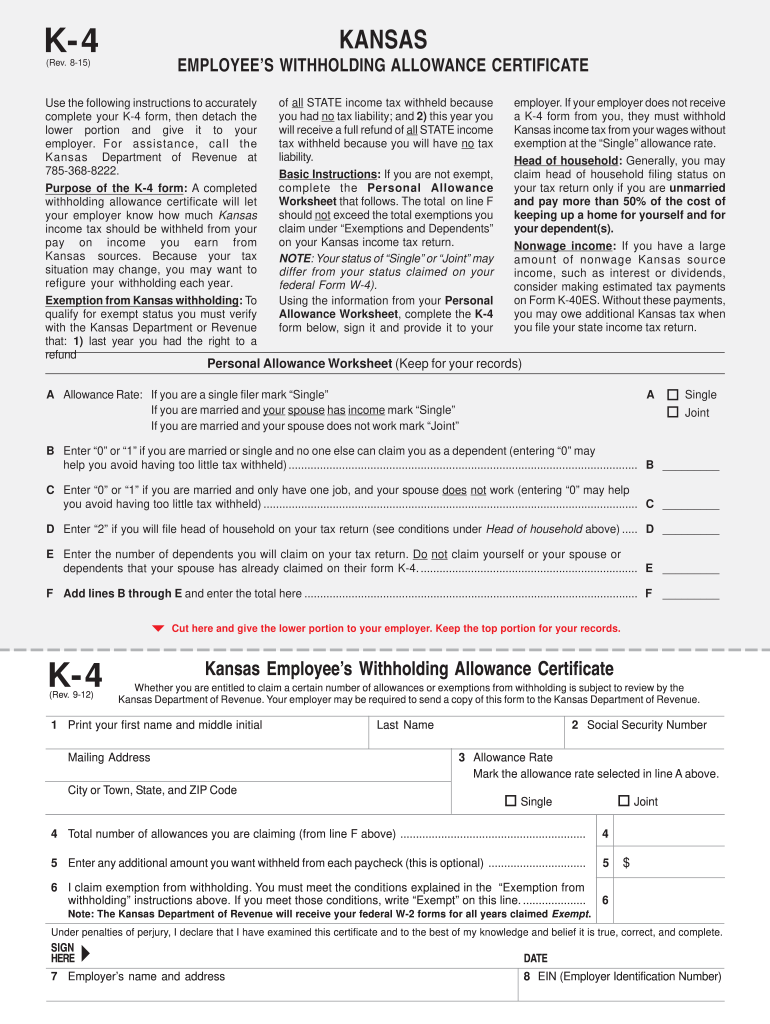

The K-4 fillable form is a Kansas withholding tax form used by employees to indicate their withholding preferences for state income tax. This form is essential for both employees and employers, as it determines the amount of state tax that will be withheld from an employee's paycheck. By completing the K-4 form, employees can ensure that their withholding aligns with their financial situation, potentially avoiding underpayment or overpayment of taxes.

How to Use the K-4 Fillable Form

Using the K-4 fillable form is straightforward. Employees can download the form from the Kansas Department of Revenue website or access it through various tax software platforms. Once downloaded, the form can be filled out electronically or printed for manual completion. It is important to provide accurate information regarding personal details, filing status, and any allowances claimed to ensure correct withholding amounts.

Steps to Complete the K-4 Fillable Form

Completing the K-4 fillable form involves several key steps:

- Download the Form: Obtain the K-4 form from the Kansas Department of Revenue website.

- Fill in Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Select Filing Status: Indicate your filing status, such as single, married, or head of household.

- Claim Allowances: Determine and enter the number of allowances you wish to claim based on your tax situation.

- Sign and Date: Ensure you sign and date the form before submission to validate it.

Legal Use of the K-4 Fillable Form

The K-4 fillable form is legally binding once completed and submitted to your employer. It must comply with Kansas state laws regarding tax withholding. Employers are required to maintain the completed forms for their records and use them to calculate state tax withholdings accurately. Failure to submit a K-4 form may result in the employer withholding taxes at the highest rate, which could lead to over-withholding for the employee.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the K-4 fillable form to avoid penalties. Typically, employees should submit their K-4 forms to their employers at the start of their employment or whenever there is a change in their withholding preferences. Employers must process these forms promptly to ensure accurate withholding on the next payroll. Additionally, employees should review their K-4 forms annually or when significant life changes occur, such as marriage or the birth of a child.

Form Submission Methods

The K-4 fillable form can be submitted to employers through various methods:

- Online Submission: Many employers allow employees to submit the K-4 form electronically through their payroll systems.

- Mail: Employees can print the completed form and mail it directly to their employer's payroll department.

- In-Person: Delivering the form in person can ensure immediate processing and confirmation of receipt.

Quick guide on how to complete k 4 fillable form 2007

Easily prepare K 4 Fillable Form on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage K 4 Fillable Form on any device using airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to modify and eSign K 4 Fillable Form effortlessly

- Find K 4 Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign K 4 Fillable Form and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 4 fillable form 2007

Create this form in 5 minutes!

How to create an eSignature for the k 4 fillable form 2007

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a K4 form and why do I need it?

A K4 form is a tax document used in various states to determine the withholding amount for state income taxes. Utilizing the K4 form can help you ensure accurate tax withholding throughout the year, preventing underpayment or overpayment. airSlate SignNow simplifies the process of filling out and eSigning your K4 form, making your tax preparations easier.

-

How does airSlate SignNow help with K4 form management?

airSlate SignNow allows you to create, send, and eSign your K4 form quickly and efficiently. The platform offers easy-to-use templates and secure storage for all your documents, so you can manage your K4 forms from anywhere. This streamlines your workflow and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for K4 forms?

With airSlate SignNow, you get features like customizable templates, real-time tracking, and secure electronic signatures for your K4 form. These tools help you avoid delays and keep all your documents organized in one place. Additionally, you can integrate with other applications to further enhance your document management.

-

Is airSlate SignNow cost-effective for managing K4 forms?

Yes, airSlate SignNow offers a range of pricing plans that cater to different budgets, making it a cost-effective solution for managing K4 forms. You can choose a plan that fits your business needs, allowing you to pay only for what you use. This financial flexibility ensures that you get the best value for managing your tax documents.

-

Can I integrate airSlate SignNow with other software for K4 forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your K4 form alongside other workflows. This capability enhances productivity by connecting your document management with your existing systems, such as CRM and accounting software.

-

What are the benefits of using airSlate SignNow for K4 forms?

Using airSlate SignNow for your K4 form offers numerous benefits, including faster processing, increased accuracy, and enhanced security. The platform enables you to track your forms in real-time and store them securely. These features help eliminate paperwork hassles and ensure you meet tax filing deadlines.

-

How secure is airSlate SignNow when handling my K4 form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance protocols to protect your K4 form and other sensitive documents. You can rest assured that your personal and financial information remains safeguarded throughout the entire eSigning process.

Get more for K 4 Fillable Form

Find out other K 4 Fillable Form

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed