Ky Inheritance Tax Form 2016

What is the Ky Inheritance Tax Form

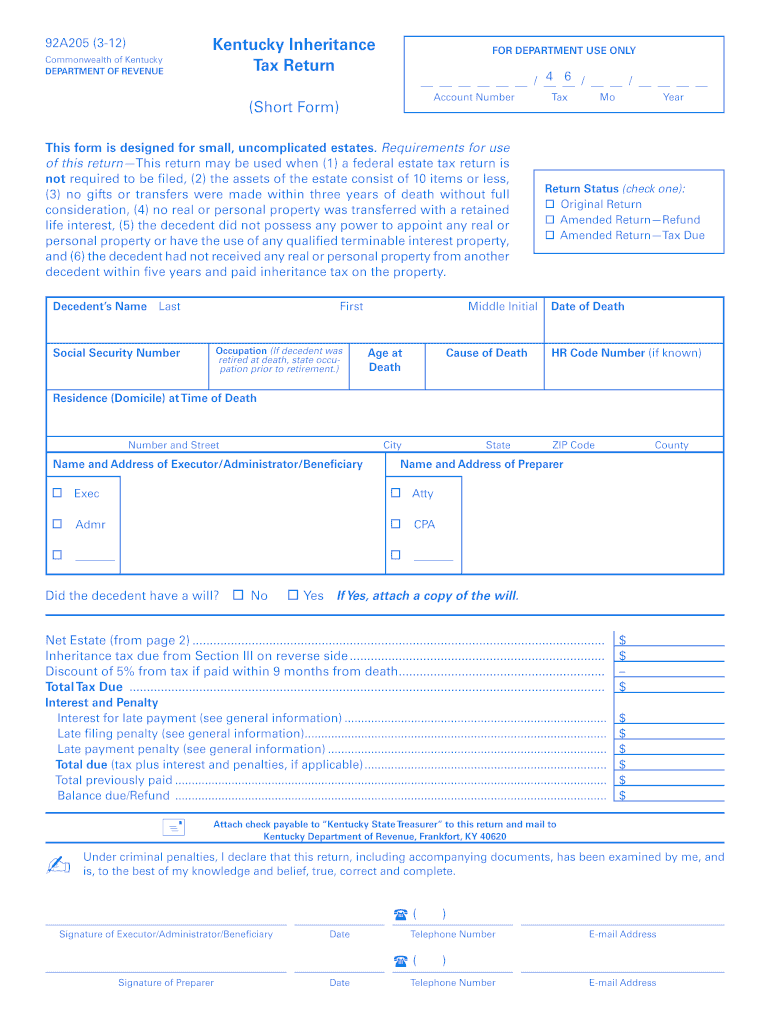

The Ky Inheritance Tax Form is a legal document required in the state of Kentucky for reporting and calculating inheritance taxes owed on the transfer of assets from a deceased individual to their beneficiaries. This form is essential for ensuring compliance with state tax laws and must be filed by the executor or administrator of the estate. The form captures details about the deceased's estate, including the value of assets and the identities of beneficiaries, which are crucial for determining the tax obligations.

How to use the Ky Inheritance Tax Form

Using the Ky Inheritance Tax Form involves several key steps. First, gather all necessary documentation related to the deceased's estate, including asset valuations and beneficiary information. Next, accurately fill out the form, ensuring that all required sections are completed. It is important to double-check the information for accuracy before submission. Once completed, the form must be submitted to the appropriate state authority, along with any required payments for the inheritance tax.

Steps to complete the Ky Inheritance Tax Form

Completing the Ky Inheritance Tax Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including bank statements, property deeds, and appraisals.

- List all assets and their estimated values on the form.

- Identify all beneficiaries and their relationship to the deceased.

- Calculate the total inheritance tax due based on the values reported.

- Review the form for completeness and accuracy.

- Submit the form to the Kentucky Department of Revenue along with any payment due.

Required Documents

To successfully complete the Ky Inheritance Tax Form, certain documents are required. These include:

- A death certificate of the deceased.

- Proof of asset valuations, such as appraisals or bank statements.

- Documentation of any debts or liabilities owed by the estate.

- Information regarding beneficiaries, including their names and addresses.

Filing Deadlines / Important Dates

Filing the Ky Inheritance Tax Form is subject to specific deadlines. The form must be submitted within a certain period following the death of the individual, typically within nine months. It is essential to be aware of these deadlines to avoid penalties or interest charges on unpaid taxes. Additionally, any payments due should be made in accordance with the state’s payment schedule to ensure compliance.

Penalties for Non-Compliance

Failure to file the Ky Inheritance Tax Form or pay the associated taxes can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against the estate. It is crucial for executors and administrators to adhere to the filing requirements and deadlines to avoid these consequences and ensure the estate is settled appropriately.

Quick guide on how to complete ky inheritance tax 2012 form

Effortlessly prepare Ky Inheritance Tax Form on any device

The management of online documents has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Ky Inheritance Tax Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

The simplest method to alter and eSign Ky Inheritance Tax Form effortlessly

- Find Ky Inheritance Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or blackout sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Thoroughly review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Ky Inheritance Tax Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ky inheritance tax 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ky inheritance tax 2012 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ky Inheritance Tax Form and why is it important?

The Ky Inheritance Tax Form is a document required by the state of Kentucky to report and calculate inheritance taxes owed on an estate. This form is crucial for ensuring compliance with state tax laws and can help beneficiaries understand their tax obligations.

-

How can airSlate SignNow help in completing the Ky Inheritance Tax Form?

airSlate SignNow simplifies the process of completing the Ky Inheritance Tax Form by providing a user-friendly interface for document preparation and electronic signatures. This streamlines the workflow, ensuring that all necessary information is collected accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Ky Inheritance Tax Form?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs. Our plans are competitive and provide excellent value for users looking to efficiently manage the Ky Inheritance Tax Form without sacrificing quality or support.

-

What features does airSlate SignNow offer for the Ky Inheritance Tax Form?

airSlate SignNow offers multiple features, including customizable templates, electronic signatures, and secure cloud storage. These tools enable users to efficiently complete and manage the Ky Inheritance Tax Form while ensuring the confidentiality and integrity of sensitive information.

-

Can I integrate airSlate SignNow with other software for the Ky Inheritance Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various CRM systems, cloud storage services, and other applications. This allows users to easily manage their documents and workflows related to the Ky Inheritance Tax Form across different platforms.

-

How does airSlate SignNow ensure the security of the Ky Inheritance Tax Form?

airSlate SignNow prioritizes security by implementing advanced encryption methods and strict access controls. This ensures that all data related to the Ky Inheritance Tax Form is protected from unauthorized access and bsignNowes.

-

Is the Ky Inheritance Tax Form easy to complete using airSlate SignNow?

Yes, one of the main benefits of using airSlate SignNow is the ease of completing the Ky Inheritance Tax Form. The intuitive interface guides users through each step of the process, making it accessible for everyone, regardless of their technical skills.

Get more for Ky Inheritance Tax Form

Find out other Ky Inheritance Tax Form

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile