St 125 Form 2018-2026

What is the St 125 Form

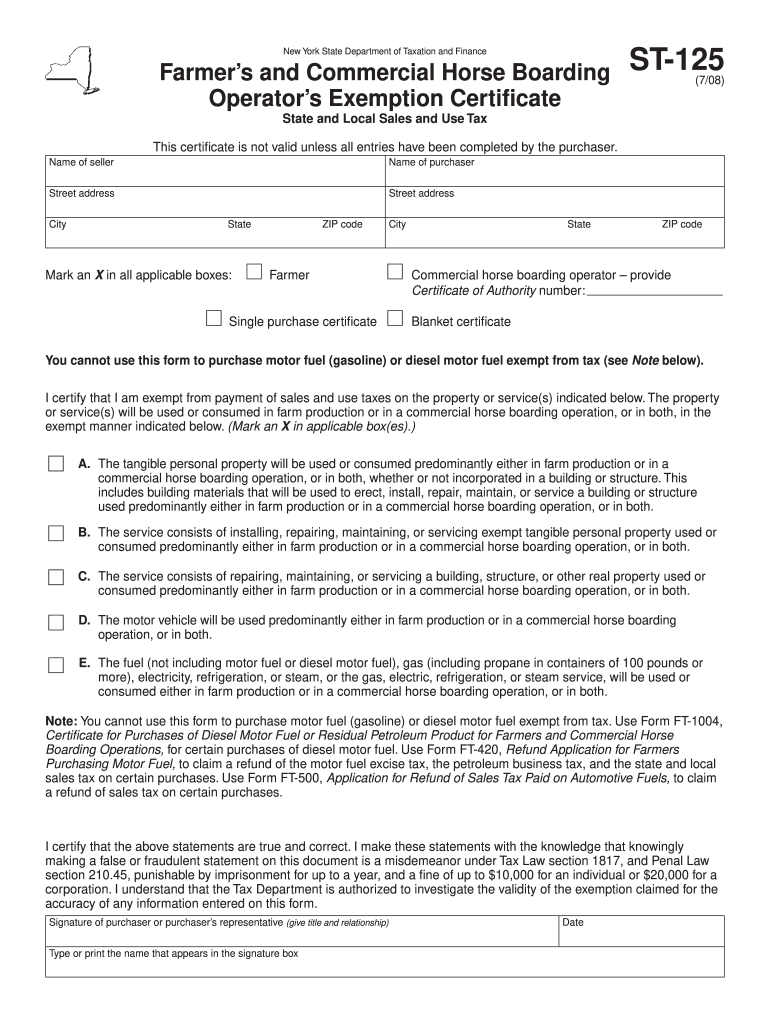

The St 125 form, also known as the NYS Farmers Tax Exempt Form, is a document utilized by farmers in New York State to claim exemption from sales tax on certain purchases related to agricultural production. This form is essential for farmers who wish to obtain tax relief on items such as equipment, supplies, and other materials necessary for their farming operations. By completing the St 125 form, eligible farmers can ensure that they are not charged sales tax on qualifying purchases, thereby reducing their overall operational costs.

How to use the St 125 Form

Using the St 125 form involves a straightforward process. Farmers must first determine their eligibility for tax exemption based on their agricultural activities. Once eligibility is confirmed, the form can be filled out with the necessary information, including the farmer's name, address, and details about the purchases for which the exemption is being claimed. After completing the form, it should be presented to the vendor at the time of purchase to avoid sales tax charges. It is important to keep a copy of the completed form for record-keeping purposes.

Steps to complete the St 125 Form

Completing the St 125 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including your farm's identification details and the specific items for which you are claiming exemption.

- Fill in your name, address, and any relevant identification numbers on the form.

- Clearly list the items being purchased and their intended use in agricultural production.

- Review the completed form for accuracy before submission.

- Provide the form to the vendor when making a purchase to claim the tax exemption.

Legal use of the St 125 Form

The St 125 form is legally recognized under New York State tax law, allowing farmers to claim exemptions from sales tax on qualifying purchases. To ensure compliance, it is crucial that the form is used correctly and only for eligible items related to agricultural production. Misuse of the form or claiming exemptions for ineligible purchases can lead to penalties or legal repercussions. Farmers should familiarize themselves with the specific regulations governing the use of the St 125 form to maintain compliance with state laws.

Key elements of the St 125 Form

Several key elements are essential for the St 125 form to be valid and effective:

- Farmer's Information: Accurate identification of the farmer, including name and address.

- Purchase Details: A clear description of the items being purchased and their intended agricultural use.

- Signature: The farmer's signature certifying that the information provided is true and that the items will be used for exempt purposes.

- Vendor Information: Details of the vendor to whom the form is presented, ensuring proper documentation of the transaction.

Who Issues the St 125 Form

The St 125 form is issued by the New York State Department of Taxation and Finance. This state agency oversees the administration of tax laws and regulations, including those related to sales tax exemptions for agricultural purchases. Farmers can obtain the form directly from the department's website or through authorized tax professionals. It is important to use the most current version of the form to ensure compliance with any updates to tax regulations.

Quick guide on how to complete st 125 2008 form

Accomplish St 125 Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without interruptions. Manage St 125 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign St 125 Form effortlessly

- Obtain St 125 Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign St 125 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 125 2008 form

Create this form in 5 minutes!

How to create an eSignature for the st 125 2008 form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the ST125 form, and why is it important?

The ST125 form is a crucial document used for sales tax exemption in certain transactions. By utilizing the ST125 form, businesses can ensure compliance with tax regulations when making exempt purchases. Understanding its importance can help streamline your financial processes and maintain accurate records.

-

How can airSlate SignNow assist with the ST125 form?

airSlate SignNow simplifies the process of filling out and eSigning the ST125 form, providing an efficient and user-friendly platform. With our solution, you can easily send the form to relevant parties for signature from anywhere, enhancing your document management workflow. Experience hassle-free administration of your ST125 forms today.

-

Is airSlate SignNow cost-effective for managing ST125 forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective choice for managing ST125 forms. By reducing the time spent on paperwork and improving efficiency, our solution can save your business money in the long run. Explore our plans to find one that suits your budget.

-

Are there features within airSlate SignNow tailored for the ST125 form?

Absolutely! airSlate SignNow includes features such as customizable templates and the ability to integrate with other software, making the management of the ST125 form seamless. Additionally, electronic signatures and real-time tracking ensure that you have full control and visibility of your documents throughout the signing process.

-

Can I store my ST125 forms securely with airSlate SignNow?

Yes, airSlate SignNow provides a secure platform for storing your ST125 forms and other documents. With industry-standard encryption and compliance with regulations, you can rest assured that sensitive information is protected. Our platform offers easy access to your stored documents at any time.

-

What integrations does airSlate SignNow offer for handling ST125 forms?

airSlate SignNow integrates with a variety of popular applications, enhancing your ability to manage ST125 forms seamlessly. Whether it’s CRM systems, cloud storage, or productivity tools, we ensure that your workflows are optimized. These integrations streamline the process, making it easier for you to handle tax exemption documents.

-

How can I ensure that my ST125 forms are compliant with state regulations?

To ensure compliance with state regulations when using the ST125 form, it's essential to stay updated with your state's tax laws. airSlate SignNow simplifies this by providing templates that meet compliance requirements and offering customer support for any inquiries. By using our platform, you can confidently manage your ST125 forms without the risk of non-compliance.

Get more for St 125 Form

- Block party permit kansas city form

- Mitsubishi galant owners manual form

- Iso 4063 pdf download form

- Spelling pretest template form

- Krauss maffei injection molding machine manual pdf form

- Irrevocable power of attorney pdf form

- Form for super fund members capital gains tax cap election

- Distributor registration form sunbird perfume

Find out other St 125 Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT