Form for Super Fund Members Capital Gains Tax Cap Election 2022-2026

What is the Form for Super Fund Members Capital Gains Tax Cap Election

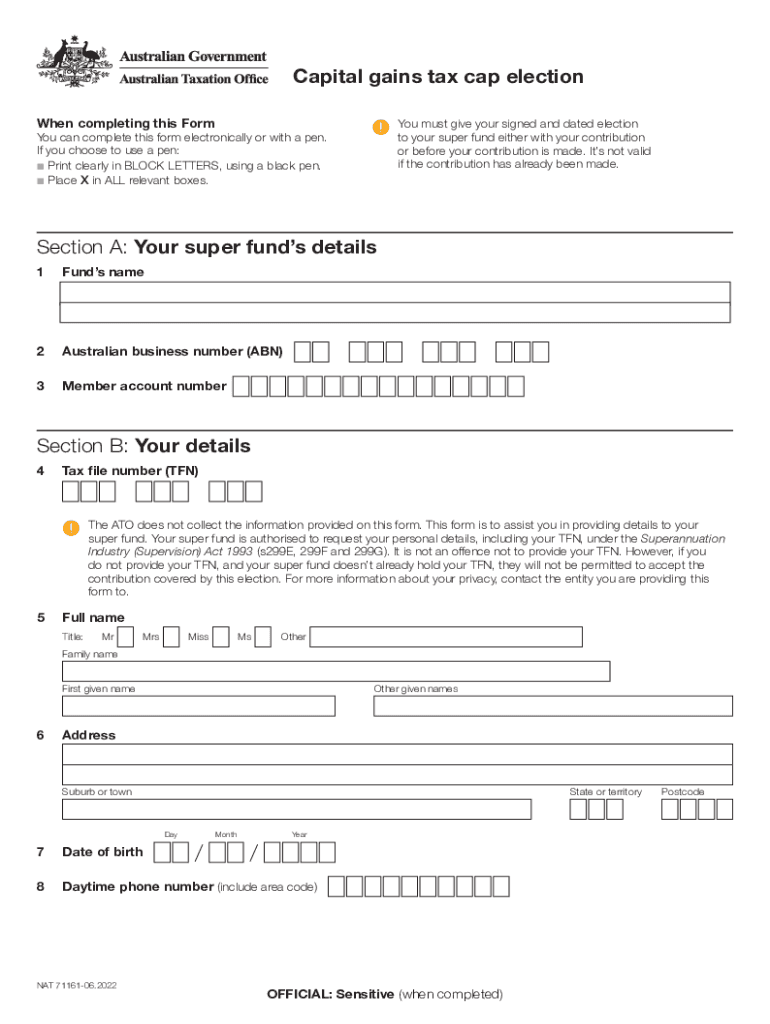

The Form for Super Fund Members Capital Gains Tax Cap Election is a crucial document that allows superannuation fund members in Australia to elect for a capital gains tax cap. This election is significant for those who wish to manage their tax liabilities effectively when withdrawing funds from their superannuation accounts. By completing this form, members can potentially reduce the amount of capital gains tax they owe on their superannuation benefits, making it a valuable tool for financial planning.

How to Use the Form for Super Fund Members Capital Gains Tax Cap Election

Using the Form for Super Fund Members Capital Gains Tax Cap Election involves several straightforward steps. First, ensure you have the correct version of the form, typically available through the Australian Taxation Office (ATO) or your superannuation fund. Next, fill out the required sections, including personal details and the specific election you are making regarding your capital gains tax cap. After completing the form, submit it according to the instructions provided, either online or via mail, depending on your fund's requirements.

Steps to Complete the Form for Super Fund Members Capital Gains Tax Cap Election

Completing the Form for Super Fund Members Capital Gains Tax Cap Election requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the ATO or your super fund.

- Fill in your personal details accurately, including your name, address, and tax file number.

- Indicate your election choice for the capital gains tax cap.

- Review your entries for accuracy and completeness.

- Submit the form as per the guidelines provided by your superannuation fund.

Key Elements of the Form for Super Fund Members Capital Gains Tax Cap Election

The key elements of the Form for Super Fund Members Capital Gains Tax Cap Election include personal identification information, the election statement regarding capital gains tax, and any relevant financial details that support your election. It is essential to provide accurate information to avoid delays or complications in processing your election.

Eligibility Criteria

To use the Form for Super Fund Members Capital Gains Tax Cap Election, individuals must meet specific eligibility criteria. Generally, you must be a member of a superannuation fund and have capital gains that you wish to manage through the election. Additionally, you should ensure that your super fund is compliant with the relevant tax laws and regulations.

Form Submission Methods

Submitting the Form for Super Fund Members Capital Gains Tax Cap Election can typically be done through various methods. Most superannuation funds allow for online submissions via their member portals. Alternatively, you may choose to mail the completed form to your fund or submit it in person at their office, depending on their specific submission guidelines.

Quick guide on how to complete form for super fund members capital gains tax cap election

Effortlessly complete Form For Super Fund Members Capital Gains Tax Cap Election on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form For Super Fund Members Capital Gains Tax Cap Election on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Form For Super Fund Members Capital Gains Tax Cap Election with ease

- Locate Form For Super Fund Members Capital Gains Tax Cap Election and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Update and eSign Form For Super Fund Members Capital Gains Tax Cap Election and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form for super fund members capital gains tax cap election

Create this form in 5 minutes!

How to create an eSignature for the form for super fund members capital gains tax cap election

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of understanding Australia capital gains tax when using airSlate SignNow?

Understanding Australia capital gains tax is crucial for businesses that engage in transactions involving assets. airSlate SignNow helps streamline the documentation process, ensuring that all necessary forms related to capital gains tax are signed and stored securely. This can save time and reduce errors in tax reporting.

-

How can airSlate SignNow assist with documents related to Australia capital gains tax?

airSlate SignNow provides a platform for businesses to create, send, and eSign documents that may be required for reporting Australia capital gains tax. By using our solution, you can ensure that all relevant documents are completed accurately and efficiently, minimizing the risk of compliance issues.

-

What features does airSlate SignNow offer that are beneficial for managing Australia capital gains tax documentation?

Our platform offers features such as customizable templates, secure eSigning, and automated workflows that are particularly beneficial for managing Australia capital gains tax documentation. These features help ensure that all necessary forms are completed and signed in a timely manner, facilitating smoother tax processes.

-

Is airSlate SignNow cost-effective for businesses dealing with Australia capital gains tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing the time spent on paperwork and ensuring compliance with Australia capital gains tax regulations, our platform can help save money in the long run.

-

Can airSlate SignNow integrate with accounting software for Australia capital gains tax?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, making it easier to manage documents related to Australia capital gains tax. This integration allows for seamless data transfer and ensures that all financial records are up-to-date and compliant.

-

What are the benefits of using airSlate SignNow for Australia capital gains tax documentation?

Using airSlate SignNow for Australia capital gains tax documentation offers numerous benefits, including enhanced efficiency, improved accuracy, and secure storage of important documents. Our platform simplifies the signing process, allowing businesses to focus on their core operations while ensuring compliance with tax regulations.

-

How does airSlate SignNow ensure the security of documents related to Australia capital gains tax?

airSlate SignNow prioritizes the security of your documents, especially those related to Australia capital gains tax. We utilize advanced encryption and secure cloud storage to protect sensitive information, ensuring that your documents are safe from unauthorized access.

Get more for Form For Super Fund Members Capital Gains Tax Cap Election

- Employer business name form

- Weiss functional impairment rating scale 221318982 form

- Lenawee county holstein association scholarship form

- Care ministry handbook form

- 1199 job application form 512650120

- Home instead application form

- Travelers change of beneficiary form

- Match the illustration with the part of the cell cycle form

Find out other Form For Super Fund Members Capital Gains Tax Cap Election

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF