Et 30 Form 2020

What is the Et 30 Form

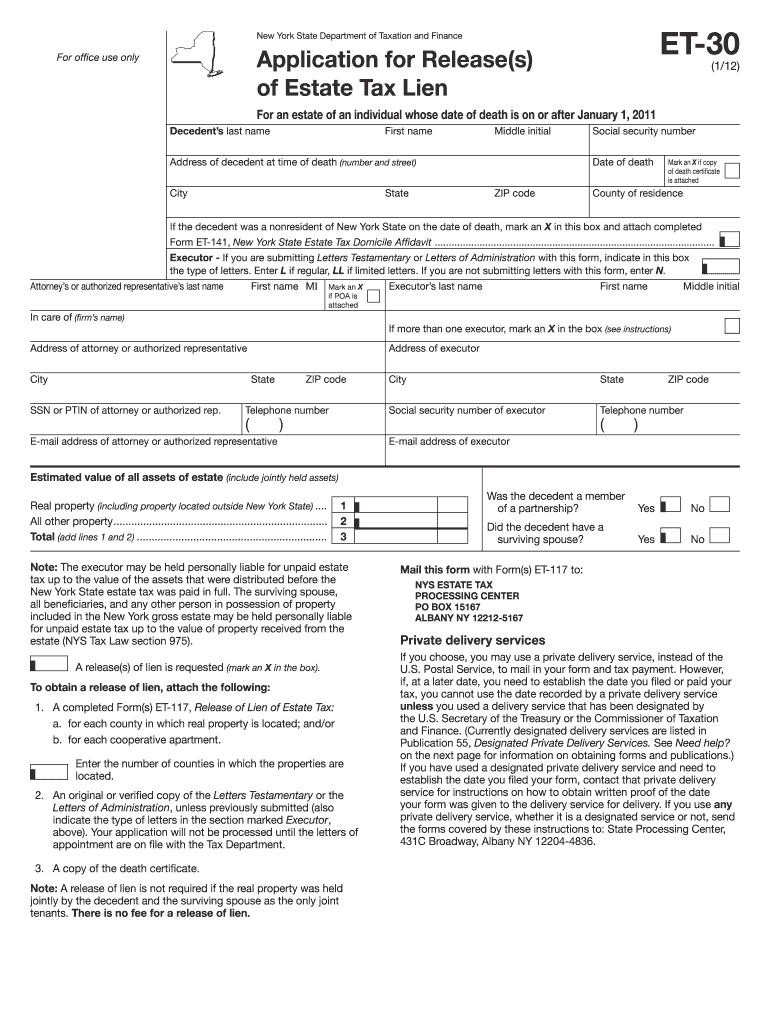

The Et 30 Form is a specific tax document used primarily in the United States for reporting various financial activities. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form collects information regarding income, deductions, and other relevant financial details that may impact tax obligations. Understanding the purpose and requirements of the Et 30 Form is crucial for effective tax management.

How to use the Et 30 Form

Using the Et 30 Form involves several steps to ensure accurate reporting of financial information. First, gather all necessary documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is complete and accurate. It is advisable to follow the instructions provided with the form closely to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to complete the Et 30 Form

Completing the Et 30 Form requires a systematic approach. Begin by reviewing the instructions accompanying the form to understand the required fields. Then, proceed with the following steps:

- Enter personal information, including name, address, and Social Security number.

- Report all sources of income, ensuring that you include all relevant financial details.

- List any deductions or credits you are eligible for, providing necessary documentation as required.

- Review the entire form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Et 30 Form

The Et 30 Form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies could lead to legal repercussions, including fines or audits. The form must be filed by the designated deadlines to maintain compliance with tax laws. Understanding the legal implications of submitting the Et 30 Form helps individuals and businesses avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Et 30 Form are critical to ensuring compliance with tax regulations. Typically, the form must be submitted by April 15 for individual taxpayers, but specific deadlines may vary based on the taxpayer's situation or any extensions granted. It is important to stay informed about any changes to these dates, as late submissions can result in penalties or interest charges. Keeping a calendar of important tax dates can help in managing timely submissions.

Required Documents

To complete the Et 30 Form accurately, several documents are necessary. These may include:

- Income statements, such as W-2s or 1099s, detailing earnings.

- Receipts for deductible expenses, which provide proof of expenditures.

- Records of any credits or deductions claimed in previous years.

- Any relevant tax documents that support your financial claims.

Having these documents ready will facilitate a smoother and more efficient completion of the Et 30 Form.

Examples of using the Et 30 Form

The Et 30 Form can be utilized in various scenarios. For instance, self-employed individuals may use it to report income from freelance work, ensuring they account for all earnings and applicable deductions. Additionally, small businesses may file the form to report revenue and expenses, helping them maintain compliance with tax regulations. Understanding these examples can provide clarity on how the Et 30 Form applies to different financial situations.

Quick guide on how to complete et 30 2012 form

Complete Et 30 Form effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Et 30 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Et 30 Form without hassle

- Locate Et 30 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Edit and eSign Et 30 Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 30 2012 form

Create this form in 5 minutes!

How to create an eSignature for the et 30 2012 form

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Et 30 Form and how can airSlate SignNow help with it?

The Et 30 Form is a tax document that can be electronically signed and submitted. With airSlate SignNow, businesses can easily manage the Et 30 Form process, allowing for quick eSigning, secure storage, and streamlined workflows. This ensures compliance and enhances efficiency in document handling.

-

How much does it cost to use airSlate SignNow for handling the Et 30 Form?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Whether you're a solo entrepreneur or a larger organization, you'll find a plan that fits your budget while providing the necessary tools to manage the Et 30 Form effectively. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for the Et 30 Form?

airSlate SignNow provides a user-friendly interface, templates for the Et 30 Form, and a signature automation feature. These tools simplify the process of filling out and signing your forms, ensuring accuracy and speed in your document workflows. Plus, mobile access means you can work anytime, anywhere.

-

Can I integrate airSlate SignNow with other applications for the Et 30 Form?

Yes, airSlate SignNow supports integrations with various applications such as CRM systems, cloud storage, and productivity tools. This allows you to seamlessly incorporate the Et 30 Form into your existing workflows, maximizing efficiency and reducing manual data entry.

-

What are the benefits of using airSlate SignNow for the Et 30 Form?

Using airSlate SignNow for the Et 30 Form streamlines the eSigning process, saving you time and reducing paperwork. It enhances security with encrypted signatures and offers compliance with legal standards, ensuring your documents are safe and valid. Moreover, the platform's automation features cut down on administrative tasks.

-

Is airSlate SignNow suitable for small businesses for the Et 30 Form?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it perfect for small businesses needing to manage the Et 30 Form efficiently. The platform supports scaling, so as your business grows, you can easily adjust your plans and features.

-

How secure is airSlate SignNow when handling the Et 30 Form?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and secure servers to protect your data while managing the Et 30 Form. Additionally, robust access controls and audit trails provide peace of mind regarding your document's integrity.

Get more for Et 30 Form

Find out other Et 30 Form

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free