Form FT 4004011109 Application for Reimbursement of NYS Tax Ny 2009

What is the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

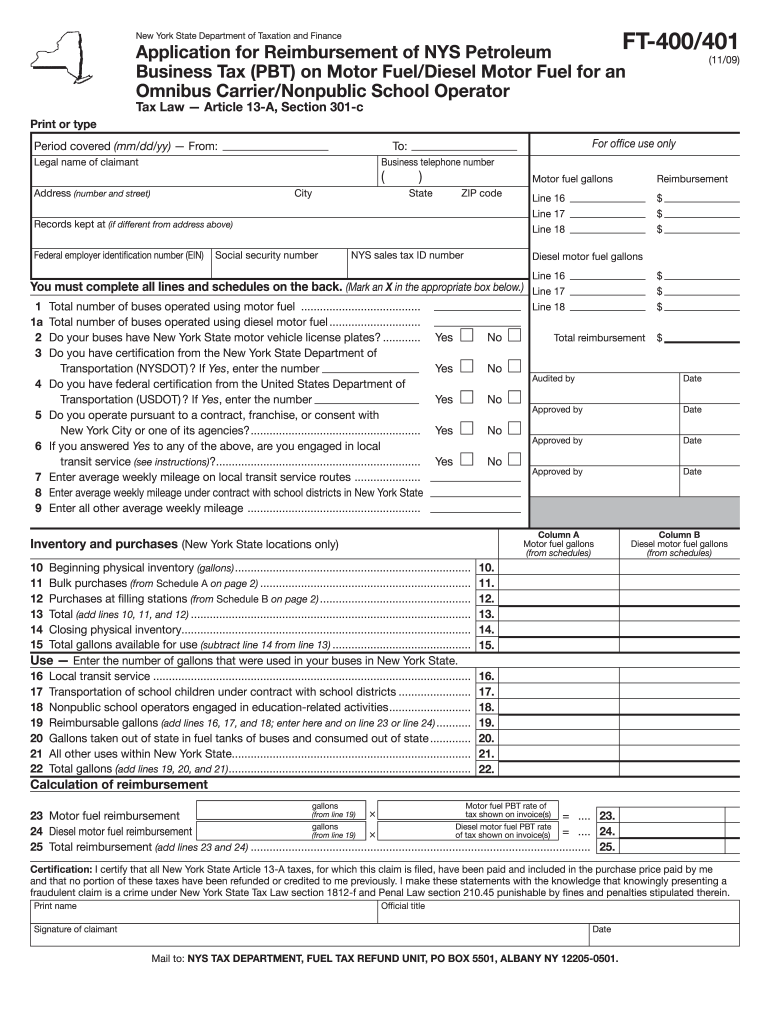

The Form FT 4004011109 is an official document used in New York State for taxpayers seeking reimbursement of certain state taxes. This form is specifically designed to facilitate the process of claiming refunds for overpaid taxes or taxes that were incorrectly assessed. Understanding the purpose of this form is crucial for ensuring that taxpayers can effectively recover funds that are rightfully theirs. The application requires detailed information about the taxpayer, the tax period in question, and the specific tax being claimed for reimbursement.

Steps to Complete the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

Completing the Form FT 4004011109 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including tax returns and any relevant correspondence from the New York State tax authority. Next, fill out the form with precise information, including your name, address, and taxpayer identification number. Be sure to specify the tax type and period for which you are seeking reimbursement. After completing the form, review it thoroughly for any errors or omissions before submitting it to the appropriate state agency.

Legal Use of the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

The Form FT 4004011109 is legally binding when completed and submitted according to New York State regulations. To ensure its legal validity, the form must be signed by the taxpayer or an authorized representative. Additionally, it is important to comply with any specific state laws regarding tax reimbursement claims. This includes adhering to deadlines for submission and providing accurate information to avoid penalties or delays in processing the reimbursement request.

Required Documents for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

To successfully complete the Form FT 4004011109, several supporting documents may be required. These typically include copies of previous tax returns, proof of payment for the taxes in question, and any notices received from the tax authority regarding the overpayment. Having these documents ready will not only facilitate the completion of the form but also strengthen your claim for reimbursement by providing necessary evidence to support your application.

Form Submission Methods for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

The Form FT 4004011109 can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include mailing the completed form to the designated state tax office, submitting it electronically through the New York State tax website, or delivering it in person to a local tax office. Each method has its own processing times and requirements, so it's advisable to choose the one that best suits your needs while ensuring compliance with state guidelines.

Eligibility Criteria for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

Eligibility for filing the Form FT 4004011109 is generally determined by the specific tax circumstances of the taxpayer. To qualify for reimbursement, individuals must have overpaid their taxes or have been subject to incorrect tax assessments. Additionally, the claim must be filed within the statutory time limits set by New York State law. Understanding these criteria is essential for taxpayers to ensure that they can successfully claim their due reimbursements without facing rejection.

Quick guide on how to complete form ft 4004011109 application for reimbursement of nys tax ny

Complete Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without issues. Handle Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny with ease

- Find Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to finalize your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ft 4004011109 application for reimbursement of nys tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ft 4004011109 application for reimbursement of nys tax ny

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

The Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny is a document required by New York State taxpayers to apply for tax reimbursements. It provides detailed information regarding your tax payments and eligibility for refunds. Properly filling out this form can streamline your reimbursement process.

-

How can airSlate SignNow assist with completing the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

airSlate SignNow offers an intuitive platform that allows users to eSign and send the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny seamlessly. With features like templates and document tracking, users can ensure their applications are filled out accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

airSlate SignNow provides flexible pricing plans that cater to various business needs, making it easy to manage documents, including the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny. You can choose from monthly or annual subscriptions, each tailored to fit different volume requirements and budgets.

-

Are there any integrations available with airSlate SignNow for handling the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

Yes, airSlate SignNow integrates seamlessly with popular applications and services, simplifying the workflow for managing the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny. These integrations allow users to enhance productivity by connecting their existing tools with SignNow's eSigning capabilities.

-

What features does airSlate SignNow offer for eSigning the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

airSlate SignNow provides robust features such as drag-and-drop document creation, digital signatures, and customizable workflows specifically for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny. These ease-of-use features help ensure that your application is completed efficiently and effectively.

-

Is it secure to use airSlate SignNow for the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny?

Absolutely! airSlate SignNow employs advanced security protocols to protect your sensitive information while processing the Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny. Your documents are stored securely, with encryption and compliance with relevant regulations, ensuring your data is safe.

-

Can I track the status of my Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny submissions using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny submissions. You'll receive real-time updates when documents are viewed and signed, providing you with visibility throughout the process.

Get more for Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

Find out other Form FT 4004011109 Application For Reimbursement Of NYS Tax Ny

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document