Form ET 706 September , New York State Estate FormSend 2019

What is the Form ET 706 September, New York State Estate FormSend

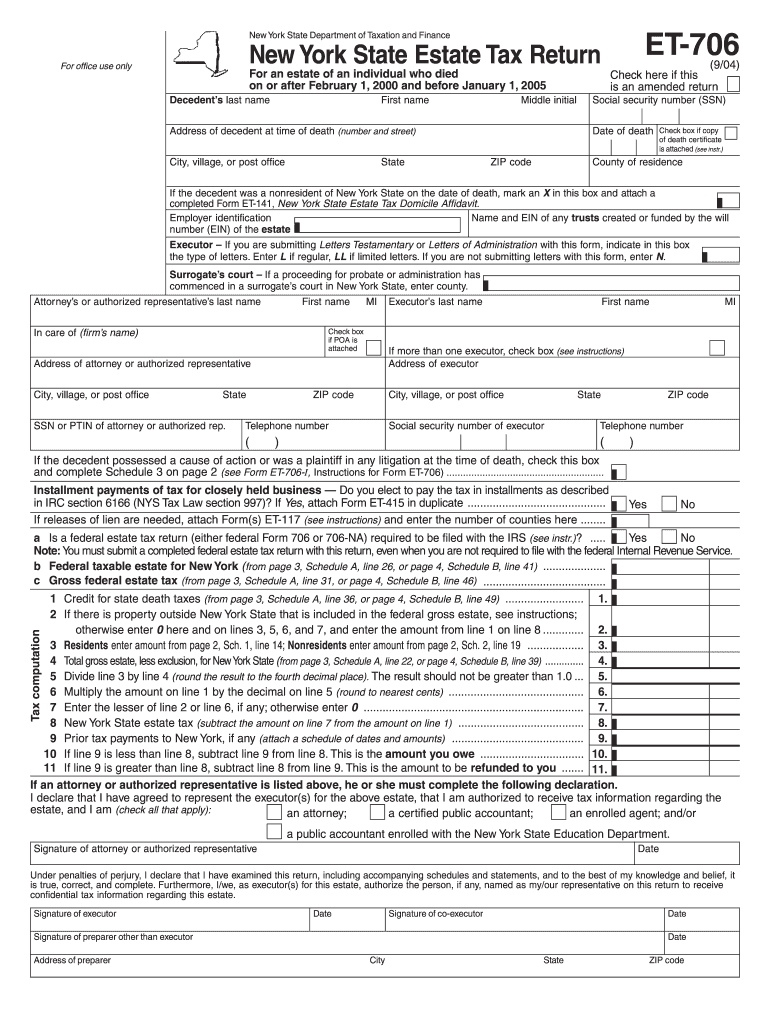

The Form ET 706, also known as the New York State Estate Tax Return, is a critical document required for reporting the estate tax liability of decedents who pass away on or after April 1, 2014. This form is essential for estates that exceed the New York State estate tax exemption limit. It provides a detailed account of the decedent's assets, liabilities, and deductions, ensuring compliance with state tax laws. The information collected through this form is used to calculate the estate tax owed to the state of New York, which is necessary for the proper settlement of the estate.

How to use the Form ET 706 September, New York State Estate FormSend

Using the Form ET 706 involves several key steps. First, gather all necessary documentation related to the decedent's assets and liabilities. This includes property deeds, bank statements, investment accounts, and any debts owed by the estate. Next, accurately complete the form by entering the required information in each section, ensuring that all values are correct and supported by documentation. Once the form is filled out, it must be signed by the executor or administrator of the estate. Finally, submit the completed form to the New York State Department of Taxation and Finance, either electronically or via mail, depending on the preferred submission method.

Steps to complete the Form ET 706 September, New York State Estate FormSend

Completing the Form ET 706 requires careful attention to detail. Here are the essential steps:

- Gather Documentation: Collect all relevant financial documents, including wills, trust documents, and asset valuations.

- Fill Out the Form: Start with the decedent's information, followed by a comprehensive listing of all assets and liabilities.

- Calculate Taxable Estate: Use the provided guidelines to determine the total taxable estate, accounting for any deductions.

- Review for Accuracy: Double-check all entries for accuracy and completeness.

- Sign and Date: Ensure the form is signed by the executor or administrator before submission.

- Submit the Form: Send the completed form to the appropriate state department, adhering to submission guidelines.

Legal use of the Form ET 706 September, New York State Estate FormSend

The legal use of the Form ET 706 is governed by New York State tax laws. It is a legally binding document that must be filed by the estate's executor or administrator to report the estate's value and calculate any taxes owed. Failure to file this form can result in penalties, including interest on unpaid taxes and potential legal action against the estate. Therefore, it is crucial to ensure that the form is completed accurately and submitted within the required timeframe to avoid legal complications.

Filing Deadlines / Important Dates

Timely filing of the Form ET 706 is essential to comply with New York State regulations. The form must be filed within nine months of the decedent's date of death. If additional time is needed, an extension request can be filed, but this does not extend the payment deadline for any taxes owed. It is advisable to mark important dates on a calendar to ensure all necessary actions are taken promptly, preventing any lapses in compliance.

Who Issues the Form

The Form ET 706 is issued by the New York State Department of Taxation and Finance. This department is responsible for the administration of state tax laws, including estate taxes. The form can be obtained directly from their official website or through their offices. It is important to ensure that the most current version of the form is used to comply with any updates in tax regulations.

Quick guide on how to complete form et 706 september 2004 new york state estate formsend

Accomplish Form ET 706 September , New York State Estate FormSend effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, adjust, and electronically sign your documents quickly without delays. Manage Form ET 706 September , New York State Estate FormSend on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form ET 706 September , New York State Estate FormSend with ease

- Locate Form ET 706 September , New York State Estate FormSend and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form ET 706 September , New York State Estate FormSend and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form et 706 september 2004 new york state estate formsend

Create this form in 5 minutes!

How to create an eSignature for the form et 706 september 2004 new york state estate formsend

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form ET 706 September, New York State Estate FormSend?

Form ET 706 September, New York State Estate FormSend is an essential document used for estate tax purposes in New York. It enables users to report the value of an estate and pay any applicable taxes. Utilizing airSlate SignNow, you can easily send and eSign this critical form, streamlining the entire process.

-

How does airSlate SignNow simplify the submission of Form ET 706 September?

airSlate SignNow simplifies the submission of Form ET 706 September, New York State Estate FormSend by providing an intuitive platform for eSigning and document management. Users can easily upload, edit, and send the form securely, ensuring compliance with New York state regulations. This efficiency saves time and reduces errors during the submission process.

-

What are the pricing options for using airSlate SignNow for Form ET 706 September?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users submitting Form ET 706 September, New York State Estate FormSend. Options range from individual plans for personal use to business plans that accommodate teams. Each plan provides comprehensive features to ensure your document handling is efficient and cost-effective.

-

Can I track the status of my Form ET 706 September after sending it with SignNow?

Yes, airSlate SignNow allows you to track the status of your Form ET 706 September, New York State Estate FormSend in real time. Once you send the form, you will receive notifications when it is viewed and signed by recipients, facilitating transparency and keeping all parties updated on the document's progress.

-

What features does airSlate SignNow offer for eSigning Form ET 706 September?

airSlate SignNow provides a variety of features specifically designed for eSigning Form ET 706 September, New York State Estate FormSend. Key features include document templates, secure cloud storage, and multi-party signing capabilities. These tools enhance the eSigning experience, making it quick and legally compliant.

-

Is airSlate SignNow compliant with legal standards for Form ET 706 September?

Absolutely! airSlate SignNow is compliant with legal standards for submitting and signing documents like Form ET 706 September, New York State Estate FormSend. The platform employs advanced security measures, including encryption and authentication, ensuring that all documents are legally binding and protected.

-

How can I integrate airSlate SignNow with other platforms for Form ET 706 September?

airSlate SignNow can be easily integrated with various third-party applications to enhance your workflow for Form ET 706 September, New York State Estate FormSend. Whether it’s CRM systems or cloud storage solutions, our platform’s robust API and integration capabilities streamline the document management process seamlessly across different platforms.

Get more for Form ET 706 September , New York State Estate FormSend

Find out other Form ET 706 September , New York State Estate FormSend

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF