Dtf 17 1210 Form 2018

What is the Dtf 17 1210 Form

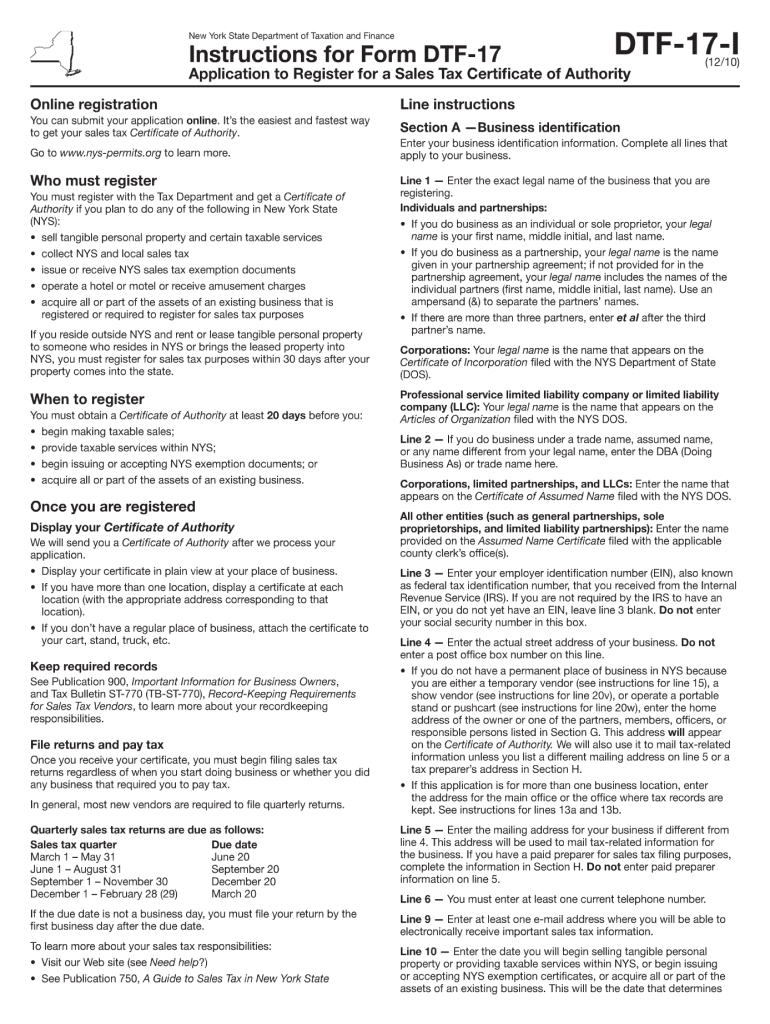

The Dtf 17 1210 Form is a tax-related document used in the state of New York. It is primarily utilized by individuals and businesses to report certain tax information to the New York State Department of Taxation and Finance. This form is essential for ensuring compliance with state tax regulations and for accurately reporting income and deductions. Understanding the purpose and requirements of the Dtf 17 1210 Form is crucial for taxpayers to avoid potential penalties and ensure proper filing.

How to use the Dtf 17 1210 Form

Using the Dtf 17 1210 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, ensuring all entries are accurate and complete. After filling out the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority by the designated deadline, either electronically or by mail.

Steps to complete the Dtf 17 1210 Form

Completing the Dtf 17 1210 Form involves a systematic approach:

- Gather necessary documents, such as W-2s, 1099s, and other income records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in personal information, including name, address, and Social Security number.

- Report income and any applicable deductions accurately.

- Double-check all entries for accuracy before finalizing the form.

- Submit the completed form by the deadline to avoid penalties.

Legal use of the Dtf 17 1210 Form

The legal use of the Dtf 17 1210 Form is crucial for compliance with New York state tax laws. This form must be filled out accurately to reflect true financial information. Failure to do so can lead to audits, fines, or other legal repercussions. It is essential to maintain records of submitted forms and any supporting documentation in case of future inquiries from tax authorities.

Who Issues the Form

The Dtf 17 1210 Form is issued by the New York State Department of Taxation and Finance. This governmental body is responsible for administering tax laws in New York and ensuring that taxpayers comply with state regulations. The department provides resources and guidance to help individuals and businesses understand their tax obligations and the proper use of tax forms.

Filing Deadlines / Important Dates

Filing deadlines for the Dtf 17 1210 Form vary depending on the tax year and the taxpayer's specific situation. Generally, individual taxpayers must submit their forms by April fifteenth of the following year. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about these dates to ensure timely submission and avoid late fees or penalties.

Quick guide on how to complete dtf 17 1210 2010 form

Manage Dtf 17 1210 Form effortlessly on any device

Digital document handling has gained traction among companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documentation, allowing you to acquire the necessary template and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents quickly and efficiently. Handle Dtf 17 1210 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Dtf 17 1210 Form with ease

- Obtain Dtf 17 1210 Form and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Dtf 17 1210 Form to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dtf 17 1210 2010 form

Create this form in 5 minutes!

How to create an eSignature for the dtf 17 1210 2010 form

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the Dtf 17 1210 Form?

The Dtf 17 1210 Form is a document used in certain states for tax-related purposes, specifically for up-to-date information regarding tax liabilities. Understanding how to complete and submit this form is crucial for compliance with state tax regulations. airSlate SignNow simplifies the process of signing and submitting the Dtf 17 1210 Form electronically.

-

How does airSlate SignNow help with the Dtf 17 1210 Form?

airSlate SignNow provides an easy-to-use platform for sending and electronically signing the Dtf 17 1210 Form. With features like templates and quick access to documents, your team can prepare and sign this form efficiently, saving time and reducing errors. Our solution streamlines the entire workflow for tax documentation.

-

Is there a cost associated with using airSlate SignNow for the Dtf 17 1210 Form?

Yes, airSlate SignNow offers a range of pricing plans to accommodate various business needs for handling documents like the Dtf 17 1210 Form. These plans are cost-effective and provide access to essential features that enhance document management. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing the Dtf 17 1210 Form?

airSlate SignNow includes features such as document templates, automatic reminders, and secure storage, all tailored to assist with the Dtf 17 1210 Form. The platform also allows for real-time collaboration and tracking, ensuring that all stakeholders can stay updated on the document's status. This makes completing and filing the form much more efficient.

-

Can I integrate airSlate SignNow with other applications for the Dtf 17 1210 Form?

Absolutely! airSlate SignNow supports various integrations with popular applications that can help streamline the submission of the Dtf 17 1210 Form. Whether you're using CRM systems, project management tools, or cloud storage services, you're likely to find a compatible integration. This enhances your workflow and keeps all your documents organized.

-

How secure is the airSlate SignNow platform for handling the Dtf 17 1210 Form?

Security is a top priority for airSlate SignNow. The platform employs strict encryption protocols and complies with industry standards to ensure that your Dtf 17 1210 Form and other documents are safe from unauthorized access. You can trust that your sensitive tax information is protected while using our services.

-

Can I track the status of my Dtf 17 1210 Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Dtf 17 1210 Form in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you remain in control of your documentation process. This visibility helps you manage deadlines effectively.

Get more for Dtf 17 1210 Form

Find out other Dtf 17 1210 Form

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document