Nys Amended Form 2018

What is the Nys Amended Form

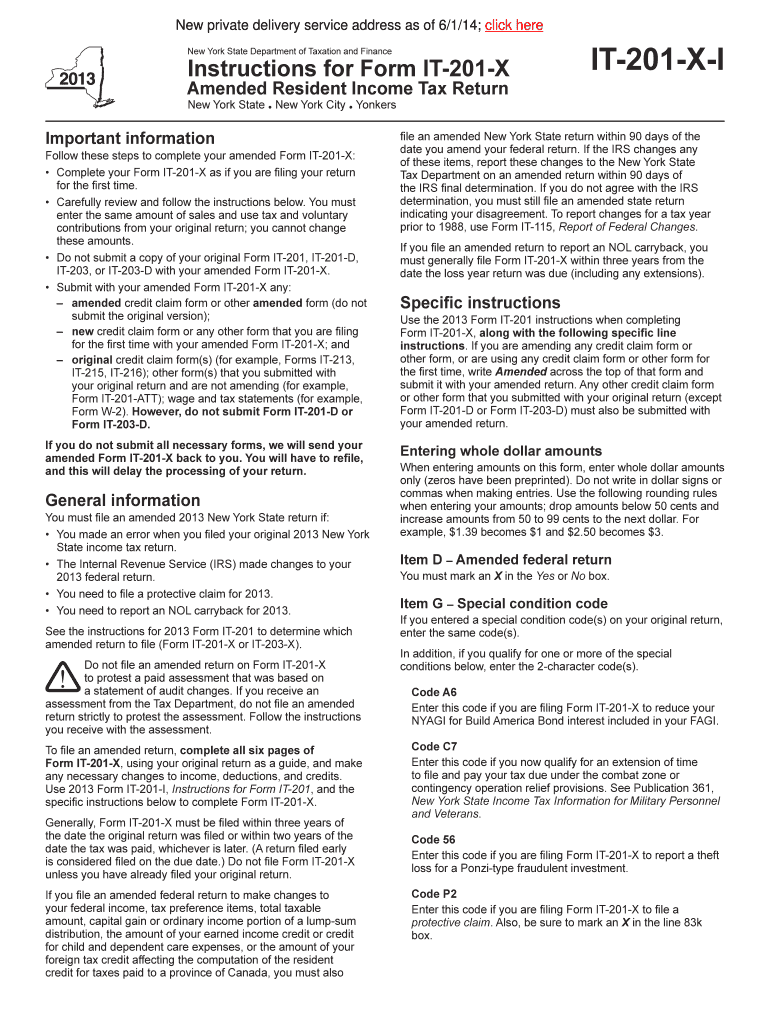

The Nys Amended Form is a specific document used in New York State for various purposes, including tax amendments and legal adjustments. It allows individuals and businesses to correct or update previously submitted information to ensure accuracy and compliance with state regulations. This form is essential for maintaining proper records and ensuring that any changes in circumstances are officially recognized by the state.

How to use the Nys Amended Form

Using the Nys Amended Form involves several steps to ensure that all necessary information is accurately reported. First, obtain the correct version of the form from the New York State Department of Taxation and Finance or the relevant agency. Next, fill out the required fields, including your personal or business information, the specific changes being made, and any supporting documentation. Finally, review the form for accuracy before submission to avoid delays or rejections.

Steps to complete the Nys Amended Form

Completing the Nys Amended Form requires careful attention to detail. Follow these steps:

- Download the latest version of the form from the official source.

- Read the instructions carefully to understand what information is needed.

- Fill in your name, address, and identification number accurately.

- Clearly indicate the changes being made and provide any necessary explanations.

- Attach any required supporting documents, such as previous forms or additional statements.

- Sign and date the form to certify its accuracy.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Nys Amended Form

The Nys Amended Form is legally recognized when completed and submitted according to state regulations. It must adhere to the requirements set forth by the New York State Department of Taxation and Finance to ensure that any amendments made are valid. This includes providing accurate information and any necessary documentation to support the changes. Failing to comply with these legal standards may result in penalties or rejection of the form.

Key elements of the Nys Amended Form

Key elements of the Nys Amended Form include:

- Personal or business identification information.

- A clear description of the changes being made.

- Supporting documentation as required by the specific amendments.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Amended Form vary depending on the type of amendment being made. It is crucial to check the specific deadlines outlined by the New York State Department of Taxation and Finance to avoid late penalties. Generally, amendments should be filed as soon as discrepancies are identified, and timely submission is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Nys Amended Form can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete 2013 nys amended form

Easily Prepare Nys Amended Form on Any Device

The utilization of online document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the tools you need to swiftly create, modify, and eSign your documents without delays. Manage Nys Amended Form on any device through airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Edit and eSign Nys Amended Form

- Obtain Nys Amended Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize crucial sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click the Done button to finalize your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, the hassle of searching for forms, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Nys Amended Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 nys amended form

Create this form in 5 minutes!

How to create an eSignature for the 2013 nys amended form

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the Nys Amended Form?

The Nys Amended Form is an official document used to make changes to a previously filed New York State form. It is essential for ensuring that your submissions reflect the most current and correct information. airSlate SignNow allows you to easily create and eSign the Nys Amended Form, streamlining your workflow.

-

How can airSlate SignNow help with the Nys Amended Form?

airSlate SignNow provides a user-friendly platform to prepare, send, and eSign the Nys Amended Form effortlessly. Our tool integrates various features that enhance document management, making it easy for you to keep all your forms organized and accessible. You can quickly make amendments, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow for the Nys Amended Form?

airSlate SignNow offers flexible pricing plans designed to meet various needs, whether you are a small business or a large organization. Our pricing model includes affordable monthly and annual subscription options. Each plan gives you access to powerful features that simplify handling the Nys Amended Form.

-

Are there any integrations available for managing the Nys Amended Form?

Yes, airSlate SignNow integrates with various business applications such as Google Drive, Salesforce, and more. These integrations facilitate easier access to your documents and allow seamless handling of the Nys Amended Form within your existing workflows. This connectivity enhances productivity and saves time.

-

Can multiple users collaborate on the Nys Amended Form with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Nys Amended Form in real-time. This feature promotes teamwork and efficiency, enabling everyone involved to make necessary changes and eSign the document quickly, regardless of their location.

-

What are the benefits of using airSlate SignNow for the Nys Amended Form?

Using airSlate SignNow for the Nys Amended Form offers numerous benefits, including convenience, security, and time savings. Our platform ensures that your documents are safely stored and easily retrievable, providing peace of mind. Additionally, eSigning the form accelerates the submission process, helping you stay compliant.

-

How secure is my information when using airSlate SignNow to eSign the Nys Amended Form?

Your security is our priority at airSlate SignNow. We implement industry-leading encryption and data protection measures to ensure that your information is safe when using our platform for the Nys Amended Form. Our compliant infrastructure meets rigorous security standards, giving you confidence in your document management.

Get more for Nys Amended Form

- Lagos homes application form

- The electromagnetic spectrum answer key form

- Sbi securities kyc form

- Secp nift signature form

- New real estate agent training manual pdf form

- This job application form must only be completed if you are applying for the finance section corporate services general

- Form n 565 application for replacement naturalizationcitizenship document

- Texas lottery electronic funds transfer authorizat form

Find out other Nys Amended Form

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT