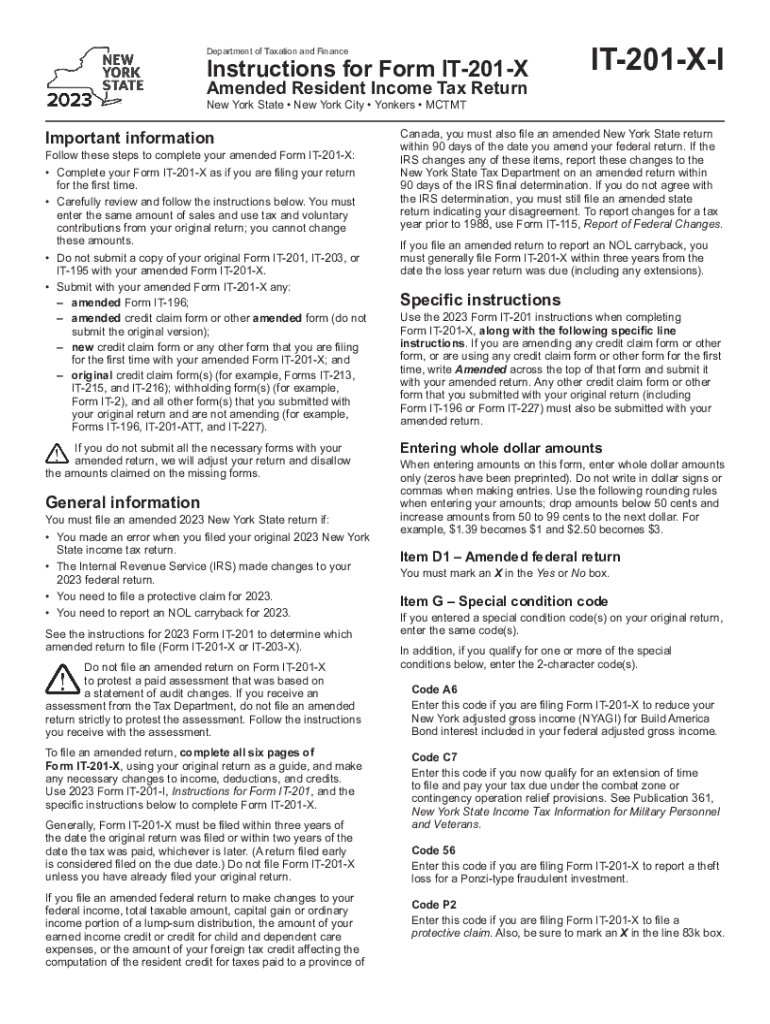

New York Form it 201 X Amended Resident Income Tax 2023

What is the New York Form IT 201 X Amended Resident Income Tax

The New York Form IT 201 X is an amended resident income tax return designed for individuals who need to correct or change their previously filed IT 201 form. This form allows taxpayers to report changes in income, deductions, or credits that may affect their tax liability. It is essential for ensuring that the tax records are accurate and up-to-date, which can help avoid potential penalties or issues with the New York State Department of Taxation and Finance.

How to use the New York Form IT 201 X Amended Resident Income Tax

Using the New York Form IT 201 X involves several steps to ensure accurate completion. Taxpayers must first gather all relevant documentation related to the changes being reported. This may include W-2 forms, 1099s, and any other financial records. After filling out the form with the corrected information, it is necessary to provide a detailed explanation of the changes in the designated section. This helps the tax authorities understand the reasons for the amendment. Finally, submit the completed form according to the provided instructions.

Steps to complete the New York Form IT 201 X Amended Resident Income Tax

Completing the New York Form IT 201 X involves the following steps:

- Obtain a copy of the form from the New York State Department of Taxation and Finance website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Report the original amounts from your initial IT 201 form and the corrected amounts.

- Provide a clear explanation of the changes in the designated section of the form.

- Review all information for accuracy before submission.

Legal use of the New York Form IT 201 X Amended Resident Income Tax

The New York Form IT 201 X is legally recognized by the state as a valid method for amending tax returns. Taxpayers are entitled to correct errors or omissions on their original returns to ensure compliance with state tax laws. It is crucial to file this form within the designated time frame to avoid any penalties. Understanding the legal implications of using this form can help taxpayers maintain good standing with the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Filing deadlines for the New York Form IT 201 X are critical for compliance. Typically, the amended return should be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later. It is important to keep track of these dates to ensure timely submission and avoid potential penalties or interest on unpaid taxes.

Required Documents

When completing the New York Form IT 201 X, certain documents are necessary to support the changes being made. These may include:

- Copies of the original IT 201 return.

- Any relevant W-2 forms or 1099s.

- Documentation for deductions or credits being claimed.

- Any correspondence from the New York State Department of Taxation and Finance regarding your original return.

Who Issues the Form

The New York Form IT 201 X is issued by the New York State Department of Taxation and Finance. This department is responsible for administering the state's tax laws and ensuring compliance among taxpayers. They provide the necessary forms and instructions to assist individuals in fulfilling their tax obligations accurately.

Quick guide on how to complete new york form it 201 x amended resident income tax

Complete New York Form IT 201 X Amended Resident Income Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage New York Form IT 201 X Amended Resident Income Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign New York Form IT 201 X Amended Resident Income Tax with ease

- Obtain New York Form IT 201 X Amended Resident Income Tax and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign New York Form IT 201 X Amended Resident Income Tax and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 201 x amended resident income tax

Create this form in 5 minutes!

How to create an eSignature for the new york form it 201 x amended resident income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form it 201 x 2021 and how can I use it with airSlate SignNow?

The form it 201 x 2021 is an essential document for various business operations. With airSlate SignNow, you can easily fill out, sign, and manage your form it 201 x 2021 electronically, streamlining your workflow and ensuring compliance with your requirements. This solution enables you to save time and reduce paper waste.

-

Are there any costs associated with using airSlate SignNow for form it 201 x 2021?

Yes, there are different pricing plans available for using airSlate SignNow based on your business needs. Each plan provides a range of features to efficiently handle documents including form it 201 x 2021. You can choose the plan that fits your budget while gaining access to powerful eSigning capabilities.

-

What features does airSlate SignNow offer for managing form it 201 x 2021?

airSlate SignNow provides a user-friendly interface to create, edit, and eSign your form it 201 x 2021. Key features include the ability to customize templates, real-time tracking of document status, and automated workflows that enhance efficiency. This allows businesses to manage their documents with ease.

-

Can I integrate airSlate SignNow with other tools for handling form it 201 x 2021?

Absolutely! airSlate SignNow offers integrations with various applications like Google Drive, Salesforce, and Dropbox, allowing you to manage your form it 201 x 2021 seamlessly. These integrations help maintain a cohesive workflow while accessing your documents across platforms.

-

What are the benefits of using airSlate SignNow for form it 201 x 2021?

Using airSlate SignNow for your form it 201 x 2021 offers numerous advantages, including increased efficiency, reduced turnaround time, and enhanced security for sensitive data. By digitizing your document process, you can eliminate the hassles of physical paperwork and ensure that signatures are collected promptly.

-

Is airSlate SignNow secure for handling sensitive form it 201 x 2021 data?

Yes, airSlate SignNow prioritizes security to protect your sensitive information, including that contained within form it 201 x 2021. The platform employs advanced encryption protocols and complies with industry standards to ensure your documents are safe and secure during transmission and storage.

-

How does airSlate SignNow improve the eSigning experience for form it 201 x 2021?

airSlate SignNow enhances the eSigning experience for form it 201 x 2021 by offering a straightforward and intuitive interface. Users can sign documents quickly from any device, streamlining the process for all parties involved. This adaptability improves user satisfaction and accelerates document completion.

Get more for New York Form IT 201 X Amended Resident Income Tax

- Wetumpka health department form

- Multi win lifeline application doc form

- Lesson 5 homework practice volume of pyramids form

- Family camping checklist by rei staff form

- Adp health care enrollment form

- Power of attorney form new jersey

- Srv form pmiwaiver indd

- Usc credit union direct deposit authorization form usccreditunion

Find out other New York Form IT 201 X Amended Resident Income Tax

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF