Instructions for Form it 201 X Tax NY Gov 2022

What is the Instructions for Form IT-201 X?

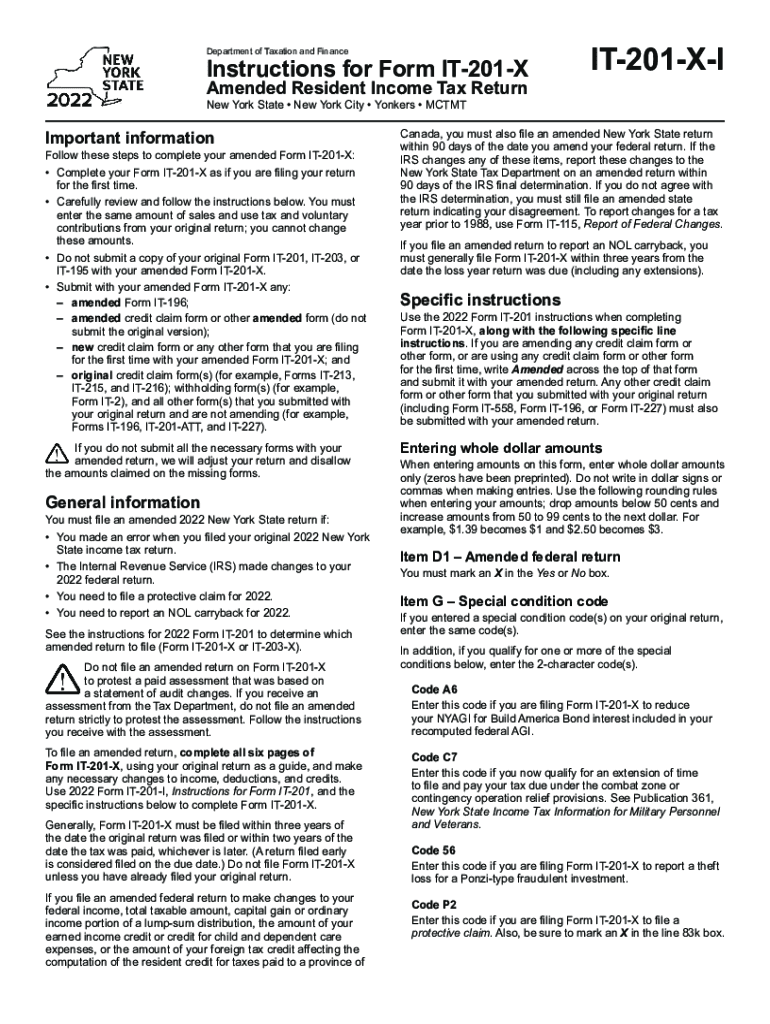

The Instructions for Form IT-201 X provide essential guidance for taxpayers in New York State who need to amend their personal income tax returns. This form is specifically designed for individuals who have already filed their IT-201 form and need to make corrections or updates to their previously submitted information. Understanding these instructions is crucial for ensuring that any amendments are completed accurately and in compliance with state tax regulations.

Steps to Complete the Instructions for Form IT-201 X

Completing the Instructions for Form IT-201 X involves several key steps:

- Review the original IT-201 form to identify the information that needs correction.

- Obtain the latest version of the IT-201 X instructions from the New York State Department of Taxation and Finance website.

- Carefully follow the step-by-step guidance provided in the instructions, ensuring that all required fields are filled out correctly.

- Double-check all calculations and ensure that any supporting documentation is included with the amended form.

- Submit the completed IT-201 X form by the specified deadline to avoid penalties.

Legal Use of the Instructions for Form IT-201 X

The Instructions for Form IT-201 X are legally binding documents that outline the proper procedures for amending a tax return in New York State. To ensure compliance with state tax laws, it is important that taxpayers adhere to the guidelines provided within these instructions. Failing to follow the legal requirements can result in delays, penalties, or other legal repercussions.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the IT-201 X form. Typically, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Keeping track of these deadlines is essential to ensure that your amendments are processed in a timely manner.

Required Documents

When completing the Instructions for Form IT-201 X, certain documents may be required to support the amendments being made. These can include:

- Copies of the original IT-201 form.

- Any additional forms or schedules that were part of the original submission.

- Documentation supporting the changes, such as W-2s, 1099s, or other income statements.

Form Submission Methods

Taxpayers have several options for submitting the IT-201 X form. The completed form can be sent via mail to the address specified in the instructions. Additionally, taxpayers may have the option to submit the form electronically, depending on the capabilities provided by the New York State Department of Taxation and Finance. It is advisable to check the latest submission methods to ensure compliance with current practices.

Quick guide on how to complete instructions for form it 201 x taxnygov

Easily prepare Instructions For Form IT 201 X Tax NY gov on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to retrieve the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Form IT 201 X Tax NY gov on any device with airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to alter and electronically sign Instructions For Form IT 201 X Tax NY gov effortlessly

- Obtain Instructions For Form IT 201 X Tax NY gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Instructions For Form IT 201 X Tax NY gov and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 201 x taxnygov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 201 x taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2020 New York State instructions for eSigning documents?

The 2020 New York State instructions for eSigning documents outline the requirements for electronic signatures within the state. They confirm that electronic signatures are legally binding, provided they adhere to certain standards. This compliance ensures that businesses can confidently use eSignatures for their documents in New York.

-

How does airSlate SignNow align with the 2020 New York State instructions?

airSlate SignNow fully complies with the 2020 New York State instructions for eSigning. Our platform is designed to meet all legal requirements, ensuring that your electronic signatures are valid and enforceable. This alignment helps businesses streamline their signing processes while remaining compliant.

-

What features does airSlate SignNow offer in relation to 2020 New York State instructions?

airSlate SignNow offers a variety of features that ensure compliance with the 2020 New York State instructions, such as customizable signing workflows and advanced security measures. Additionally, users can track document statuses and easily manage their eSigning processes. These features enhance the overall efficiency of document management.

-

Is there a cost associated with using airSlate SignNow for the 2020 New York State instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans are cost-effective and designed to provide comprehensive features that comply with the 2020 New York State instructions. You can select a plan that best fits your organizational needs and budget.

-

Can I integrate airSlate SignNow with other software while following the 2020 New York State instructions?

Absolutely! airSlate SignNow offers seamless integration with a variety of popular software applications. This allows for streamlined workflows while maintaining compliance with the 2020 New York State instructions, enhancing your document management processes.

-

What benefits does using airSlate SignNow provide regarding the 2020 New York State instructions?

Using airSlate SignNow ensures that your eSigning processes are efficient and compliant with the 2020 New York State instructions. This leads to reduced turnaround times and enhanced security for your documents. By going digital, businesses can also save costs associated with paper and storage.

-

Are there any limitations to eSigning as per the 2020 New York State instructions?

While the 2020 New York State instructions support eSigning, certain legal documents, such as wills or court documents, may have specific signing requirements. It’s crucial to understand these exceptions when using airSlate SignNow. Ensure that your documents are eligible for electronic signatures to remain compliant.

Get more for Instructions For Form IT 201 X Tax NY gov

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles south carolina form

- Letter from tenant to landlord about landlords failure to make repairs south carolina form

- Letter notice rent template form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession south carolina form

- Letter from tenant to landlord about illegal entry by landlord south carolina form

- Letter from landlord to tenant about time of intent to enter premises south carolina form

- Tenant notice rent 497325652 form

- Letter from tenant to landlord about sexual harassment south carolina form

Find out other Instructions For Form IT 201 X Tax NY gov

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online