Nys Et 706 810 Form 2019

What is the Nys Et 706 810 Form

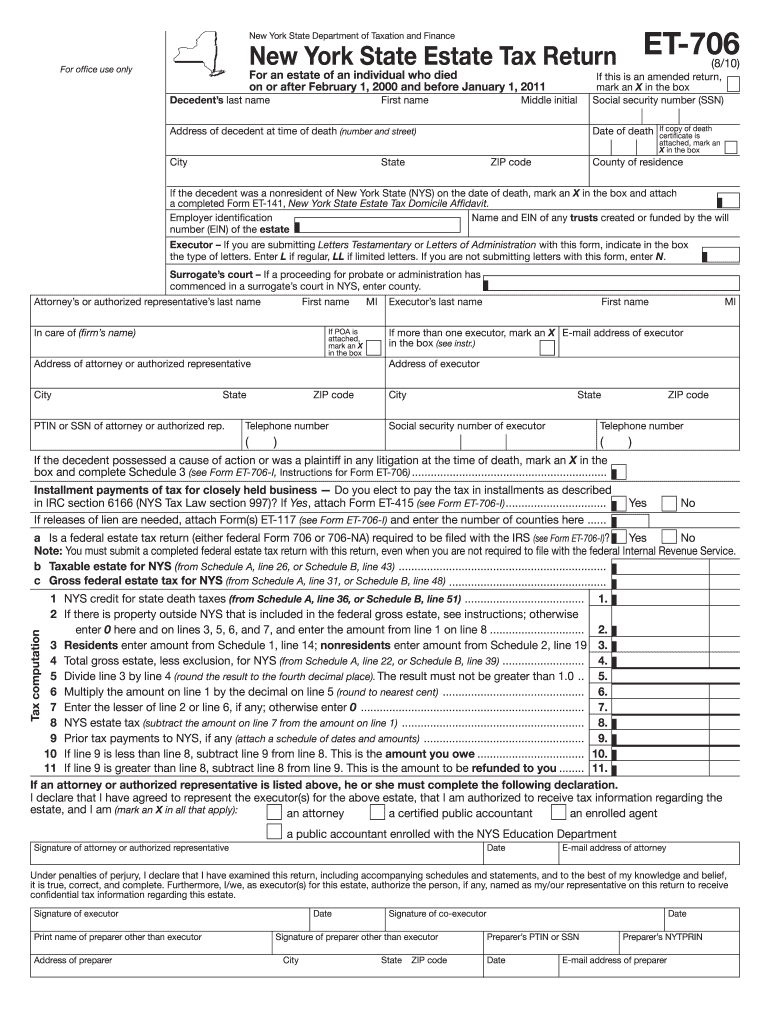

The Nys Et 706 810 Form is a New York State estate tax return that must be filed by the executor of an estate when the gross estate exceeds a specific threshold. This form is essential for reporting the value of the estate and calculating any estate taxes owed to the state. It includes detailed information about the deceased's assets, liabilities, and other relevant financial data. Understanding this form is crucial for compliance with state tax laws and ensuring that the estate is settled correctly.

How to use the Nys Et 706 810 Form

Using the Nys Et 706 810 Form involves several steps to ensure accurate completion. Executors should first gather all necessary documentation, including asset valuations and debts. Next, they should carefully fill out the form, providing detailed information about the estate's assets, liabilities, and deductions. Once completed, the form must be submitted to the New York State Department of Taxation and Finance, along with any required supporting documents. It is advisable to review the form thoroughly before submission to avoid any errors that could lead to delays or penalties.

Steps to complete the Nys Et 706 810 Form

Completing the Nys Et 706 810 Form involves a systematic approach:

- Gather all relevant documents, including death certificates, asset appraisals, and debt statements.

- Begin filling out the form by entering the decedent's personal information, such as name, date of birth, and date of death.

- List all assets owned by the decedent at the time of death, including real estate, bank accounts, and investments.

- Document any liabilities or debts that the estate owes.

- Calculate the total value of the estate and determine any deductions that may apply.

- Review the completed form for accuracy and completeness.

- Submit the form and any required attachments to the appropriate state department.

Legal use of the Nys Et 706 810 Form

The Nys Et 706 810 Form is legally binding and must be filed in accordance with New York State laws. Proper use of this form ensures that the estate complies with state tax obligations. Failure to file the form or inaccuracies in reporting can result in penalties, interest on unpaid taxes, or legal complications for the estate and its executor. It is important to adhere to all legal requirements when completing and submitting this form to avoid potential issues.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Et 706 810 Form are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. If additional time is needed, executors may request an extension; however, this does not extend the time to pay any taxes owed. It is essential to be aware of these deadlines to ensure timely compliance with state tax laws.

Required Documents

When completing the Nys Et 706 810 Form, several documents are required to support the information provided:

- Death certificate of the decedent.

- Appraisals of real estate and other significant assets.

- Statements of all bank accounts, investments, and retirement accounts.

- Documentation of any debts owed by the decedent.

- Any prior tax returns that may impact the estate's tax obligations.

Quick guide on how to complete nys et 706 810 2010 form

Complete Nys Et 706 810 Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your papers swiftly without delays. Manage Nys Et 706 810 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to edit and eSign Nys Et 706 810 Form without any hassle

- Obtain Nys Et 706 810 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Nys Et 706 810 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys et 706 810 2010 form

Create this form in 5 minutes!

How to create an eSignature for the nys et 706 810 2010 form

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Nys Et 706 810 Form?

The Nys Et 706 810 Form is a tax form used in New York State for estate tax purposes. This form helps in reporting the value of the estate and calculating the taxes owed. By using airSlate SignNow, you can easily manage and eSign your Nys Et 706 810 Form for a hassle-free filing process.

-

How can I use airSlate SignNow for the Nys Et 706 810 Form?

You can use airSlate SignNow to upload your Nys Et 706 810 Form and eSign it quickly. Our platform allows you to collaborate with others, track your document's status, and ensure that all signatures are collected promptly. It's a streamlined solution for managing important legal documents.

-

Is there a cost associated with using the Nys Et 706 810 Form on airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans to accommodate various needs, including those who need to handle the Nys Et 706 810 Form. We provide a cost-effective solution that scales with your business requirements, ensuring you get the best value for document management and eSigning.

-

What are the main features for managing the Nys Et 706 810 Form with airSlate SignNow?

Key features for managing the Nys Et 706 810 Form with airSlate SignNow include document sharing, real-time collaboration, and secure eSigning. Additionally, our intuitive interface allows users to customize their forms easily, ensuring that you have a seamless experience while preparing your tax documents.

-

Can I integrate airSlate SignNow with other software to handle the Nys Et 706 810 Form?

Absolutely! airSlate SignNow offers integrations with a variety of software applications, enhancing your workflow for managing the Nys Et 706 810 Form. These integrations allow for easy data sharing and improved efficiency in handling your estate tax filings.

-

What benefits does airSlate SignNow provide for eSigning the Nys Et 706 810 Form?

Using airSlate SignNow to eSign the Nys Et 706 810 Form offers benefits such as time savings and improved accuracy. Our eSigning feature ensures that documents are securely signed and easily accessible, streamlining the process for both individuals and businesses involved in estate management.

-

Is airSlate SignNow secure for handling sensitive documents like the Nys Et 706 810 Form?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents such as the Nys Et 706 810 Form. We utilize advanced encryption and security protocols to protect your data and ensure that your estate tax documents remain confidential throughout the signing process.

Get more for Nys Et 706 810 Form

Find out other Nys Et 706 810 Form

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA