New York State Tax Exempt Form for Hotels New York State Tax Exempt Form for Hotels 2018

What is the New York State Tax Exempt Form for Hotels?

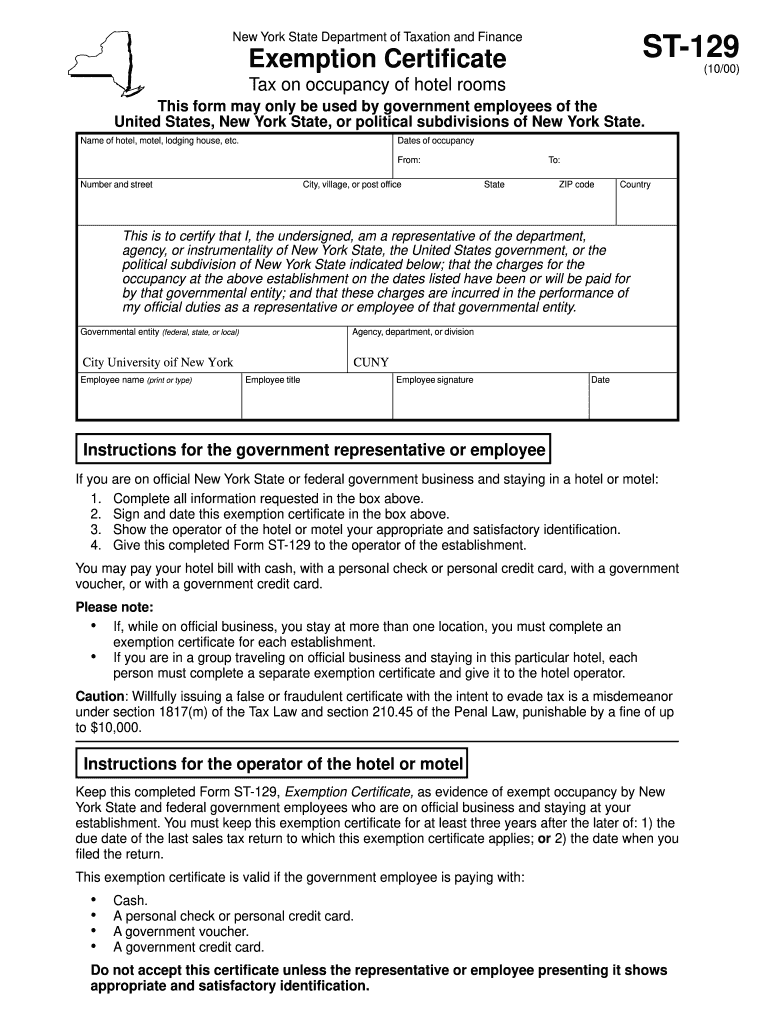

The New York State Tax Exempt Form for Hotels is a specific document that allows eligible organizations to claim exemption from sales tax when booking hotel accommodations in New York State. This form is primarily used by government entities, nonprofit organizations, and certain educational institutions that are exempt from paying sales tax under New York State law. By presenting this form to the hotel, the organization can avoid incurring additional costs associated with sales tax on their lodging expenses.

How to Obtain the New York State Tax Exempt Form for Hotels

To obtain the New York State Tax Exempt Form for Hotels, eligible organizations can download the form directly from the New York State Department of Taxation and Finance website. It is essential for organizations to ensure they are using the most current version of the form. Additionally, organizations may need to provide proof of their tax-exempt status, such as a determination letter from the IRS or a certificate of incorporation, to validate their eligibility when completing the form.

Steps to Complete the New York State Tax Exempt Form for Hotels

Completing the New York State Tax Exempt Form for Hotels involves several key steps:

- Begin by entering the name and address of the organization requesting the exemption.

- Provide the organization’s tax-exempt number and the reason for the exemption.

- Fill in the details of the hotel stay, including the dates of the stay and the name of the hotel.

- Sign and date the form to certify that the information provided is accurate and that the organization qualifies for the exemption.

Legal Use of the New York State Tax Exempt Form for Hotels

The legal use of the New York State Tax Exempt Form for Hotels is governed by New York State tax regulations. To be valid, the form must be completed accurately and presented to the hotel at the time of booking. Hotels are required to retain a copy of the completed form for their records. Misuse of the form, such as presenting it without being an eligible organization, can result in penalties, including the obligation to pay the sales tax that was exempted.

Key Elements of the New York State Tax Exempt Form for Hotels

Key elements of the New York State Tax Exempt Form for Hotels include:

- Organization Information: Name, address, and tax-exempt number.

- Hotel Information: Name and address of the hotel, along with the dates of stay.

- Certification: Signature of an authorized representative of the organization, affirming eligibility for tax exemption.

Examples of Using the New York State Tax Exempt Form for Hotels

Examples of using the New York State Tax Exempt Form for Hotels include:

- A government agency booking accommodations for employees attending a conference.

- A nonprofit organization reserving rooms for volunteers participating in a charitable event.

- An educational institution arranging lodging for students attending a field trip.

Quick guide on how to complete new york state tax exempt form for hotels new york state tax exempt form for hotels

Complete New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels effortlessly on any device

Web-based document administration has become increasingly favored among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to generate, modify, and electronically sign your documents swiftly without interruptions. Manage New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels effortlessly

- Find New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow manages all your document organization needs in just a few clicks from any device you choose. Modify and electronically sign New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state tax exempt form for hotels new york state tax exempt form for hotels

Create this form in 5 minutes!

How to create an eSignature for the new york state tax exempt form for hotels new york state tax exempt form for hotels

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the New York State Tax Exempt Form For Hotels?

The New York State Tax Exempt Form For Hotels is a document used by qualifying organizations to claim exemption from paying certain taxes when booking hotel accommodations in New York State. This form ensures that eligible entities can benefit from tax savings during their stay. It is crucial for hotels to verify whether guests are tax-exempt by using this form.

-

How can airSlate SignNow help with the New York State Tax Exempt Form For Hotels?

airSlate SignNow provides a user-friendly platform that allows businesses to send and electronically sign the New York State Tax Exempt Form For Hotels seamlessly. With our solution, hotels can streamline the process, ensuring quick and efficient verification of tax-exempt status. This enhances customer satisfaction and optimizes operations for hotel management.

-

What features does airSlate SignNow offer for managing the New York State Tax Exempt Form For Hotels?

Our platform offers features like customizable templates, automated reminders, and secure cloud storage specifically for the New York State Tax Exempt Form For Hotels. These tools enable hotels to efficiently manage documents and ensure compliance with tax regulations. Additionally, users can track the signing status of forms in real time.

-

Is there a cost associated with using airSlate SignNow for the New York State Tax Exempt Form For Hotels?

Yes, there is a cost for using airSlate SignNow, but we offer competitive pricing plans that cater to different business sizes and needs. Our pricing is designed to provide a cost-effective solution for managing the New York State Tax Exempt Form For Hotels, ensuring you receive value for your investment. You can contact our sales team for detailed pricing options.

-

Can I integrate airSlate SignNow with other systems when using the New York State Tax Exempt Form For Hotels?

Absolutely! airSlate SignNow allows integration with various systems, including CRM software and accounting platforms, which can be particularly beneficial when processing the New York State Tax Exempt Form For Hotels. This integration helps in automating workflows, reducing errors, and improving data management across your business operations.

-

What are the benefits of using airSlate SignNow for the New York State Tax Exempt Form For Hotels?

Using airSlate SignNow for the New York State Tax Exempt Form For Hotels offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved collaboration between hotels and tax-exempt guests. As a digital solution, it minimizes delays associated with traditional paperwork and helps ensure compliance with tax regulations. This results in a better overall experience for all users.

-

How does airSlate SignNow ensure security for the New York State Tax Exempt Form For Hotels?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect the New York State Tax Exempt Form For Hotels and other sensitive documents. Our platform complies with industry standards to ensure that your information remains confidential and secure. This commitment to security helps build trust among users.

Get more for New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels

- Fear ladder worksheet form

- Vantage medical group prior authorization form

- How to teach composition writing in primary school pdf form

- Morneau transport bill of lading form

- Water chemistry mark benjamin solutions form

- Intermember form hcd

- Fin 74 form

- Utah 4 h member registration form dixie 4h dixie4h

Find out other New York State Tax Exempt Form For Hotels New York State Tax Exempt Form For Hotels

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now