Psers 1099 2018-2026

What is the Psers 1099?

The Psers 1099 form, also known as the Psers retirement 1099, is a tax document issued to individuals who receive retirement benefits from the Public School Employees' Retirement System (PSERS) in the United States. This form reports the total amount of taxable distributions received during the tax year, which is essential for accurately filing income taxes. Understanding this form is crucial for retirees to ensure they comply with IRS regulations and report their income correctly.

How to Obtain the Psers 1099

To obtain your Psers 1099 form, you can follow a few straightforward steps. First, check the PSERS official website, where you can access your account online. If you are a registered user, you can log in to download your form directly. Alternatively, you may request a physical copy by contacting PSERS customer service. Ensure that you provide the necessary identification details to verify your identity. It is important to obtain this form before the tax filing deadline to avoid any delays in your tax preparation.

Steps to Complete the Psers 1099

Completing the Psers 1099 form involves several steps to ensure accuracy. Begin by reviewing the information on the form, including your name, address, and Social Security number. Next, verify the total distribution amount reported on the form. If you notice any discrepancies, contact PSERS for clarification. Once you confirm that all information is correct, you can use this data to complete your tax return. It is advisable to keep a copy of the completed form for your records.

Legal Use of the Psers 1099

The Psers 1099 form has legal significance as it provides essential information for tax reporting purposes. This document must be filed with your federal income tax return to ensure compliance with IRS regulations. Failure to accurately report the income from your Psers retirement benefits could result in penalties or additional taxes owed. Therefore, it is crucial to treat this form with care and ensure that all information is reported accurately.

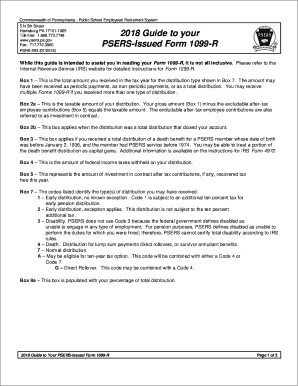

Key Elements of the Psers 1099

Several key elements are included in the Psers 1099 form that are important for taxpayers to understand. These elements typically include:

- Recipient Information: Name, address, and Social Security number of the individual receiving benefits.

- Total Distribution Amount: The total amount of taxable distributions received during the year.

- Taxable Amount: The portion of the distribution that is subject to federal income tax.

- Withholding Information: Any federal income tax withheld from the distributions.

Each of these components plays a critical role in the accurate reporting of income and tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Psers 1099 form coincide with the general tax filing deadlines established by the IRS. Typically, the deadline for filing your federal income tax return is April fifteenth of each year. It is advisable to complete your tax return as soon as you receive your Psers 1099 form to ensure you meet this deadline. Additionally, if you need to file for an extension, be aware of the extended deadlines and ensure all necessary forms are submitted on time.

Quick guide on how to complete psers 1099

Complete Psers 1099 effortlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Manage Psers 1099 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Psers 1099 with ease

- Locate Psers 1099 and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhaustive form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Psers 1099 and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct psers 1099

Create this form in 5 minutes!

How to create an eSignature for the psers 1099

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a PSERS 1099 R form?

The PSERS 1099 R form is used to report distributions from pension plans, including payments from the Pennsylvania Public School Employees' Retirement System (PSERS). This form is essential for individuals receiving retirement benefits to report taxable income on their tax returns.

-

How can airSlate SignNow help with PSERS 1099 R forms?

airSlate SignNow provides an efficient platform for eSigning and sending PSERS 1099 R forms securely. With its user-friendly interface, you can easily create, distribute, and manage your forms, helping ensure compliance and reducing turnaround times.

-

Is there a cost associated with using airSlate SignNow for PSERS 1099 R forms?

Yes, airSlate SignNow offers various pricing plans catering to different business sizes, allowing you to choose the best option for your needs related to processing PSERS 1099 R forms. These plans are designed to be cost-effective, ensuring you get value for your money.

-

What features does airSlate SignNow offer for managing PSERS 1099 R forms?

airSlate SignNow includes key features like eSignature capabilities, document templates, real-time tracking, and cloud storage which are all invaluable for managing PSERS 1099 R forms. These features streamline your document workflow and ensure that every form is accurately handled.

-

Can I integrate airSlate SignNow with other software for handling PSERS 1099 R?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, such as CRM systems and accounting software, allowing for a more extensive management process for PSERS 1099 R forms. These integrations help automate workflows and minimize manual data entry.

-

Is airSlate SignNow secure for sending PSERS 1099 R forms?

Yes, airSlate SignNow employs robust security measures to ensure that your PSERS 1099 R forms are sent securely. With encryption, password protection, and secure cloud storage, you can trust that your sensitive information is well protected.

-

How quickly can I get started with airSlate SignNow for PSERS 1099 R forms?

Getting started with airSlate SignNow is quick and easy! You can sign up for an account, choose your pricing plan, and begin creating and sending your PSERS 1099 R forms within minutes, streamlining your document management process right away.

Get more for Psers 1099

Find out other Psers 1099

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy