Tax Deed Application 201437 2016-2026

Understanding the Tax Deed Application

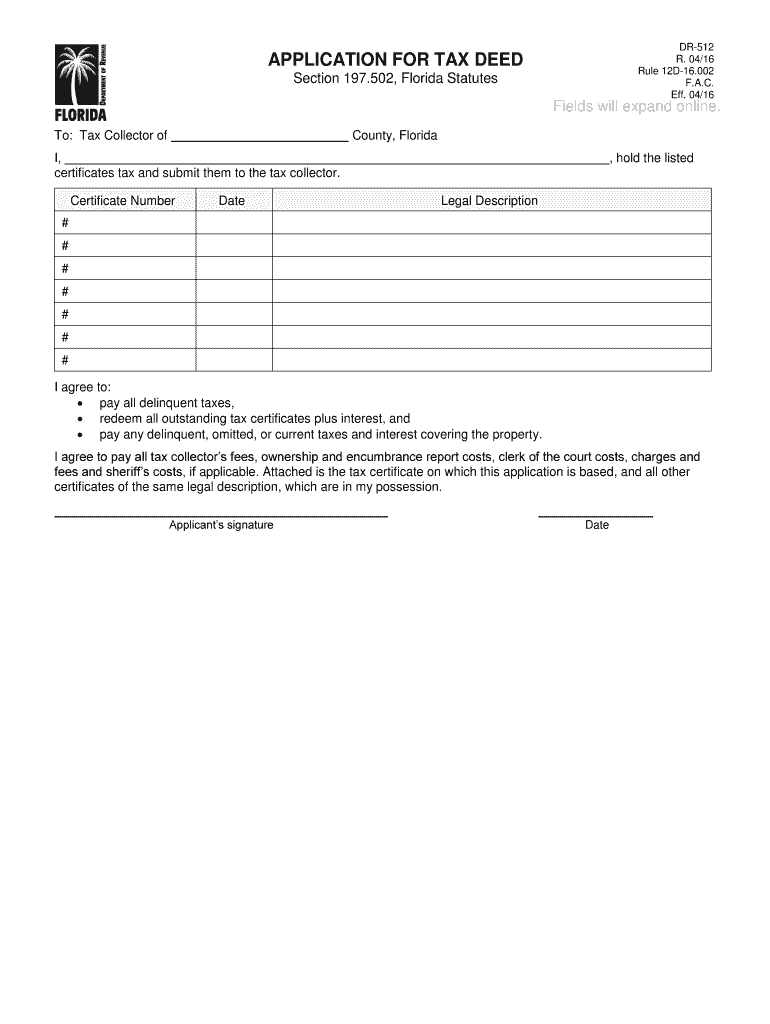

The application tax deed is a legal document used in the United States, particularly in Florida, to facilitate the transfer of property ownership due to unpaid taxes. This application allows individuals or entities to claim ownership of a property that has been tax-deeded by the county. Understanding the purpose and implications of this application is crucial for anyone involved in real estate or tax-related transactions.

Steps to Complete the Tax Deed Application

Completing the application tax deed involves several important steps:

- Gather necessary information about the property, including its legal description and tax identification number.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach supporting documents, such as proof of payment for any outstanding taxes or fees.

- Submit the application to the appropriate county office, either online, by mail, or in person.

Each of these steps is essential to ensure that the application is processed smoothly and without delays.

Key Elements of the Tax Deed Application

The application tax deed contains several key elements that must be included for it to be valid:

- Applicant's full name and contact information.

- Property details, including the address and legal description.

- Information about the tax deed, such as the date of the tax sale.

- Signature of the applicant, affirming the accuracy of the information provided.

Ensuring that all these elements are present will help in the successful processing of the application.

Legal Use of the Tax Deed Application

The legal use of the application tax deed is governed by state laws, particularly in Florida. It serves as a formal request for ownership transfer due to tax delinquency. Proper submission and adherence to legal requirements ensure that the application is recognized by the courts and local authorities. This legal framework protects both the applicant and the previous property owner, establishing clear ownership rights.

Required Documents for the Tax Deed Application

To successfully submit the application tax deed, several documents are typically required:

- Completed application tax deed form.

- Proof of identity, such as a government-issued ID.

- Documentation of tax payments or receipts.

- Any additional forms specified by the county office.

Having these documents ready will streamline the application process and help avoid potential delays.

Application Process and Approval Time

The application process for the tax deed can vary by county but generally follows a similar timeline. Once the application is submitted, it may take several weeks for processing. During this time, the county will review the application and verify the provided information. Applicants should be prepared for possible follow-up requests for additional information or documentation.

Quick guide on how to complete tax deed application 201437

Effortlessly Prepare Tax Deed Application 201437 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and store it securely online. airSlate SignNow equips you with all the essential tools to quickly create, edit, and eSign your documents without any hold-ups. Manage Tax Deed Application 201437 on any platform with airSlate SignNow's Android or iOS applications and enhance your document-driven workflows today.

How to Edit and eSign Tax Deed Application 201437 with Ease

- Obtain Tax Deed Application 201437 and then click Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for these tasks.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced papers, tiring searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Tax Deed Application 201437 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax deed application 201437

Create this form in 5 minutes!

How to create an eSignature for the tax deed application 201437

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is an application tax deed?

An application tax deed is a legal document that allows property owners to reclaim their rights after a tax lien sale. By filing an application tax deed, you can secure your property status and maintain ownership against tax-related issues. Understanding this process is crucial for property holders who want to safeguard their investments.

-

How can airSlate SignNow help with the application tax deed process?

airSlate SignNow streamlines the application tax deed process by enabling users to eSign and send necessary documents quickly and securely. Our platform provides an easy-to-use interface that simplifies tracking and managing your application tax deed paperwork, ensuring compliance and timely submissions.

-

Are there any fees associated with using airSlate SignNow for application tax deed documents?

Yes, there are fees associated with using airSlate SignNow, but they are designed to be cost-effective. We offer various pricing plans that can fit businesses of all sizes, allowing you to manage your application tax deed needs without breaking the bank. For detailed pricing information, check our pricing page.

-

What features does airSlate SignNow offer for managing application tax deed documents?

airSlate SignNow provides features like real-time tracking, templates for application tax deed documents, and secure cloud storage. These tools make it easy to manage your documents efficiently and ensure that you never lose track of your application tax deed submissions. Our platform is designed to enhance your productivity and streamline workflows.

-

Can I integrate airSlate SignNow with other software for my application tax deed management?

Absolutely! airSlate SignNow offers robust integrations with popular tools like Google Drive, Dropbox, and various CRM systems. These integrations allow you to manage your application tax deed documents seamlessly within your existing workflows, making document management as efficient as possible.

-

What are the benefits of using airSlate SignNow for application tax deed processing?

Using airSlate SignNow for application tax deed processing provides enhanced efficiency and security. With electronic signatures and automation features, you speed up the filing process and reduce the likelihood of errors. This ensures your application tax deed is processed promptly and correctly.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with application tax deed documents?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, from small startups to large enterprises. Whether you need to handle a few application tax deed documents or manage a high volume, our platform can scale to meet your needs while ensuring ease of use and effectiveness.

Get more for Tax Deed Application 201437

Find out other Tax Deed Application 201437

- How Can I Sign Wyoming Affidavit of Service

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title

- Help Me With Sign Pennsylvania Affidavit of Title

- Can I Sign Pennsylvania Affidavit of Title

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself