Oregon Resale Certificate 2017-2026

What is the Oregon Resale Certificate

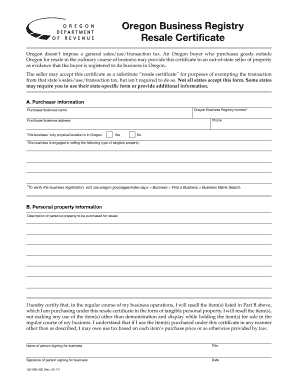

The Oregon resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers who want to avoid the additional costs associated with sales tax on items they plan to sell to consumers. By using the resale certificate, businesses can streamline their purchasing process and maintain compliance with state tax regulations.

How to use the Oregon Resale Certificate

To use the Oregon resale certificate, a business must present it to suppliers when making purchases. The certificate should be filled out completely, including the seller's name, address, and the type of goods being purchased. It is crucial to ensure that the certificate is only used for items that will be resold, as misuse can lead to penalties. Suppliers are required to keep a copy of the certificate for their records, which helps facilitate tax compliance and audit processes.

Steps to complete the Oregon Resale Certificate

Completing the Oregon resale certificate involves several key steps:

- Obtain the official Oregon resale certificate form, often referred to as the Oregon 150.

- Fill in the required information, including your business name, address, and seller's permit number.

- Specify the type of goods you intend to purchase for resale.

- Sign and date the certificate to validate it.

- Provide the completed certificate to your supplier at the time of purchase.

Legal use of the Oregon Resale Certificate

The legal use of the Oregon resale certificate is governed by state tax laws. It is essential that businesses only use the certificate for items they intend to resell in the regular course of business. Misuse of the certificate, such as using it for personal purchases or non-resale items, can result in penalties, including fines and back taxes owed to the state. Businesses should maintain accurate records of all transactions involving the resale certificate to ensure compliance.

Eligibility Criteria

To be eligible for the Oregon resale certificate, a business must be registered with the Oregon Secretary of State and possess a valid seller's permit. This permit indicates that the business is authorized to collect sales tax and engage in retail sales. Additionally, the business must demonstrate that it operates primarily as a retailer or wholesaler, purchasing goods for resale rather than for personal use.

Who Issues the Form

The Oregon resale certificate is issued by the Oregon Department of Revenue. Businesses can obtain the form through the department's official website or by contacting their local office. It is important for businesses to ensure they are using the most current version of the form to comply with state regulations.

Quick guide on how to complete oregon resale certificate

Manage Oregon Resale Certificate effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Handle Oregon Resale Certificate on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The simplest way to alter and eSign Oregon Resale Certificate effortlessly

- Obtain Oregon Resale Certificate and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive details with tools that airSlate SignNow supplies specifically for this reason.

- Create your eSignature using the Sign tool, which takes only a few seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and eSign Oregon Resale Certificate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon resale certificate

Create this form in 5 minutes!

How to create an eSignature for the oregon resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is an Oregon business registry resale certificate?

An Oregon business registry resale certificate is a document that allows businesses in Oregon to purchase goods tax-free as they intend to resell them. This certificate simplifies the resale process and helps businesses save on tax expenses. Obtaining this certificate is crucial for complying with state tax regulations.

-

How can I obtain an Oregon business registry resale certificate?

To obtain an Oregon business registry resale certificate, you must register your business with the Oregon Secretary of State. Once your business is registered, you can apply for the resale certificate through their online portal or by submitting a paper application. Ensure that you meet all eligibility requirements to streamline the process.

-

Are there any costs associated with applying for an Oregon business registry resale certificate?

There are typically no direct costs for applying for an Oregon business registry resale certificate itself, as it is provided by the state. However, costs may arise from starting and maintaining your business, such as registration fees or local licensing. It's beneficial to consider these associated costs when planning your business expenses.

-

What documents do I need to apply for an Oregon business registry resale certificate?

To apply for an Oregon business registry resale certificate, you'll need your business registration details, including your Business Identification Number (BIN) and any relevant tax information. You might also require a description of the types of products you plan to purchase for resale. Having accurate documentation will facilitate a smoother application process.

-

Can I use my Oregon business registry resale certificate for out-of-state purchases?

Generally, an Oregon business registry resale certificate is valid only for purchases made within Oregon. However, some states have reciprocal agreements that recognize Oregon's resale certificate. It's essential to check the regulations of the specific state where you plan to make purchases to ensure compliance.

-

How does the Oregon business registry resale certificate benefit my business?

The Oregon business registry resale certificate benefits your business by allowing you to buy inventory without paying sales tax upfront. This helps improve cash flow and reduces initial costs, enabling you to invest more in your business. Additionally, it ensures compliance with state regulations, safeguarding your business from potential penalties.

-

What types of businesses can benefit from an Oregon business registry resale certificate?

Various types of businesses can benefit from an Oregon business registry resale certificate, including retail shops, wholesalers, and e-commerce businesses. If your company sells physical products and purchases inventory for resale, obtaining this certificate is advantageous. It's essential for anyone looking to maintain compliance while maximizing cost-effectiveness.

Get more for Oregon Resale Certificate

Find out other Oregon Resale Certificate

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form