Tax Alaska Form

What is the Tax Alaska

The Tax Alaska form is a specific document used for reporting income and calculating tax liabilities for individuals and businesses operating within the state of Alaska. Unlike many other states, Alaska does not impose a state income tax, making this form unique. Instead, residents may need to report certain types of income and comply with federal tax requirements. Understanding the purpose of the Tax Alaska form is essential for ensuring compliance with both state and federal tax regulations.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all applicable income sources as required. After completing the form, review it for accuracy and ensure all necessary signatures are included before submission.

Steps to complete the Tax Alaska

Completing the Tax Alaska form can be broken down into a series of straightforward steps:

- Collect all relevant financial documents.

- Fill in your personal information accurately.

- Report your income from various sources.

- Calculate any applicable deductions or credits.

- Review the form for completeness and accuracy.

- Sign and date the form before submission.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form requires adherence to both state and federal laws. While Alaska does not have a state income tax, residents must still comply with federal tax laws. This means accurately reporting income and ensuring that all information provided is truthful and complete. Failure to comply with these regulations can lead to penalties, including fines or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form align with federal tax deadlines. Typically, individuals must submit their forms by April fifteenth of each year. It is crucial to be aware of any changes in deadlines due to holidays or specific state regulations. Keeping track of these dates helps avoid late fees and ensures compliance with tax obligations.

Required Documents

To complete the Tax Alaska form, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any additional income sources.

- Documentation for any deductions or credits claimed.

Having these documents ready will streamline the filing process and help ensure accuracy.

Who Issues the Form

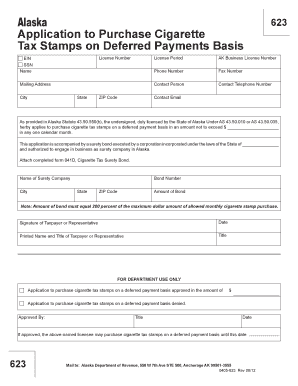

The Tax Alaska form is issued by the Alaska Department of Revenue. This department is responsible for tax collection and ensuring compliance with state tax laws. Residents can obtain the form directly from the department's website or through authorized distribution channels. Understanding who issues the form is essential for accessing accurate and up-to-date information.

Quick guide on how to complete tax alaska 6967192

Effortlessly Prepare Tax Alaska on Any Gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric function today.

How to Modify and eSign Tax Alaska with Ease

- Find Tax Alaska and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark essential parts of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to send your form—by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Alaska and ensure outstanding communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967192

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is an eSignature platform that allows businesses to send and sign documents securely and efficiently. For those dealing with Tax Alaska, it simplifies the process of signing important tax documents, ensuring compliance and saving time.

-

How can airSlate SignNow help with filing Tax Alaska documents?

Using airSlate SignNow, you can prepare and send your Tax Alaska forms digitally, allowing for quick eSignatures. This eliminates the hassle of printing and mailing documents, making tax filing more efficient and straightforward.

-

What are the pricing plans for airSlate SignNow for Tax Alaska users?

airSlate SignNow offers various pricing plans designed to meet the needs of different users, including businesses and individuals dealing with Tax Alaska. Plans typically range from basic to advanced features, allowing you to choose one that fits your budget and requirements.

-

Are there any special features of airSlate SignNow that cater to Tax Alaska compliance?

Yes, airSlate SignNow includes features specifically aimed at ensuring compliance with Tax Alaska. These features include secure document storage, audit trails, and customizable templates catering to Alaska tax regulations, providing peace of mind to users.

-

What benefits does airSlate SignNow provide for businesses managing Tax Alaska paperwork?

By using airSlate SignNow, businesses managing Tax Alaska paperwork can enjoy benefits like increased efficiency, reduced paper waste, and faster turnaround times on document processing. The ease of electronic signing also enhances the overall experience for clients.

-

How does airSlate SignNow integrate with other applications for Tax Alaska users?

airSlate SignNow seamlessly integrates with numerous applications such as CRM and accounting software that can be beneficial for handling Tax Alaska. This ensures a smooth workflow, allowing you to manage all aspects of tax documentation without switching platforms frequently.

-

Is airSlate SignNow secure for handling sensitive Tax Alaska information?

Yes, airSlate SignNow prioritizes security with bank-level encryption and compliance with regulations, making it safe for handling sensitive Tax Alaska information. Users can trust that their data is protected throughout the signing process.

Get more for Tax Alaska

- Png medical board registration form

- Bir 0619 e form download

- Mauritius police force recruitment form

- Bmw r1150rt manual form

- Sample reason for delayed registration of marriage 51693757 form

- Fashion and fabrics notes pdf form

- Agent release authorization form goindustry dovebid

- J1 general inspection of property addresspurch form

Find out other Tax Alaska

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document