Ndiana Annual Consolidated Sales Tax Information Return

What is the Indiana Annual Consolidated Sales Tax Information Return

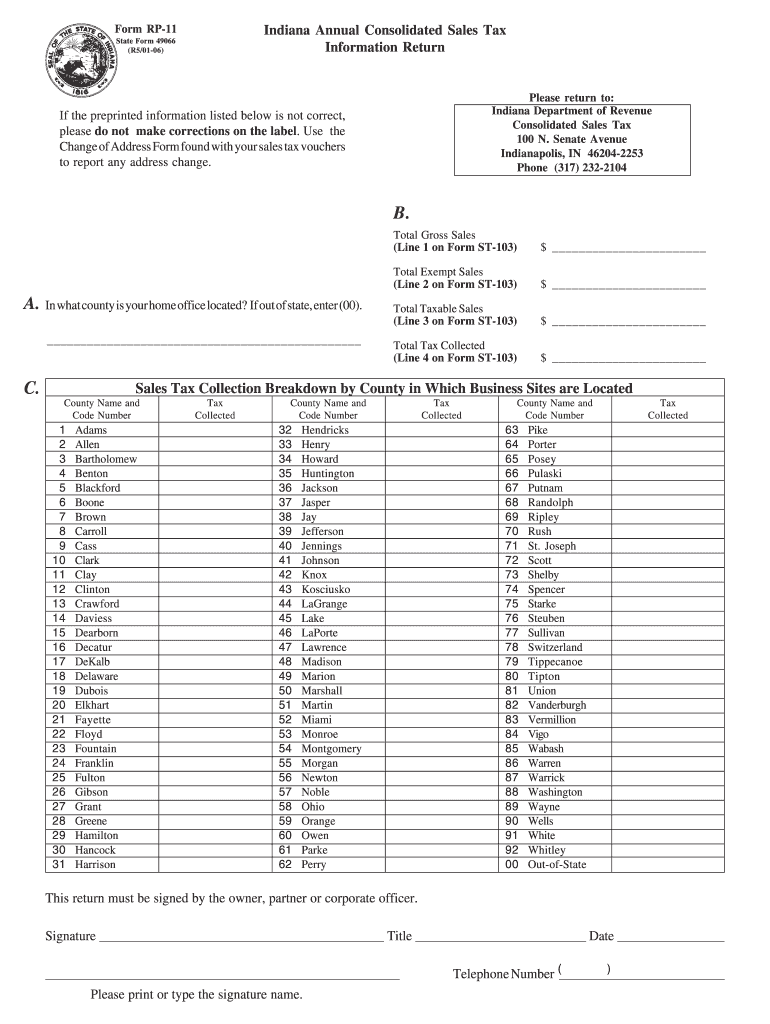

The Indiana Annual Consolidated Sales Tax Information Return, commonly referred to as the form 49066, is a crucial document for businesses operating within the state. This form is designed to report the total sales tax collected over the year, ensuring compliance with Indiana sales tax regulations. Businesses must accurately complete this return to reflect their sales activities, as it serves as an official record for tax authorities.

Steps to Complete the Indiana Annual Consolidated Sales Tax Information Return

Completing the Indiana Annual Consolidated Sales Tax Information Return involves several important steps:

- Gather all sales records for the year, including invoices and receipts.

- Calculate the total sales tax collected during the reporting period.

- Fill out the form 49066, ensuring all required fields are completed accurately.

- Review the form for any discrepancies or missing information.

- Submit the completed form either electronically or via mail, depending on your preference.

Legal Use of the Indiana Annual Consolidated Sales Tax Information Return

The Indiana Annual Consolidated Sales Tax Information Return is legally binding when filled out correctly and submitted to the appropriate tax authorities. Compliance with the state's tax laws is essential to avoid potential penalties. It is important for businesses to maintain accurate records and ensure that the information reported on the form is truthful and complete.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines for the Indiana Annual Consolidated Sales Tax Information Return to remain compliant. The return is typically due on the last day of the month following the end of the reporting year. For example, if the reporting year ends on December thirty-first, the return must be filed by January thirty-first of the following year. Staying informed about these deadlines helps avoid late fees and penalties.

Required Documents

To successfully complete the Indiana Annual Consolidated Sales Tax Information Return, certain documents are necessary:

- Sales records, including invoices and receipts.

- Previous tax returns for reference.

- Any correspondence from the Indiana Department of Revenue.

- Bank statements that reflect sales transactions.

Form Submission Methods

The Indiana Annual Consolidated Sales Tax Information Return can be submitted through various methods:

- Online submission via the Indiana Department of Revenue's e-filing system.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Penalties for Non-Compliance

Failure to file the Indiana Annual Consolidated Sales Tax Information Return on time can result in significant penalties. Businesses may incur fines based on the amount of tax owed, and repeated non-compliance can lead to increased scrutiny from tax authorities. It is essential to adhere to filing requirements to maintain good standing and avoid unnecessary financial burdens.

Quick guide on how to complete ndiana annual consolidated sales tax information return

Complete Ndiana Annual Consolidated Sales Tax Information Return effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ndiana Annual Consolidated Sales Tax Information Return on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Ndiana Annual Consolidated Sales Tax Information Return with ease

- Locate Ndiana Annual Consolidated Sales Tax Information Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to finalize your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Ndiana Annual Consolidated Sales Tax Information Return and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ndiana annual consolidated sales tax information return

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is Indiana sales tax and how does it apply to my business?

Indiana sales tax is a tax imposed on sales of goods and services within the state. If your business sells taxable products or services in Indiana, you are required to collect this tax from customers. Understanding Indiana sales tax is crucial to ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with managing Indiana sales tax documentation?

airSlate SignNow offers an efficient way to manage documents related to Indiana sales tax, such as sales tax exemption certificates and compliance forms. By using our platform, you can securely send, eSign, and store these documents, ensuring you have organized and easily accessible records for your tax obligations.

-

What features does airSlate SignNow provide for businesses dealing with Indiana sales tax?

With airSlate SignNow, businesses can streamline their tax documentation processes with features like eSigning, templates for sales tax forms, and automated reminders. These features help ensure that you never miss a deadline or fail to submit necessary Indiana sales tax documents, thereby enhancing compliance.

-

Is airSlate SignNow cost-effective for managing Indiana sales tax tasks?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing Indiana sales tax documentation. By reducing administrative burden and streamlining processes, companies can save time and resources, making it a valuable investment for those needing to handle sales tax effectively.

-

Can I integrate airSlate SignNow with other software to manage Indiana sales tax more efficiently?

Absolutely! airSlate SignNow integrates seamlessly with numerous accounting and tax software solutions, allowing you to synchronize your Indiana sales tax data. This integration ensures that all your documents and transactions are aligned, enabling a smoother workflow and better tax management.

-

What are the benefits of using airSlate SignNow for Indiana sales tax processes?

Using airSlate SignNow for managing Indiana sales tax processes provides several benefits, including enhanced efficiency, reduced errors, and improved compliance. The platform's intuitive design allows users to execute tasks quickly, leading to faster turnaround times for tax filings and improved overall business operations.

-

How secure is airSlate SignNow when handling Indiana sales tax information?

airSlate SignNow places a high priority on security, utilizing advanced encryption methods to protect your Indiana sales tax information. All documents and signatures are stored securely, ensuring that sensitive tax-related data remains confidential and is protected from unauthorized access.

Get more for Ndiana Annual Consolidated Sales Tax Information Return

Find out other Ndiana Annual Consolidated Sales Tax Information Return

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free