Michigan Form L

What is the Michigan Form L 4035?

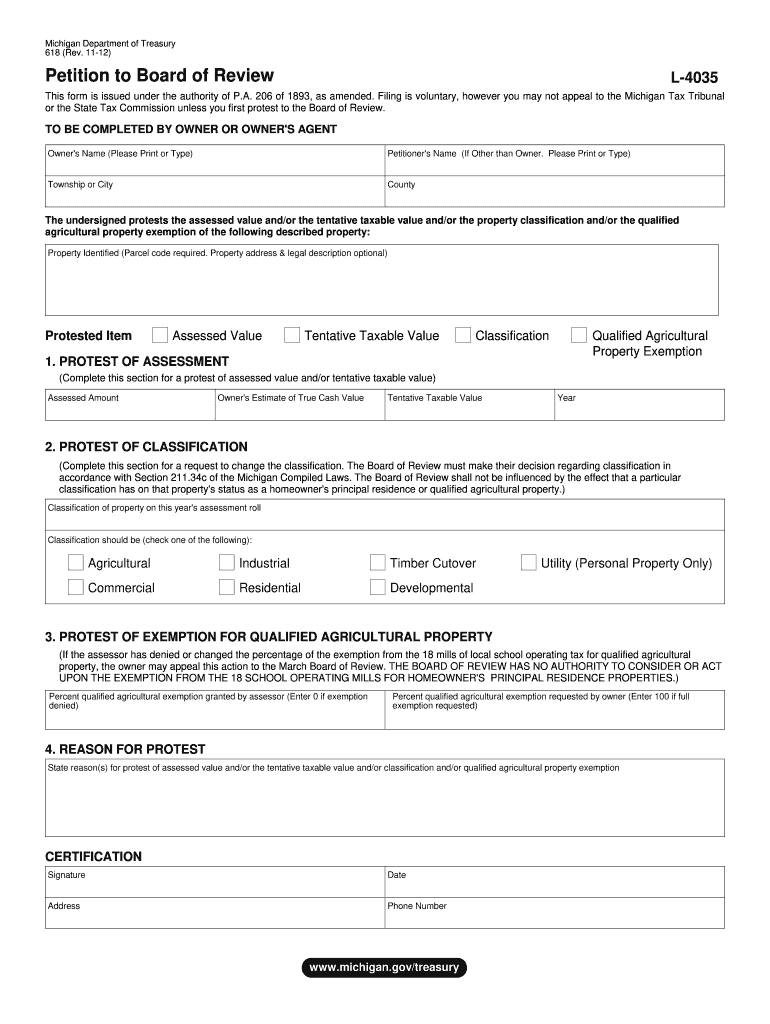

The Michigan Form L 4035 is a specific document used for property tax appeals in Michigan. This form allows property owners to petition the Michigan Board of Review regarding their property assessments. The form is essential for those who believe their property has been overvalued, resulting in higher taxes than warranted. Completing this form accurately is crucial for a successful appeal process.

How to Obtain the Michigan Form L 4035

Property owners can obtain the Michigan Form L 4035 from various sources. It is typically available through local government offices, such as the county assessor's office or the Board of Review. Additionally, the form can often be downloaded from official Michigan state websites that provide resources for property tax appeals. Ensuring you have the most current version of the form is important for compliance.

Steps to Complete the Michigan Form L 4035

Completing the Michigan Form L 4035 involves several key steps:

- Gather necessary documentation, including property tax statements and any evidence supporting your claim.

- Fill out the form with accurate information regarding your property, including its address and the assessed value.

- Provide a detailed explanation of why you believe the assessment is incorrect.

- Attach any supporting documents that substantiate your appeal.

- Review the completed form for accuracy before submission.

Legal Use of the Michigan Form L 4035

The Michigan Form L 4035 is legally binding when completed and submitted in accordance with state laws. It is necessary to ensure that all information provided is truthful and accurate, as false information can lead to penalties or dismissal of the appeal. Understanding the legal implications of the form helps property owners navigate the appeal process effectively.

Key Elements of the Michigan Form L 4035

The Michigan Form L 4035 includes several key elements that must be addressed:

- Identification of the property owner and property details.

- Assessment details, including the current assessed value and the requested value.

- A clear statement of the reasons for the appeal.

- Signature of the property owner or authorized representative.

Form Submission Methods

Property owners can submit the Michigan Form L 4035 through various methods:

- By mail to the local Board of Review.

- In-person at the designated local government office.

- Some jurisdictions may offer online submission options, which can streamline the process.

Quick guide on how to complete michigan form l

Prepare Michigan Form L effortlessly on any platform

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Michigan Form L on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Michigan Form L with ease

- Find Michigan Form L and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors requiring the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Michigan Form L and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form l

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is form l 4035 and why is it important?

Form l 4035 is a crucial document used for various applications and submissions. It ensures that all necessary data is collected accurately, making it essential for businesses to use an efficient eSigning solution like airSlate SignNow.

-

How can airSlate SignNow help me with form l 4035?

airSlate SignNow simplifies the process of completing and eSigning form l 4035. With our intuitive platform, you can easily create, send, and manage this form electronically, ensuring quick turnaround times and compliance.

-

Is there a cost associated with using airSlate SignNow for form l 4035?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution for managing form l 4035 allows you to choose a plan that fits your budget while providing all the necessary features for seamless eSigning.

-

What features does airSlate SignNow offer for managing form l 4035?

airSlate SignNow provides several features for managing form l 4035, including customizable templates, secure cloud storage, and real-time tracking. These features ensure that the process of completing and signing your form is efficient and user-friendly.

-

How secure is submitting form l 4035 with airSlate SignNow?

When using airSlate SignNow to submit form l 4035, your data is protected with top-tier security measures, including encryption and compliance with industry standards. You can confidently eSign and send your documents, knowing that your sensitive information is secure.

-

Can I integrate airSlate SignNow with other software for form l 4035?

Absolutely! airSlate SignNow can be easily integrated with various software applications, enhancing your workflow for form l 4035. This flexibility allows you to sync data with existing systems, making document management even more streamlined.

-

What are the benefits of using airSlate SignNow for form l 4035?

Using airSlate SignNow for form l 4035 brings numerous benefits, including faster processing times, reduced paper usage, and improved accuracy. By leveraging our platform, you can enhance productivity and ensure that your forms are handled efficiently.

Get more for Michigan Form L

- Abkc registration 478923020 form

- Mental status examination sample report pdf form

- Medical check up form

- Personal information form northern illinois university

- Eligibility requirements follow all instructions form

- Dotuninsuredmotorist dot wi gov form

- Dancer contract template form

- Work schedule change sheet form

Find out other Michigan Form L

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors