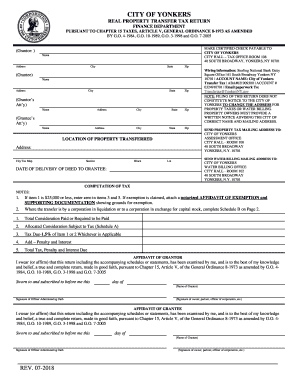

Yonkers Property Tax Form

What is the Yonkers Property Tax

The Yonkers property tax is a local tax imposed on real estate properties within the city of Yonkers, New York. This tax is based on the assessed value of the property, which is determined by the local tax assessor. The revenue generated from property taxes is primarily used to fund essential services such as education, public safety, and infrastructure maintenance. Homeowners and property owners in Yonkers are required to pay this tax annually, and the rates can vary depending on the property's classification and location.

Steps to Complete the Yonkers Property Tax

Completing the Yonkers property tax process involves several key steps:

- Determine your property’s assessed value: This value is provided by the Yonkers tax assessor and is crucial for calculating your tax obligation.

- Calculate your tax liability: Multiply the assessed value by the current property tax rate set by the city.

- Gather necessary documents: Prepare any required documents, including proof of ownership and previous tax statements.

- Complete the Yonkers tax return: Fill out the appropriate forms accurately, ensuring all information is correct.

- Submit your tax return: File your completed return by the deadline, either online or through traditional mail.

Required Documents

To successfully complete the Yonkers property tax return, you will need to gather specific documents, including:

- Proof of property ownership, such as a deed or title.

- Previous year’s tax return, if applicable.

- Assessment notices from the Yonkers tax assessor.

- Any relevant documentation related to exemptions or deductions.

Form Submission Methods

Property owners in Yonkers have several options for submitting their property tax forms:

- Online: Many residents prefer to file their forms electronically through the Yonkers city website.

- By Mail: Forms can be printed and mailed to the appropriate tax office address.

- In-Person: Property owners can also submit their forms directly at designated city offices during business hours.

Penalties for Non-Compliance

Failure to comply with Yonkers property tax regulations can result in significant penalties. These may include:

- Late fees assessed on unpaid taxes.

- Interest charges that accumulate over time.

- Potential legal action, including property liens or foreclosure in extreme cases.

Legal Use of the Yonkers Property Tax

The Yonkers property tax is governed by local laws and regulations. It is essential for property owners to understand their legal obligations, including:

- Filing deadlines to avoid penalties.

- Eligibility for exemptions, such as those for seniors or veterans.

- Rights to appeal assessments if property owners believe their assessed value is inaccurate.

Quick guide on how to complete yonkers property tax

Complete Yonkers Property Tax effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Handle Yonkers Property Tax on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and electronically sign Yonkers Property Tax with ease

- Find Yonkers Property Tax and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Yonkers Property Tax and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the yonkers property tax

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the importance of understanding Yonkers property tax?

Understanding Yonkers property tax is crucial for homeowners and real estate investors in the area. It affects overall home ownership costs and can influence property investment decisions. Having a clear grasp of property tax rates can help budget more effectively for future expenses.

-

How does airSlate SignNow assist with managing Yonkers property tax documents?

airSlate SignNow streamlines the process of managing Yonkers property tax documents by allowing users to create, sign, and store essential tax forms electronically. This reduces paperwork and enhances efficiency, ensuring timely submission and compliance with tax regulations. Our platform simplifies the entire workflow involved with property tax documentation.

-

Are there any integration options for handling Yonkers property tax in airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software, making it easier to manage Yonkers property tax. These integrations provide seamless data transfer and simplify the overall process of calculating and reporting taxes. Users can ensure they are up-to-date with the latest tax regulations effortlessly.

-

What are the costs associated with using airSlate SignNow for Yonkers property tax management?

airSlate SignNow provides a cost-effective solution for managing Yonkers property tax while offering competitive pricing plans tailored to businesses of all sizes. Users can choose a plan that fits their budget and access comprehensive features without hidden fees. This transparency helps in effective financial planning related to property taxes.

-

How does airSlate SignNow enhance the eSigning process for Yonkers property tax forms?

The eSigning process for Yonkers property tax forms is made efficient and secure with airSlate SignNow's user-friendly platform. Users can initiate electronic signatures quickly, ensuring all signed documents are stored securely and easily accessible. This convenience saves time and simplifies tax filing processes.

-

What benefits does airSlate SignNow provide for property tax professionals in Yonkers?

Property tax professionals in Yonkers benefit from airSlate SignNow's automation features designed to reduce administrative burdens. With easy document generation and tracking, they can focus on providing better service to clients. The platform also offers compliance tools to keep professionals in line with local tax regulations.

-

Can airSlate SignNow help with property tax appeals in Yonkers?

Absolutely, airSlate SignNow can assist in preparing and submitting documents necessary for property tax appeals in Yonkers. Users can create and eSign appeal letters and required forms efficiently, ensuring they meet all deadlines. This functionality helps in navigating the appeals process with ease.

Get more for Yonkers Property Tax

Find out other Yonkers Property Tax

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe